Apple aapl stock gets downgraded to sell ahead of earnings should investors be worried – Apple AAPL stock gets downgraded to sell ahead of earnings: should investors be worried? The tech giant’s stock took a hit after a major analyst firm issued a “sell” rating, sending ripples through the market. This isn’t just another day of market fluctuations; this downgrade comes ahead of Apple’s crucial earnings report, adding a layer of uncertainty for investors already grappling with a volatile economic climate. Let’s dive into the details and figure out what this means for your portfolio.

The downgrade sparked immediate debate. Some analysts point to concerns about slowing iPhone sales and increasing competition, while others argue that the sell rating is an overreaction and that Apple’s long-term prospects remain strong. We’ll examine the analyst’s reasoning, compare it to other opinions, and explore the potential impact of macroeconomic factors like inflation and interest rates. Ultimately, we’ll help you navigate this uncertainty and decide your best course of action.

Downgrade Impact on Investor Sentiment

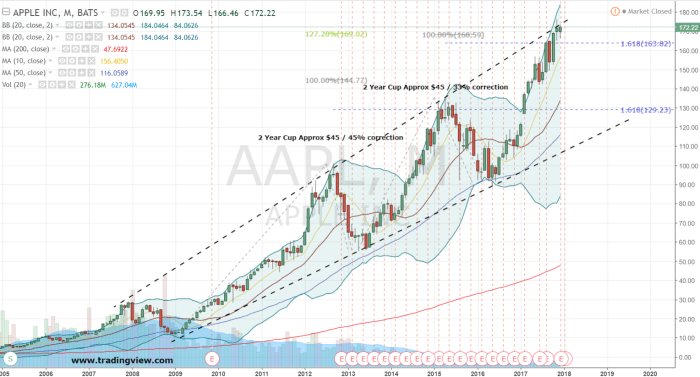

Source: investorplace.com

A “sell” rating from analysts for a tech giant like Apple (AAPL) isn’t just a casual opinion; it’s a seismic event that can send ripples throughout the financial world. Investors, both big and small, react swiftly, and the consequences can be significant, impacting both short-term trading and long-term investment strategies. Understanding this impact requires examining how the market typically responds to such news and the various factors that influence investor behavior.

Analyst downgrades often trigger immediate sell-offs, as investors scramble to protect their portfolios. The severity of the reaction depends on various factors, including the reputation of the analyst firm, the strength of their rationale, and the overall market sentiment. In the short term, we might see a sharp decline in the stock price as panic selling ensues. Long-term investors, however, might take a more measured approach, analyzing the downgrade’s justification and considering the company’s overall fundamentals before making any significant changes to their holdings. Some might even see the dip as a buying opportunity, depending on their risk tolerance and investment horizon.

Market Reactions to Sell Ratings

The market’s response to a sell rating varies depending on the context. Sometimes, a downgrade is simply confirmation of existing concerns, leading to a relatively muted reaction. Other times, it can be a catalyst for a larger sell-off, especially if it’s unexpected or comes from a highly influential analyst firm. Historically, similar downgrades for major tech companies have resulted in significant short-term price drops, though the long-term effects have been mixed, depending on the company’s subsequent performance and the broader market conditions. For instance, a surprise downgrade might cause a 5-10% drop in the first few trading days, while a less surprising one might only cause a 2-3% dip. The recovery time also varies greatly.

Historical Downgrades and Their Impact

To illustrate the potential impact, let’s consider some hypothetical scenarios, comparing them to past events affecting similar companies. While precise comparisons are difficult due to the unique circumstances surrounding each downgrade, the table below highlights potential scenarios based on past observations.

| Event | Company | Downgrade Rationale | Stock Price Movement (Short-Term) |

|---|---|---|---|

| Scenario 1: Unexpected Downgrade | Similar Tech Giant A | Concerns about slowing growth in a key market | -8% to -12% |

| Scenario 2: Expected Downgrade | Similar Tech Giant B | Confirmation of previously reported supply chain issues | -2% to -5% |

| Scenario 3: Downgrade Amidst Market Correction | Similar Tech Giant C | Concerns about increased competition and margin pressure | -5% to -10% (amplified by broader market downturn) |

Note: These are hypothetical examples and should not be considered investment advice. Actual stock price movements vary greatly based on numerous factors. Further research into specific historical downgrades is recommended.

AAPL’s Upcoming Earnings Report

Apple’s upcoming earnings report is a crucial event for investors, particularly given the recent downgrade to “sell.” The report will provide concrete financial data to either validate or refute the analysts’ bearish sentiment. The market will be keenly observing several key performance indicators to gauge Apple’s future trajectory.

