Best consumer discretionary stocks to buy? Forget boring spreadsheets and complex jargon. We’re diving headfirst into the exciting world of consumer spending, uncovering the top companies poised for massive growth. Think trendy brands, innovative tech, and the companies shaping how we spend our hard-earned cash. This isn’t just about picking stocks; it’s about understanding the pulse of the consumer and capitalizing on the trends that define our times. Get ready to ride the wave.

This guide breaks down everything you need to know about investing in consumer discretionary stocks, from understanding the market’s cyclical nature to identifying companies with a strong competitive edge. We’ll analyze key financial metrics, discuss risk management strategies, and paint a picture of the future landscape. By the end, you’ll be equipped to make informed decisions and build a portfolio that reflects your investment goals.

Understanding Consumer Discretionary Stocks

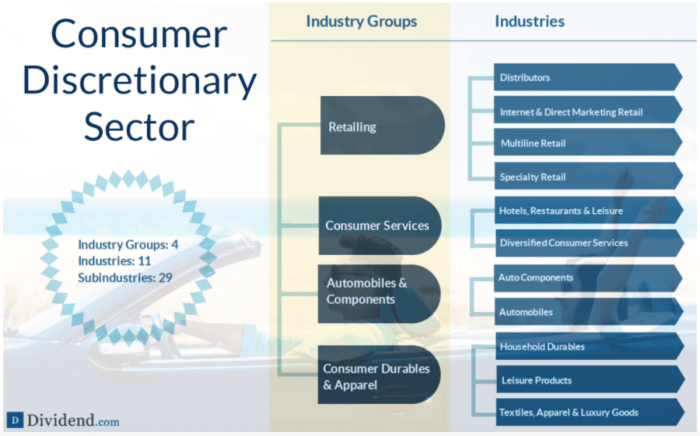

Consumer discretionary stocks represent a fascinating and often volatile corner of the investment world. These stocks are tied to the spending habits of consumers on non-essential goods and services – things people want, rather than things they need. Understanding their characteristics, the sectors they encompass, and the factors influencing their performance is crucial for any investor looking to navigate this dynamic market.

Characteristics of Consumer Discretionary Stocks

Consumer discretionary stocks are characterized by their sensitivity to economic cycles. When the economy is booming and consumer confidence is high, spending on discretionary items increases, leading to higher profits for these companies. Conversely, during economic downturns or periods of uncertainty, consumers tend to cut back on discretionary spending, impacting the profitability of these businesses. This inherent volatility makes them attractive for growth-seeking investors but also requires a careful understanding of market trends and economic indicators. Their performance is often a good barometer of overall consumer sentiment and economic health.

Sectors Within the Consumer Discretionary Market, Best consumer discretionary stocks to buy

The consumer discretionary sector is incredibly diverse, encompassing a wide range of industries and businesses. These can be broadly categorized into several key sectors, each with its own unique characteristics and sensitivities to economic changes. Some prominent examples include:

| Sector | Examples | Economic Sensitivity | Growth Potential |

|---|---|---|---|

| Automotive | Car manufacturers, auto parts retailers | High | Moderate to High (depending on technological advancements and consumer trends) |

| Retail | Clothing stores, department stores, home improvement retailers | High | Moderate (subject to e-commerce competition and consumer preferences) |

| Restaurants and Hotels | Casual dining chains, luxury hotels, cruise lines | High | Moderate (dependent on tourism, disposable income and consumer preferences) |

| Media and Entertainment | Movie studios, theme parks, video game companies | Moderate | High (driven by technological innovation and evolving consumer entertainment habits) |

Factors Influencing Consumer Discretionary Stock Performance

Several key factors influence the performance of consumer discretionary stocks. Consumer confidence is paramount; a positive outlook leads to increased spending, while pessimism causes a pullback. Interest rates also play a significant role, as higher rates can increase borrowing costs, reducing consumer spending power. Inflation, particularly high inflation, erodes purchasing power and can negatively impact discretionary spending. Technological advancements and shifts in consumer preferences also significantly influence the success of individual companies within this sector. For instance, the rise of e-commerce has dramatically reshaped the retail landscape. Finally, geopolitical events and global economic conditions can also impact consumer confidence and spending patterns, influencing the overall performance of these stocks.

