Best growth stocks aren’t just a buzzword; they’re the engine of significant wealth creation. This guide dives deep into what makes a growth stock tick, how to identify promising candidates, and the strategies to navigate the inherent risks. We’ll explore the financial metrics that matter, dissect successful (and failed) investments, and equip you with the knowledge to build a robust growth stock portfolio.

From understanding the difference between growth and value investing to mastering the art of projecting future growth, we’ll demystify the world of growth stocks. We’ll cover everything from fundamental analysis and risk management to practical strategies for diversifying your investments and building a long-term strategy. Get ready to unlock the potential of growth stocks.

Defining “Best Growth Stocks”

Growth stocks represent a compelling investment opportunity, but understanding their characteristics is crucial for success. These aren’t simply stocks that are currently increasing in value; they represent companies expected to experience significantly higher-than-average earnings growth in the future. This expectation drives investor interest and, consequently, higher valuations.

Growth stocks are characterized by several key traits. They typically operate in industries poised for expansion, reinvest a substantial portion of their earnings back into the business (rather than paying out large dividends), and demonstrate a strong track record of innovation and market share gains. This focus on future growth often means these companies may have higher price-to-earnings (P/E) ratios compared to other stocks.

Industries Associated with Growth Stocks

Several industries are frequently associated with growth stocks. These sectors often involve technological advancements, disruptive business models, or cater to expanding consumer demands. The technology sector, for example, is a prime example, encompassing companies developing cutting-edge software, hardware, and internet services. The biotechnology and pharmaceutical industries also offer significant growth potential due to ongoing medical research and the development of new treatments. Renewable energy companies, benefiting from increasing global focus on sustainability, are another prominent example. Finally, consumer discretionary sectors, like e-commerce and entertainment, often include companies considered growth stocks due to changing consumer preferences and technological innovations.

Growth Stocks Versus Value Stocks

Growth stocks are often contrasted with value stocks. Value stocks are characterized by lower price-to-earnings ratios and typically represent companies that are undervalued by the market. They often pay higher dividends and exhibit more stable, predictable earnings growth. Growth stocks, on the other hand, prioritize future earnings growth over current profitability and dividend payouts. Investors choose between these strategies based on their risk tolerance and investment horizon. A portfolio might contain a mix of both to balance risk and potential reward.

Risks and Rewards of Investing in Growth Stocks

Investing in growth stocks carries inherent risks. The high valuations often associated with these stocks make them vulnerable to market corrections. If a company fails to meet its growth expectations, the stock price can plummet significantly. Furthermore, the focus on future growth means that current profits might be low or even nonexistent. However, the potential rewards can be substantial. Successful growth stocks can generate exceptionally high returns over the long term, significantly outpacing the market average. For example, the meteoric rise of companies like Amazon and Microsoft demonstrates the immense potential for growth stock investments. However, investors must be prepared for volatility and potential losses, as these are inherent in any growth-oriented investment strategy.

Identifying Potential Growth Stocks

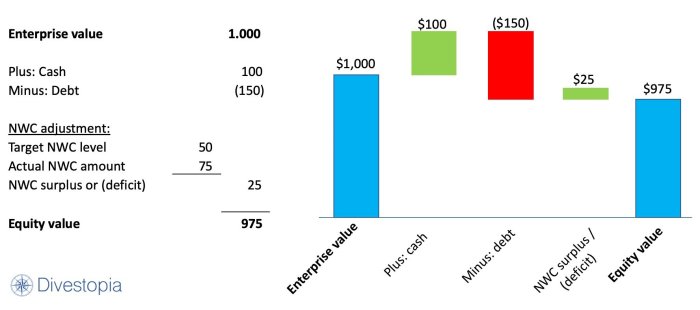

Source: divestopia.com

Pinpointing the next big winner in the stock market is the holy grail for many investors. While no method guarantees success, a strategic approach combining financial analysis and qualitative assessment significantly improves your odds of identifying promising growth stocks. This involves a deep dive into a company’s financial health, understanding its market position, and assessing its future prospects.

A robust methodology for screening potential growth stocks relies heavily on a combination of quantitative and qualitative factors. Financial metrics provide a quantifiable snapshot of a company’s performance, allowing for objective comparisons. However, these numbers tell only part of the story. Qualitative factors, such as management quality and competitive landscape, offer crucial context and insights that purely numerical analysis often misses.