Key Factors Investors Will Be Watching

Investors will scrutinize a range of metrics to assess Apple’s performance. These include revenue growth across various product segments (iPhone, Mac, iPad, Services, Wearables), profit margins, and the overall financial health of the company. Particular attention will be paid to the performance of the iPhone, which remains Apple’s flagship product and a significant driver of revenue. The success of newer products, like the Vision Pro headset, will also be under the microscope, though its impact on this quarter’s financials may be limited. Furthermore, guidance provided by Apple for the coming quarters will be a key indicator of future expectations and investor confidence. A positive outlook will likely buoy the stock, while a conservative or negative forecast could trigger further selling pressure.

Potential Positive and Negative Surprises

Positive surprises could stem from exceeding revenue expectations in key product segments, particularly in services where recurring revenue provides stability. Strong iPhone sales despite macroeconomic headwinds, or unexpectedly high demand for newer products like the Vision Pro, would also be viewed positively. Conversely, weaker-than-expected iPhone sales, a significant decline in services revenue, or reduced profit margins due to increased component costs or supply chain disruptions could negatively impact the stock price. A disappointing outlook for future quarters, especially concerning the iPhone 15 launch, would also be considered a significant negative surprise.

Significance of Revenue Growth, Profit Margins, and Guidance

Revenue growth is a fundamental indicator of Apple’s overall business health. Consistent and robust revenue growth across various segments demonstrates the company’s ability to innovate and capture market share. Profit margins reflect Apple’s pricing power and efficiency in managing costs. Squeezed margins, even with strong revenue, would signal underlying challenges. Finally, guidance provided by Apple for future quarters is a crucial forward-looking indicator. This guidance sets investor expectations and can significantly impact the stock price in the short and long term. A cautious or pessimistic outlook could lead to sell-offs, while a confident and optimistic forecast could boost investor sentiment.

Expected Earnings Figures and Potential Scenarios

The following table Artikels potential earnings scenarios based on the recent downgrade. These figures are estimations and should not be considered financial advice.

| Scenario | EPS (USD) | Revenue (USD Billion) | Impact on Stock Price |

|---|---|---|---|

| Best Case (Exceeds Expectations) | 2.00 | 90 | Potential short-term rally, but long-term impact depends on guidance. |

| Base Case (Meets Expectations) | 1.80 | 85 | Limited impact; stock price likely to consolidate. |

| Worst Case (Misses Expectations) | 1.50 | 80 | Significant sell-off likely, especially if guidance is weak. |

Analyst Rationale Behind the Downgrade

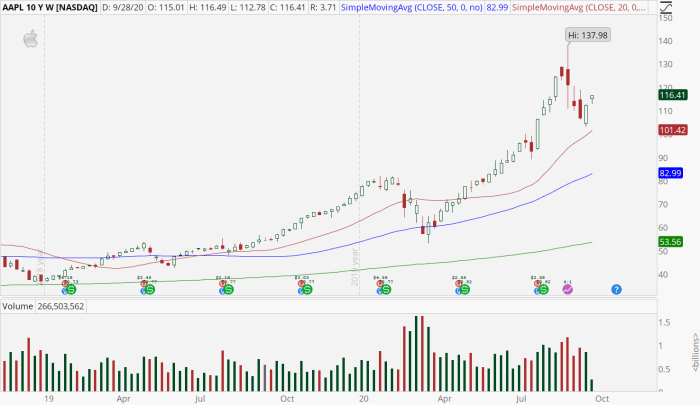

Source: investorplace.com

The recent downgrade of Apple (AAPL) to a “sell” rating by certain analysts has sent ripples through the investment community. Understanding the reasoning behind this bearish outlook is crucial for investors trying to navigate the complexities of the tech giant’s future. Several factors contributed to this decision, ranging from concerns about slowing iPhone sales to a more pessimistic outlook on the broader tech sector. This analysis will dissect the analysts’ rationale, compare it to other opinions, and explore alternative perspectives on Apple’s valuation.

Reasons for the Downgrade

Analysts issuing the “sell” rating typically cited a combination of factors. Concerns about weakening demand for iPhones, particularly in key markets like China, played a significant role. The global economic slowdown and increased competition in the smartphone market were also highlighted as contributing to a less optimistic outlook for Apple’s near-term growth. Furthermore, some analysts expressed concerns about Apple’s valuation, arguing that the current stock price doesn’t accurately reflect the potential risks to the company’s future earnings. The analysts’ models likely factored in slower-than-expected revenue growth and potentially lower profit margins. A key argument revolved around the belief that the market has already priced in much of Apple’s positive future growth, leaving little room for further upside.