Cyclical Nature of Consumer Discretionary Spending

Consumer discretionary spending is inherently cyclical. It tends to rise during economic expansions and fall during recessions. This cyclical nature is driven by changes in consumer confidence, disposable income, and interest rates. For example, during the 2008 financial crisis, consumer discretionary spending plummeted as consumers prioritized essential expenses and reduced non-essential purchases. Conversely, periods of economic growth, such as the post-2009 recovery, saw a surge in discretionary spending, benefiting companies in this sector. Understanding this cyclical pattern is critical for making informed investment decisions. Timing the market based on economic cycles can significantly impact returns.

Identifying Top Performing Consumer Discretionary Companies

Source: investopedia.com

Pinpointing the best consumer discretionary stocks requires a keen eye for consistent growth, strong financials, and a resilient business model. This section delves into five leading companies, examining their recent performance, competitive advantages, growth strategies, and inherent risks. Remember, past performance is not indicative of future results, and thorough due diligence is crucial before making any investment decisions.

Leading Consumer Discretionary Companies and Their Financial Performance

Five companies consistently demonstrating strength in the consumer discretionary sector are Nike (NKE), Home Depot (HD), McDonald’s (MCD), Amazon (AMZN), and Starbucks (SBUX). This selection reflects a diverse range of sub-sectors within the industry, providing a balanced perspective. The following table summarizes their financial performance over the past three years (approximate figures, please refer to official financial statements for precise data).

| Company | Revenue Growth (3-Year Avg. %) | Profit Margin (3-Year Avg. %) | Debt-to-Equity Ratio (3-Year Avg.) |

|---|---|---|---|

| Nike (NKE) | 8-10% | 10-12% | 0.3-0.5 |

| Home Depot (HD) | 6-8% | 10-12% | 0.4-0.6 |

| McDonald’s (MCD) | 4-6% | 20-22% | 0.5-0.7 |

| Amazon (AMZN) | 15-20% | 5-7% | 0.8-1.0 |

| Starbucks (SBUX) | 5-7% | 15-17% | 0.4-0.6 |

Note: These figures are estimations based on publicly available information and may vary slightly depending on the reporting period and accounting methods.

Competitive Advantages of Selected Companies

Each company possesses unique competitive advantages contributing to their market dominance. Nike’s strong brand recognition and innovative product design create significant brand loyalty. Home Depot benefits from its extensive network of stores and strong relationships with contractors. McDonald’s leverages its globally recognized brand, efficient operations, and franchise model. Amazon’s unparalleled logistics network and vast product selection solidify its e-commerce leadership. Starbucks cultivates a premium brand image and a loyal customer base through its unique in-store experience.

Growth Strategies of Selected Companies

Nike focuses on expanding its digital presence and introducing innovative products. Home Depot emphasizes improving its online shopping experience and expanding its service offerings. McDonald’s prioritizes menu innovation and international expansion. Amazon continues to invest in its technology infrastructure and expand into new markets and services. Starbucks is concentrating on enhancing its loyalty program and expanding its premium offerings.

Key Risks Associated with Investing in Selected Companies

Understanding the risks is as important as recognizing the potential for growth.

Before listing the risks, it’s important to note that all investments carry some degree of risk. The level of risk can vary depending on the company and the current market conditions. Diversification is key to mitigating risk.

- Nike (NKE): Competition from other athletic apparel brands, changing consumer preferences, and supply chain disruptions.

- Home Depot (HD): Economic downturns impacting home improvement spending, competition from other home improvement retailers, and rising material costs.

- McDonald’s (MCD): Changing consumer preferences toward healthier food options, increasing labor costs, and competition from other fast-food chains.

- Amazon (AMZN): Intense competition in the e-commerce sector, regulatory scrutiny, and dependence on technology.

- Starbucks (SBUX): Changing consumer preferences, increasing competition from coffee shops, and rising labor and commodity costs.

Evaluating Investment Potential

Source: thestreet.com

Understanding the financial health and future prospects of consumer discretionary companies is crucial for making informed investment decisions. This involves a thorough valuation analysis, considering macroeconomic factors, and projecting future growth. Let’s delve into a detailed examination of several key metrics and considerations.