Financial Metrics for Growth Stock Identification

Several key financial ratios offer valuable clues about a company’s growth potential. Analyzing these ratios in conjunction, rather than in isolation, provides a more holistic understanding. Remember, these ratios should be compared against industry averages and historical trends for the company itself to be truly meaningful.

Here’s a breakdown of some crucial financial ratios and their relevance:

| Ratio | Description | Relevance to Growth | Example |

|---|---|---|---|

| Revenue Growth Rate | Percentage change in revenue over a specific period (e.g., year-over-year). | Indicates the company’s ability to expand its sales. Higher growth rates generally signal stronger growth potential. | A company with a consistent 20% year-over-year revenue growth rate shows strong expansion. |

| Earnings Per Share (EPS) Growth Rate | Percentage change in EPS over a specific period. | Reflects the company’s profitability growth. Sustained EPS growth indicates increasing earnings for shareholders. | Consistent double-digit EPS growth suggests strong profitability and potential for higher stock valuation. |

| Return on Equity (ROE) | Measures the profitability of a company relative to shareholder equity. | High ROE indicates efficient use of shareholder capital to generate profits. This suggests strong internal growth potential. | An ROE consistently above the industry average implies superior efficiency and growth prospects. |

| Price-to-Earnings (P/E) Ratio | Market price per share divided by earnings per share. | While not a direct measure of growth, a relatively high P/E ratio often reflects market expectations of future growth. However, it needs to be considered in context with industry averages and growth rates. | A high P/E ratio might indicate strong investor confidence in future growth, but also carries higher risk if growth expectations are not met. |

| Debt-to-Equity Ratio | Measures the proportion of a company’s financing from debt compared to equity. | A low debt-to-equity ratio indicates lower financial risk, suggesting greater financial stability to support growth initiatives. | A low debt-to-equity ratio shows the company is less reliant on debt financing, reducing financial vulnerability. |

Stock Screening Methods Comparison, Best growth stocks

Different approaches exist for identifying potential growth stocks, each with its strengths and weaknesses. Choosing the right method depends on your investment goals and risk tolerance.

| Method Name | Metrics Used | Advantages | Disadvantages |

|---|---|---|---|

| Fundamental Analysis | Financial statements, ratios, industry analysis | Provides a deep understanding of a company’s financial health and future prospects. | Time-consuming and requires significant financial expertise. |

| Technical Analysis | Chart patterns, trading volume, indicators | Identifies potential entry and exit points based on price movements. | Can be subjective and prone to false signals. |

| Quantitative Screening | Algorithmic selection based on predefined financial metrics. | Efficiently screens large numbers of stocks. | May overlook qualitative factors and potentially miss undervalued gems. |

| Growth Stock Funds | Managed portfolios focused on growth stocks. | Diversification and professional management. | Higher fees and less control over individual stock selection. |

Qualitative Factors in Growth Stock Evaluation

While financial metrics provide a quantitative foundation, neglecting qualitative factors is a recipe for potential disaster. These non-numerical aspects offer invaluable context and insights into a company’s long-term potential.

Factors such as the quality of management, the strength of the company’s competitive advantage (e.g., strong brand, patents, proprietary technology), market position, industry trends, and regulatory environment are all crucial considerations. For example, a company with a revolutionary product but weak management might struggle to capitalize on its potential, while a company in a declining industry, even with strong financials, might face headwinds.

Evaluating Growth Stock Performance

Deciphering the true potential of a growth stock requires more than just a gut feeling; it demands a rigorous examination of its past performance. Analyzing historical financial data allows investors to understand the company’s growth trajectory and identify potential red flags before committing significant capital. This analysis forms the bedrock of informed investment decisions, helping to separate promising companies from those merely riding a wave of hype.

Analyzing historical financial data involves more than simply glancing at the top-line numbers. A thorough evaluation requires a deep dive into key financial metrics to gauge the company’s past growth performance and sustainability. This process helps to determine if the company’s past success is indicative of future potential or a mere anomaly.

Revenue Growth Rate Calculation

Revenue growth is a fundamental indicator of a company’s overall health and expansion. Calculating this growth rate helps to quantify the pace at which a company is increasing its sales. A consistently high revenue growth rate suggests strong market demand and effective business strategies. The formula for calculating the compound annual growth rate (CAGR) of revenue is:

CAGR = [(Ending Revenue / Beginning Revenue)^(1 / Number of Years)] – 1

For example, if a company’s revenue increased from $10 million to $20 million over five years, its CAGR would be approximately 14.87%. This signifies a robust annual growth rate. Conversely, a consistently declining or stagnant revenue growth rate could indicate underlying problems.