Comparison with Other Analyst Ratings

Not all analysts share this pessimistic view. Many maintain a “buy” or “hold” rating on AAPL, citing Apple’s strong brand loyalty, diversified revenue streams (including services and wearables), and substantial cash reserves. These analysts often point to the company’s consistent innovation and its ability to adapt to changing market conditions as reasons for their optimism. The divergence in opinion highlights the inherent uncertainty in predicting future stock performance, emphasizing the importance of conducting thorough due diligence before making investment decisions. Some analysts, while acknowledging potential headwinds, believe that Apple’s long-term growth prospects remain strong, making the current dip a buying opportunity.

Alternative Perspectives on AAPL Valuation

Alternative valuation models, focusing on factors beyond short-term sales figures, might paint a different picture. For example, a discounted cash flow (DCF) analysis that incorporates Apple’s robust cash flows and potential for future innovation could justify a higher valuation. Similarly, a relative valuation approach comparing Apple’s price-to-earnings ratio to its competitors might suggest that the stock is undervalued. These alternative perspectives highlight the subjectivity inherent in stock valuation and the importance of considering multiple analytical frameworks. The debate essentially boils down to the weighting given to short-term market volatility versus long-term growth potential.

Summary of Analyst Opinions

To summarize the varying perspectives:

- Points of Agreement: Most analysts agree that the macroeconomic environment presents challenges for Apple. The impact of inflation and potential recessionary pressures are acknowledged across the board.

- Points of Disagreement: The primary point of contention lies in the interpretation of Apple’s resilience to these challenges. Bearish analysts emphasize the potential for significant revenue declines, while bullish analysts highlight Apple’s diversified revenue streams and strong brand loyalty as mitigating factors.

- Bearish View (Sell Rating): Focuses on slowing iPhone sales, increased competition, and a potentially overvalued stock price, leading to a pessimistic outlook on short-term growth. They anticipate lower-than-expected earnings and believe the current price reflects over-optimism.

- Bullish View (Buy/Hold Rating): Emphasizes Apple’s strong brand, diversified revenue, substantial cash reserves, and consistent innovation as reasons for continued growth. They see the current market conditions as temporary headwinds and believe the stock is undervalued or at least fairly priced for its long-term potential.

Macroeconomic Factors and Their Influence

Apple’s performance, like any major multinational corporation, is inextricably linked to the broader macroeconomic environment. Global economic headwinds and tailwinds significantly influence consumer spending, investor sentiment, and ultimately, AAPL’s stock price. Understanding these factors is crucial for assessing the downgrade’s implications and predicting future performance.

The current macroeconomic climate is characterized by persistent inflation, fluctuating interest rates, and geopolitical uncertainty. These factors interact in complex ways, impacting Apple’s supply chains, consumer demand for its products, and investor confidence in the tech sector. High inflation, for instance, can erode consumer purchasing power, potentially reducing demand for Apple’s premium-priced products. Conversely, rising interest rates increase borrowing costs for businesses and consumers, impacting both Apple’s investment strategies and consumer spending habits.

Inflation’s Impact on AAPL Stock

High inflation erodes purchasing power, potentially leading to reduced consumer spending on discretionary items like iPhones and Macs. Historically, periods of high inflation have often correlated with periods of slower growth in Apple’s revenue and stock price. Conversely, periods of low and stable inflation have generally been more favorable for Apple’s performance. The Federal Reserve’s actions to control inflation directly influence interest rates, creating a ripple effect across the economy and impacting Apple’s financial outlook. For example, during the 2008 financial crisis, high inflation and subsequent economic downturn significantly impacted Apple’s sales and stock price. The company’s response involved cost-cutting measures and a focus on product innovation to navigate the challenging economic climate.

Interest Rates and Apple’s Investment Strategy

Rising interest rates increase the cost of borrowing for Apple, potentially impacting its investment in research and development, expansion projects, and share buyback programs. Higher interest rates also make alternative investments, such as government bonds, more attractive, potentially diverting investor capital away from the stock market, including AAPL. Conversely, lower interest rates can stimulate economic activity and encourage investment in the stock market, potentially boosting AAPL’s stock price. The relationship between interest rates and AAPL’s stock price isn’t always linear, however. Other factors, such as investor sentiment and company-specific news, also play a significant role. For example, despite rising interest rates in 2022, Apple’s stock price remained relatively resilient due to strong demand for its products and positive investor sentiment.