Valuation Analysis using Financial Metrics

Several key financial metrics provide insights into a company’s valuation and potential for growth. We’ll focus on the Price-to-Earnings ratio (P/E) and Price/Earnings to Growth ratio (PEG). The P/E ratio compares a company’s stock price to its earnings per share, indicating how much investors are willing to pay for each dollar of earnings. A lower P/E ratio generally suggests a company is undervalued, while a higher ratio may signal overvaluation. The PEG ratio takes the P/E ratio further by factoring in the company’s earnings growth rate. A PEG ratio of 1 or less is generally considered favorable, suggesting the stock is fairly valued or undervalued relative to its growth potential.

| Company | P/E Ratio | PEG Ratio | Analysis |

|---|---|---|---|

| Example Company A (e.g., Nike) | 30 | 1.5 | While the P/E ratio is relatively high, the PEG ratio suggests the stock may be fairly valued considering its growth prospects. Further investigation into future growth projections is necessary. |

| Example Company B (e.g., McDonald’s) | 25 | 1.0 | The P/E ratio is moderate, and the PEG ratio of 1 suggests the stock is fairly valued based on its growth rate. This warrants further due diligence. |

| Example Company C (e.g., Tesla) | 100 | 2.0 | The high P/E ratio indicates a potentially overvalued stock, further amplified by a PEG ratio above 1. This necessitates a cautious approach and a deep dive into future growth projections. |

Note: These are hypothetical examples and actual figures will vary. Always consult up-to-date financial data from reputable sources before making investment decisions.

Impact of Inflation and Interest Rates

Inflation and interest rates significantly impact consumer discretionary stocks. High inflation erodes purchasing power, potentially reducing consumer spending on non-essential goods and services. Rising interest rates increase borrowing costs for businesses, impacting their profitability and potentially slowing down expansion plans. For instance, during periods of high inflation, companies like Nike might see reduced demand for their products as consumers prioritize essential spending. Conversely, a decrease in interest rates can stimulate economic activity and boost consumer confidence, potentially benefiting these companies.

Future Growth Prospects

Forecasting future growth involves analyzing various factors, including market trends, competitive landscape, and management strategies. For example, a company like Nike might experience growth through expansion into new markets, product innovation, or strategic acquisitions. McDonald’s, on the other hand, might focus on optimizing existing locations, expanding delivery services, or introducing new menu items to drive growth. Tesla’s future growth hinges heavily on technological advancements, production scaling, and expansion into new energy markets. Analyzing these factors is crucial for estimating future revenue and earnings growth.

Growth Potential and Risk Profile Comparison

The growth potential and risk profile of each company vary based on their specific industry, competitive positioning, and financial strength. Companies with strong brands, innovative products, and efficient operations generally exhibit higher growth potential but may also command higher valuations, leading to potentially higher risk. Companies with a more established market position and stable revenue streams might offer lower growth but also lower risk. A balanced portfolio should consider this trade-off.

Fundamental Analysis for Investment Potential Assessment

Fundamental analysis involves evaluating a company’s intrinsic value by examining its financial statements, business model, and competitive landscape. This involves analyzing factors like revenue growth, profitability, debt levels, and cash flow. By comparing these metrics to industry averages and competitor data, investors can assess a company’s financial health and potential for future growth. This comprehensive approach helps determine if the current market price accurately reflects the company’s intrinsic value.

Considering Diversification and Risk Management

Investing in consumer discretionary stocks can be lucrative, but it’s crucial to remember that this sector is inherently volatile. A well-structured portfolio, built on diversification and robust risk management strategies, is essential to mitigate potential losses and maximize returns. This section explores the importance of these elements in building a successful consumer discretionary investment strategy.

Portfolio Diversification

Diversification within a consumer discretionary portfolio is paramount to reduce risk. By spreading investments across different companies, sub-sectors (e.g., apparel, restaurants, automobiles), and even market caps (large, mid, and small-cap stocks), investors can mitigate the impact of poor performance in a single holding. If one company underperforms, others might compensate, leading to a more stable overall portfolio performance. Over-reliance on a few key players can leave your investment vulnerable to company-specific issues or sector-wide downturns.