Earnings Growth Rate Calculation

While revenue growth is crucial, analyzing earnings growth provides a clearer picture of a company’s profitability and efficiency. Earnings per share (EPS) growth showcases the increase in profits available to shareholders. Similar to revenue growth, the CAGR formula can be applied to calculate EPS growth:

CAGR = [(Ending EPS / Beginning EPS)^(1 / Number of Years)] – 1

Suppose a company’s EPS grew from $1 to $2 over three years. Its CAGR would be approximately 25.99%. This indicates a significant increase in profitability. However, it’s vital to remember that EPS can be influenced by accounting practices, so a comprehensive analysis is necessary.

Industry Benchmark Comparison

Evaluating growth in isolation is misleading. Comparing a company’s growth rates to its industry peers provides crucial context. A company boasting 20% revenue growth might seem impressive, but if the industry average is 30%, it suggests the company is underperforming. Industry benchmarks help to assess a company’s relative performance and competitiveness within its market. Resources like financial news websites, industry reports, and company filings offer industry-specific data for comparison.

Projecting Future Growth Rates

Predicting future growth rates is inherently challenging, but several methods can provide reasonable estimates. One common approach is to extrapolate past growth rates, assuming similar trends will continue. However, this method is unreliable for companies experiencing significant changes (e.g., new product launches, market disruptions). More sophisticated methods involve analyzing market size, competitive landscape, and management forecasts to arrive at a more informed projection. For instance, a company entering a rapidly expanding market might justify a higher projected growth rate than a company in a mature market. A company with a proven track record of exceeding its own forecasts may also warrant a more optimistic projection than one with a history of missed targets.

Managing Risk in Growth Stock Investments

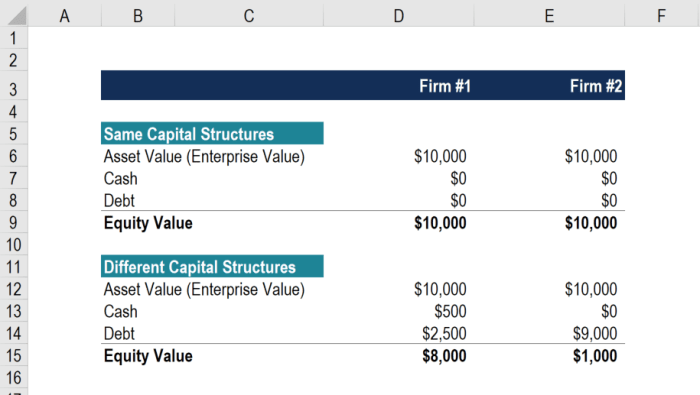

Source: corporatefinanceinstitute.com

Investing in growth stocks can be incredibly rewarding, offering the potential for substantial returns. However, the path to riches isn’t paved with gold; it’s often riddled with potholes of volatility and uncertainty. Understanding and managing these risks is crucial for long-term success. Ignoring the inherent dangers can lead to significant losses, even wiping out your investment entirely. This section will equip you with the knowledge to navigate these challenges and make informed decisions.

Growth stocks, by their very nature, are riskier than more established, slow-and-steady investments. Their valuations often soar based on future potential, not current earnings. This makes them susceptible to sharp declines if that potential fails to materialize. Moreover, the market’s perception of a company’s future can shift rapidly, leading to dramatic price swings. This volatility can be unsettling, especially for investors with shorter time horizons.

Potential Risks Associated with Growth Stock Investments

Growth stocks inherently carry higher risk than more established companies. Volatility is a primary concern; their prices can fluctuate significantly in response to market sentiment, news events, or even minor shifts in investor expectations. Overvaluation is another major pitfall. The excitement surrounding a high-growth company can drive its stock price far beyond its fundamental value, creating a bubble that’s prone to bursting. Furthermore, the financial health of a growth company might be less stable than that of a mature company, increasing the risk of bankruptcy or significant financial distress. Consider the dot-com bubble of the late 1990s: many internet companies saw their valuations skyrocket, only to plummet dramatically when the market corrected. This highlights the importance of thorough due diligence and a realistic assessment of risk.