Global Economic Uncertainty and Investor Decisions

Geopolitical events and global economic uncertainty can significantly influence investor decisions regarding AAPL. Concerns about trade wars, supply chain disruptions, or a global recession can lead to increased market volatility and reduced investor confidence in the tech sector. This can result in a sell-off of AAPL shares, even if the company’s fundamental performance remains strong. For example, the COVID-19 pandemic initially caused significant uncertainty in the market, but Apple’s ability to adapt and maintain strong sales ultimately helped to bolster investor confidence.

Correlation Between Macroeconomic Indicators and AAPL Stock Performance

| Indicator | Description | Impact on AAPL | Example |

|---|---|---|---|

| Inflation Rate | Measure of the rate of price increases in the economy | High inflation can reduce consumer spending and negatively impact AAPL’s sales. Low and stable inflation is generally positive. | High inflation in 2022 impacted consumer spending, but Apple’s strong product demand partially offset this effect. |

| Interest Rates | Cost of borrowing money | Higher rates increase borrowing costs for Apple and can reduce investor appetite for stocks. Lower rates can stimulate investment. | Rising interest rates in 2022 led to some investor concern, but Apple’s strong financial position mitigated the impact. |

| GDP Growth | Overall economic growth | Strong GDP growth generally correlates with increased consumer spending and positive impact on AAPL sales. | Strong US GDP growth in the years leading up to the pandemic positively impacted Apple’s sales and stock price. |

| Unemployment Rate | Percentage of the workforce that is unemployed | High unemployment can reduce consumer spending, while low unemployment can be positive for AAPL’s sales. | Low unemployment rates in the pre-pandemic years contributed to strong consumer demand for Apple products. |

Apple’s Long-Term Growth Prospects: Apple Aapl Stock Gets Downgraded To Sell Ahead Of Earnings Should Investors Be Worried

Apple’s current sell-side downgrade shouldn’t overshadow its substantial long-term growth potential. While short-term market fluctuations are inevitable, a deeper dive reveals a company strategically positioned for continued success, albeit with inherent risks. The key lies in understanding Apple’s innovation pipeline, its dominant market share in key segments, and its ability to navigate a fiercely competitive landscape.

Apple’s long-term growth hinges on several interconnected factors. Continued innovation in existing product lines, coupled with the expansion into new and emerging markets, will be crucial. Strategic initiatives like the burgeoning services sector and the exploration of augmented and virtual reality technologies represent significant growth opportunities. However, intensifying competition, macroeconomic headwinds, and supply chain vulnerabilities pose considerable challenges.

Apple’s Innovation Pipeline and Market Share

Apple’s history is punctuated by groundbreaking innovations that have redefined entire industries. The iPhone, iPad, and Apple Watch stand as testaments to this ability. Maintaining this innovative edge is paramount. Future growth will likely depend on successful launches of new products and services, along with consistent upgrades to existing offerings. Apple’s robust ecosystem, with its loyal customer base and high switching costs, provides a strong foundation for market share dominance. This existing market share, coupled with continued innovation, positions Apple to capitalize on future technological advancements and consumer trends. For example, the consistent improvement and expansion of its wearables segment demonstrates this strategy in action.

Strategic Initiatives and Their Impact on Future Earnings

Apple’s strategic diversification beyond hardware is a key driver of long-term growth. The services segment, encompassing the App Store, Apple Music, iCloud, and Apple Pay, has become a significant revenue stream and displays high profitability. Continued growth in this area, coupled with expansion into new services such as augmented reality applications and enhanced subscription models, can significantly bolster future earnings. Investments in areas like autonomous vehicles, while still in early stages, represent potential future growth drivers, albeit with significant uncertainty and risk.

Risks and Opportunities Facing Apple

Several significant risks could hinder Apple’s long-term growth. Intensifying competition from Android manufacturers in the smartphone market, coupled with rising production costs and potential supply chain disruptions, pose immediate challenges. Geopolitical instability and changing regulatory landscapes also present uncertainty. However, opportunities abound. The expansion into emerging markets, particularly in Asia, offers substantial untapped potential. Furthermore, the increasing adoption of 5G technology and the potential for breakthroughs in areas like AR/VR present significant growth avenues. Mastering these opportunities while mitigating the risks will be crucial for Apple’s future success.