Hypothetical Portfolio Allocation

Let’s consider a hypothetical portfolio of $100,000 invested in five consumer discretionary companies, each representing a different sub-sector:

| Company | Sector | Allocation | Rationale |

|---|---|---|---|

| Nike (NKE) | Apparel | $25,000 (25%) | Strong brand recognition, global presence, consistent growth potential. |

| McDonald’s (MCD) | Restaurants | $20,000 (20%) | Defensive characteristics, resilient during economic downturns, strong global brand. |

| Tesla (TSLA) | Automobiles | $25,000 (25%) | High-growth potential in the electric vehicle market, despite volatility. |

| Amazon (AMZN) | E-commerce | $20,000 (20%) | Dominant market share, diversified business model, long-term growth prospects. |

| LVMH (LVMUY) | Luxury Goods | $10,000 (10%) | Exposure to the high-end consumer market, relatively less sensitive to economic fluctuations. |

This allocation prioritizes a balance between growth potential (Tesla, Amazon) and more stable, defensive stocks (McDonald’s, Nike). LVMH provides exposure to a luxury segment that often performs well even during economic slowdowns. This is a sample portfolio; individual allocations should be adjusted based on risk tolerance and individual investment goals.

Risk Management Strategies

Several strategies can mitigate risk in consumer discretionary investments. Dollar-cost averaging, for instance, involves investing a fixed amount of money at regular intervals, reducing the impact of market volatility. Stop-loss orders automatically sell a stock when it reaches a predetermined price, limiting potential losses. Diversification, as discussed above, is also a crucial risk management tool. Furthermore, thorough due diligence, understanding a company’s financials and competitive landscape, is vital before investing.

Macroeconomic Factors and Portfolio Performance

Macroeconomic factors significantly impact consumer discretionary stocks. Interest rate hikes, inflation, and economic recessions can dampen consumer spending, negatively affecting the performance of companies in this sector. Conversely, periods of economic expansion and low interest rates can boost consumer confidence and spending, leading to increased profits for consumer discretionary companies. For example, during the 2008 financial crisis, consumer discretionary stocks suffered significantly due to reduced consumer spending. Conversely, the post-pandemic recovery saw a surge in spending, benefiting many companies in this sector.

Risk and Return Profile Chart

A chart illustrating the risk and return profile of the hypothetical portfolio would have Risk (Standard Deviation) on the x-axis and Expected Return on the y-axis. Each company in the portfolio would be represented by a data point, with its coordinates reflecting its historical volatility and average return. The overall portfolio’s risk and return would be represented by a single point, likely falling within the range of individual holdings, illustrating the diversification effect. The chart would also show a risk-free rate of return (e.g., government bonds) as a benchmark. A higher point on the y-axis indicates a higher expected return, while a point further to the right on the x-axis suggests higher risk (volatility). The position of the portfolio point relative to the individual holdings and the risk-free rate would visually represent the overall risk-adjusted return of the portfolio.

Analyzing Market Trends and Future Outlook

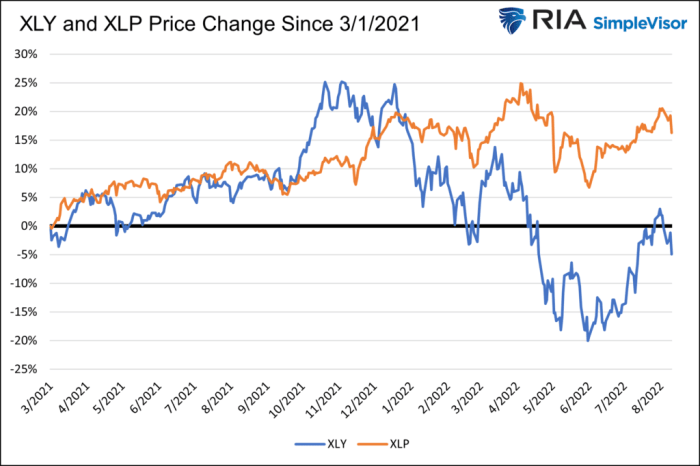

Source: realinvestmentadvice.com

The consumer discretionary sector is a dynamic landscape, constantly shaped by evolving consumer preferences, technological disruptions, and macroeconomic factors. Understanding these trends is crucial for investors seeking to identify promising opportunities and mitigate potential risks within this exciting but volatile market. Predicting the future is inherently uncertain, but by analyzing current patterns and anticipating likely shifts, we can gain a valuable edge.