Strategies for Diversifying a Portfolio

Diversification is your best friend when it comes to managing risk in growth stock investments. Don’t put all your eggs in one basket! Spreading your investments across different sectors, industries, and even asset classes (like bonds or real estate) helps to cushion the blow if one investment underperforms. For example, if you’re heavily invested in technology growth stocks and the tech sector experiences a downturn, the losses will be partially offset by gains in other parts of your portfolio. A well-diversified portfolio reduces the overall volatility and improves the chances of achieving consistent, long-term growth. Consider allocating a portion of your portfolio to established, dividend-paying stocks to balance out the riskier growth stocks.

The Importance of a Long-Term Investment Horizon

Growth stocks are a marathon, not a sprint. Their value often fluctuates dramatically in the short term, making it tempting to panic and sell during dips. However, a long-term perspective is essential for success. Many growth companies take time to mature and reach their full potential. By holding onto your investments through market cycles, you give your growth stocks the opportunity to recover from temporary setbacks and ultimately deliver substantial returns. Consider the long-term growth of companies like Amazon or Google, which experienced significant volatility early on but ultimately delivered enormous returns for patient investors.

Steps to Develop a Robust Investment Strategy for Growth Stocks

A robust investment strategy is essential for navigating the risks associated with growth stocks. Before investing, thoroughly research potential investments. Understand the company’s business model, financial health, competitive landscape, and growth potential. Then, diversify your portfolio across various sectors and asset classes. Allocate a portion of your investments to lower-risk assets to balance out the volatility of growth stocks. Next, establish a clear investment timeline and stick to it. Avoid making impulsive decisions based on short-term market fluctuations. Regularly monitor your portfolio and adjust your strategy as needed, but avoid frequent trading. Finally, stay informed about market trends and economic conditions to anticipate potential risks and opportunities. This disciplined approach will help you manage risk and maximize your chances of long-term success.

Case Studies of Growth Stocks

Source: gtowizard.com

Understanding the nuances of growth stock investing requires more than theoretical knowledge; it demands a deep dive into real-world examples. Analyzing both successful and unsuccessful investments reveals crucial insights into the factors that drive growth and the pitfalls to avoid. By studying these case studies, we can better understand how to identify promising opportunities and mitigate potential risks.

| Company Name | Industry | Key Success/Failure Factors | Lessons Learned |

|---|---|---|---|

| Microsoft (MSFT) | Technology (Software) | Early dominance in PC operating systems, consistent innovation (Windows, Office suite, Azure cloud services), effective management, strategic acquisitions. | Adaptability to changing technological landscapes is crucial for long-term success. Strong leadership and a focus on innovation are key drivers of growth. Strategic acquisitions can significantly accelerate growth but must be carefully evaluated. |

| Netflix (NFLX) | Entertainment (Streaming) | Successful transition from DVD rentals to streaming, original content creation, global expansion, effective data-driven decision-making. | Disruptive innovation can create massive growth opportunities. Understanding and leveraging consumer data is critical for success. Aggressive expansion strategies can yield significant returns but also carry substantial risks. |

| Enron | Energy | Aggressive accounting practices, opaque financial reporting, excessive risk-taking, lack of corporate governance. | Ethical considerations are paramount. Transparency and robust corporate governance are essential to prevent financial scandals. Overly aggressive growth strategies can lead to unsustainable practices and ultimately, failure. |

| Blockbuster | Entertainment (Video Rental) | Failure to adapt to the rise of streaming services, resistance to technological change, slow response to competitor innovation. | Ignoring technological advancements and failing to adapt to changing consumer preferences can lead to obsolescence. Inertia and a lack of foresight can be fatal in rapidly evolving industries. Maintaining a competitive edge requires continuous innovation and adaptation. |

Microsoft and Netflix: Success Through Innovation and Adaptation

Microsoft’s success story highlights the importance of continuous innovation and adaptation. Its initial dominance in the PC operating system market provided a strong foundation, but its subsequent expansion into cloud computing (Azure) and other areas demonstrates its ability to evolve with the technological landscape. Netflix, on the other hand, showcases the power of disruptive innovation and data-driven decision-making. Its successful transition from DVD rentals to streaming and its investment in original content demonstrates a keen understanding of evolving consumer preferences.