Hypothetical Scenario: A Positive Long-Term Outlook

Imagine a scenario where Apple successfully launches a revolutionary AR/VR headset, seamlessly integrating it into its existing ecosystem. This device, coupled with innovative software and services, attracts a massive user base, driving significant revenue growth in both hardware and services. Simultaneously, Apple successfully navigates geopolitical challenges and supply chain disruptions, maintaining its strong market share in existing product categories. This scenario, while hypothetical, illustrates the potential for sustained growth even amidst current market headwinds. The combination of innovation, ecosystem strength, and strategic diversification would position Apple for continued dominance in the technology landscape for years to come. This hypothetical scenario is not unrealistic; it mirrors Apple’s historical track record of innovation and market leadership, suggesting a path to future success despite temporary setbacks.

Investor Strategies in Light of the Downgrade

Apple’s recent downgrade to “sell” has understandably shaken some investors. The decision, however, doesn’t automatically equate to a panicked sell-off. A rational response requires careful consideration of your personal investment goals, risk tolerance, and overall portfolio strategy. This section Artikels various strategies, highlighting the pros and cons of each approach.

The “sell” rating doesn’t dictate a single course of action. Whether you hold, sell, or even buy AAPL stock depends entirely on your individual circumstances and investment philosophy. Remember, this is just one analyst’s opinion, and market movements are rarely predictable.

Holding AAPL Stock

Holding onto AAPL shares despite the downgrade might be suitable for long-term investors with a high risk tolerance and strong belief in Apple’s long-term prospects. The potential for significant upside remains, even if the short-term outlook is less optimistic. However, the risk of further price declines is a real consideration. This strategy requires patience and the ability to withstand potential losses. For example, an investor who bought AAPL at a significantly lower price might choose to hold, accepting the temporary downturn as a normal part of the market cycle. Conversely, an investor who purchased near the peak might consider their position more carefully.

Selling AAPL Stock

Selling AAPL stock following the downgrade is a defensive strategy that prioritizes capital preservation over potential gains. This approach is particularly appealing to risk-averse investors or those with shorter-term investment horizons. Realizing losses now could prevent larger losses later if the stock price continues to decline. However, selling might mean missing out on potential future gains if the stock price recovers. Consider the example of an investor who needs the funds for a down payment on a house within the next year. Selling AAPL might be a prudent decision to secure those funds.

Buying AAPL Stock, Apple aapl stock gets downgraded to sell ahead of earnings should investors be worried

Buying AAPL stock after a downgrade might seem counterintuitive, but it presents an opportunity for contrarian investors. If the analyst’s rationale is flawed or the market overreacts, the current price could represent a buying opportunity. This is a high-risk, high-reward strategy requiring a deep understanding of Apple’s fundamentals and the ability to withstand potential further price drops. However, if the stock price rebounds, the potential for substantial profits is considerable. An investor who believes the downgrade is an overreaction and that Apple’s long-term growth prospects remain strong might find this a viable strategy.

Risk Tolerance and Investment Decisions

Risk tolerance is paramount in deciding how to proceed. A risk-averse investor will likely favor selling or holding, while a risk-tolerant investor might consider buying or holding. Risk tolerance isn’t just about how much money you can afford to lose; it also encompasses your emotional response to market volatility. A carefully constructed investment plan, outlining your risk tolerance and investment goals, is essential before making any significant investment decisions. Consider the example of a young investor with a long time horizon who is comfortable with potential losses. They might choose to hold or even buy more AAPL, knowing they have time to recover from any potential downturn.

Portfolio Allocation Strategies

The optimal portfolio allocation strategy depends on your individual circumstances. Diversification is key to mitigating risk. Given the downgrade, you might consider reducing your AAPL allocation and reallocating those funds to other assets, such as bonds, real estate, or other technology stocks with stronger analyst ratings. A balanced portfolio, diversified across different asset classes, reduces the impact of any single stock’s underperformance. For example, an investor might reduce their AAPL holdings from 15% to 10% of their portfolio, allocating the 5% to a broader technology ETF or a bond fund.

Concluding Remarks

Source: investorplace.com

So, should you panic? Not necessarily. While the downgrade is a serious development, it’s crucial to consider the bigger picture. Apple’s long-term growth potential, driven by innovation and a loyal customer base, remains a compelling factor. The upcoming earnings report will be pivotal, offering a clearer picture of the company’s performance and future direction. Before making any rash decisions, carefully weigh the risks and rewards, considering your own risk tolerance and investment strategy. This isn’t just about the short-term stock price; it’s about assessing Apple’s long-term health and its place in your investment portfolio.