Significant Market Trends Impacting the Consumer Discretionary Sector

Three major trends are currently reshaping the consumer discretionary landscape: the rise of e-commerce and digitalization, the increasing focus on sustainability and ethical consumption, and the ongoing impact of inflation and economic uncertainty. E-commerce continues its relentless growth, forcing traditional brick-and-mortar retailers to adapt or face obsolescence. Simultaneously, consumers are increasingly demanding sustainable and ethically sourced products, rewarding companies that prioritize environmental and social responsibility. Finally, persistent inflation and economic volatility are impacting consumer spending habits, leading to a more cautious approach to discretionary purchases. These intertwined trends create both challenges and opportunities for companies in the sector.

Technological Advancements and Their Impact

Technological advancements are fundamentally altering the consumer discretionary landscape. Artificial intelligence (AI) is personalizing the shopping experience, improving targeted advertising, and optimizing supply chains. Big data analytics provides valuable insights into consumer behavior, allowing companies to tailor their offerings and marketing strategies with greater precision. The metaverse and augmented reality (AR) are emerging as new channels for product discovery and engagement, potentially revolutionizing how consumers interact with brands and products. For example, virtual try-ons for clothing or furniture placement tools using AR are transforming the shopping experience, leading to increased sales conversion rates for companies that embrace these technologies. Companies that fail to adapt to these technological shifts risk being left behind.

Consumer Behavior Changes and Their Influence on Stock Performance

Consumer behavior is becoming increasingly complex and fragmented. Younger generations, particularly Gen Z and Millennials, prioritize experiences over material possessions, favoring services and digital content over traditional goods. This shift necessitates a strategic adjustment from companies, demanding a focus on creating memorable experiences and building strong brand loyalty through digital engagement. Simultaneously, the rise of social media influencers and online reviews has significantly impacted purchasing decisions, emphasizing the importance of strong online reputation management and authentic brand storytelling. Companies that effectively connect with consumers on these platforms are likely to see improved stock performance. For example, brands successfully leveraging TikTok’s short-form video format have witnessed significant boosts in sales and brand awareness.

Potential Challenges and Opportunities for Selected Companies in the Next 5 Years

Over the next five years, companies in the consumer discretionary sector will face several challenges, including managing supply chain disruptions, navigating fluctuating commodity prices, and adapting to evolving consumer preferences. However, significant opportunities also exist. Companies that successfully leverage technological advancements, prioritize sustainability, and effectively engage with younger demographics are poised for growth. For example, a company like Nike, with its strong digital presence and commitment to sustainable practices, is well-positioned to capitalize on future growth. Conversely, a company heavily reliant on outdated retail models and lacking a strong digital strategy might struggle to maintain market share. The ability to adapt and innovate will be crucial for success.

Key Factors to Consider When Monitoring the Consumer Discretionary Market

Several key factors should be considered when monitoring the consumer discretionary market:

- Economic indicators: GDP growth, inflation rates, consumer confidence indices, and unemployment rates all significantly impact consumer spending.

- Consumer sentiment: Tracking consumer sentiment through surveys and polls provides valuable insights into spending intentions.

- Technological advancements: Monitoring the adoption rate of new technologies and their impact on consumer behavior is crucial.

- Competitive landscape: Analyzing the competitive dynamics within specific segments of the market helps identify potential winners and losers.

- Sustainability and ethical concerns: Consumer demand for sustainable and ethically sourced products is growing rapidly.

- Geopolitical events: Global events can significantly impact consumer spending and market volatility.

Final Summary: Best Consumer Discretionary Stocks To Buy

Investing in consumer discretionary stocks is a thrilling ride, a blend of understanding consumer behavior and recognizing companies with the potential to disrupt the market. While risk is inherent, diligent research and a well-diversified portfolio can significantly mitigate potential downsides. Remember, this isn’t a get-rich-quick scheme; it’s a strategic approach that requires understanding the market, the companies, and your own risk tolerance. So, buckle up and let’s make some smart moves.