Enron and Blockbuster: Failures Due to Mismanagement and Inertia

The failures of Enron and Blockbuster offer stark warnings. Enron’s collapse underscores the devastating consequences of unethical practices and a lack of transparency. Its aggressive accounting practices and opaque financial reporting ultimately led to its downfall, highlighting the critical importance of ethical behavior and strong corporate governance in sustainable growth. Blockbuster’s failure, in contrast, exemplifies the dangers of inertia and a lack of foresight. Its resistance to change and slow response to the rise of streaming services ultimately led to its demise, emphasizing the need for adaptability and innovation in a rapidly changing market.

The Importance of Fundamental Analysis

These case studies demonstrate the crucial role of fundamental analysis in growth stock investing. Fundamental analysis involves examining a company’s financial statements, business model, competitive landscape, and management team to assess its intrinsic value and growth potential. By understanding a company’s strengths and weaknesses, investors can make more informed decisions about whether to invest and at what price. For example, a thorough fundamental analysis of Enron would have revealed its unsustainable business practices and excessive risk-taking, preventing significant losses. Conversely, a similar analysis of Microsoft and Netflix would have highlighted their strong competitive advantages and growth potential.

Illustrative Examples of Growth Stock Characteristics

Understanding the nuances of growth stocks requires looking beyond simple definitions. Let’s examine some real-world scenarios to illustrate key characteristics and their implications. These examples highlight the potential rewards and inherent risks associated with investing in growth companies.

Growth Stock with Strong Revenue Growth but Weak Profitability

Imagine a burgeoning tech startup, “InnovateTech,” specializing in cutting-edge AI software. InnovateTech boasts phenomenal revenue growth, year-over-year increases exceeding 50% for the past three years. However, its profitability remains elusive, consistently reporting net losses as it aggressively invests in research and development, marketing, and expansion. This situation, while seemingly concerning, is not uncommon for high-growth companies in their early stages. The focus is on capturing market share and establishing dominance before prioritizing immediate profits. The implication for investors is a potentially volatile stock price, heavily reliant on future projections and the company’s ability to eventually translate revenue growth into sustainable profitability. A failure to achieve profitability could lead to a significant drop in stock value, even with continued revenue growth. Conversely, a successful transition to profitability could result in exponential gains.

Growth Stock with High Market Capitalization and High Price-to-Earnings Ratio

Consider “GlobalMegaCorp,” a mature tech giant with a massive market capitalization exceeding $1 trillion and a high price-to-earnings (P/E) ratio of 40. Its high market cap reflects investor confidence in its established brand, strong revenue streams, and future growth potential. The elevated P/E ratio, however, suggests investors are willing to pay a premium for its earnings, anticipating continued strong performance. This presents both opportunities and risks. The opportunity lies in the potential for continued capital appreciation as the company continues to grow. However, the risk is significant; a high P/E ratio makes the stock vulnerable to market corrections and negative news. Any slowdown in growth could trigger a sharp decline in the stock price as investors re-evaluate their premium valuation. A similar situation unfolded with several high-growth tech companies during the 2022 market downturn, where their high P/E ratios amplified their price drops.

Visual Representation of a Successful Growth Stock’s Trajectory

Imagine a graph charting the stock price of a successful growth company over time. The graph would initially show slow, steady growth during the early stages (the “seed” phase), representing the company’s initial development and market entry. This is followed by a period of rapid, exponential growth (the “growth” phase) as the company gains traction and market share. As the company matures and approaches market saturation, the growth rate begins to slow (the “maturity” phase), leveling off to a more moderate, sustainable increase. Finally, the graph may show a period of relative stability or even slight decline (the “decline” phase) as competition intensifies or the company fails to innovate and adapt. The overall shape of the graph would resemble a hockey stick, initially flat, then sharply rising, and eventually plateauing or slightly declining. This visual representation highlights the typical lifecycle of a growth stock, emphasizing the importance of timing and understanding the different stages of a company’s development.

Ultimate Conclusion

Investing in growth stocks can be a thrilling ride, offering the potential for substantial returns. However, it’s crucial to remember that high growth often comes with higher risk. By understanding the key characteristics of growth stocks, employing rigorous screening methods, and developing a sound investment strategy, you can significantly increase your chances of success. Remember, thorough research, diversification, and a long-term perspective are your best allies in this exciting investment journey.