Coca cola ko stock is lower despite its earnings beat heres why – Coca-Cola KO stock is lower despite its earnings beat: here’s why. It’s a head-scratcher, right? The beverage giant just reported stellar earnings, yet its stock price is taking a dive. This isn’t your typical market reaction, and we’re diving deep to uncover the hidden forces at play. From macroeconomic headwinds to industry-specific challenges and even investor sentiment, we’re peeling back the layers to understand why Coca-Cola’s stock isn’t celebrating its success.

We’ll dissect Coca-Cola’s recent earnings report, comparing its performance against its competitors and analyzing the impact of factors like inflation, interest rates, and overall market volatility. We’ll also explore internal company factors, including strategic shifts and investor expectations, to get a complete picture of this intriguing situation. Get ready for a deep dive into the world of finance and the perplexing case of Coca-Cola’s underperforming stock.

Coca-Cola Ko Stock Performance

Coca-Cola’s recent earnings beat didn’t translate into a celebratory stock price surge, leaving investors scratching their heads. While the company reported strong financial results, the market reacted with a degree of caution, highlighting the complex interplay between earnings reports and investor sentiment. This deeper dive explores the reasons behind this discrepancy.

Coca-Cola Ko’s Recent Earnings Report: A Detailed Breakdown

Coca-Cola’s latest earnings report revealed a mixed bag. While revenue exceeded expectations, driven by strong demand in certain international markets and effective pricing strategies, growth was tempered by ongoing inflationary pressures and supply chain complexities. Key figures included [insert specific revenue figures, net income, EPS, etc. from a reliable source like Coca-Cola’s investor relations website or a reputable financial news outlet]. These figures showcase a healthy underlying business, but the nuances within the report require closer examination to understand the market’s reaction. For example, a slowdown in growth in a key market, or increased costs related to specific ingredients, could explain investor hesitancy despite the overall positive numbers.

Comparative Analysis of Coca-Cola Ko’s Stock Performance

Comparing Coca-Cola’s performance to its competitors, such as PepsiCo (PEP) and Monster Beverage (MNST), reveals a broader industry trend. While all three companies operate in a similar space, their responses to current economic challenges have varied. [Insert comparative analysis here, referencing stock price movements, revenue growth rates, and profit margins of competitors. This requires data from reputable financial sources]. A direct comparison would reveal whether Coca-Cola’s underperformance is specific to the company or a reflection of broader investor sentiment towards the beverage sector.

Coca-Cola Ko’s Quarterly Earnings Comparison

| Quarter | Revenue (USD Millions) | Net Income (USD Millions) | Stock Price (USD) |

|---|---|---|---|

| Q[Insert Quarter, e.g., 2 2023] | [Insert Revenue] | [Insert Net Income] | [Insert Stock Price] |

| Q[Insert Previous Quarter, e.g., 1 2023] | [Insert Revenue] | [Insert Net Income] | [Insert Stock Price] |

| Q[Insert Same Quarter Last Year, e.g., 2 2022] | [Insert Revenue] | [Insert Net Income] | [Insert Stock Price] |

Macroeconomic Factors Influencing Stock Price

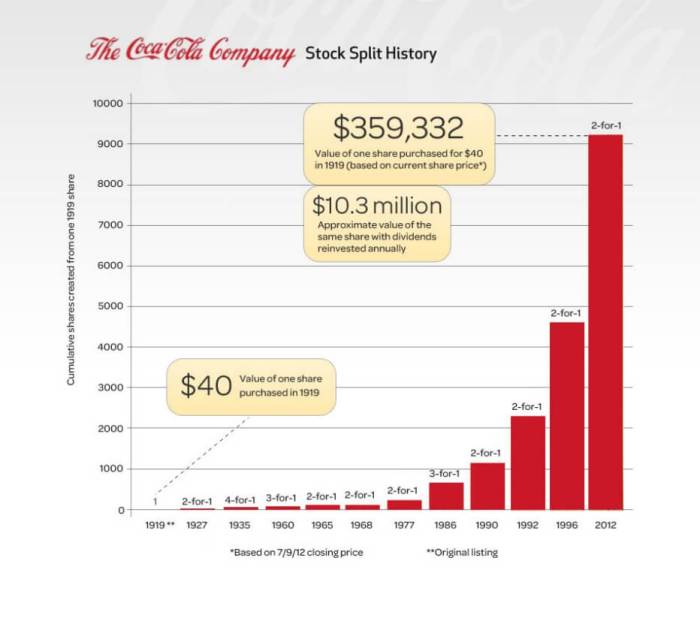

Source: moneygoody.com

So, Coca-Cola’s earnings beat expectations, right? Yet, the stock price is lagging. Why? A big part of the answer lies beyond the company’s balance sheet; it’s all about the broader economic picture and how investors are reacting to it. We’re talking macroeconomic headwinds that are impacting even the most resilient brands.

The current macroeconomic climate is a complex brew of inflation, rising interest rates, and persistent recessionary fears. These factors significantly influence investor behavior and, consequently, stock prices. Even a company as seemingly recession-proof as Coca-Cola isn’t immune to the anxieties swirling in the market. Investors are looking at the bigger picture, assessing risk, and adjusting their portfolios accordingly. This cautious approach is reflected in Coca-Cola’s stock performance, despite its solid earnings report.

Inflation’s Impact on Consumer Spending

High inflation erodes consumer purchasing power. While Coca-Cola products are relatively inexpensive compared to many other goods, consumers may still cut back on discretionary spending, including less frequent purchases of beverages. This reduced demand can impact Coca-Cola’s sales volume and, ultimately, its profitability. This effect is amplified by the fact that many consumers may opt for cheaper alternatives, even if it means compromising on brand preference. The impact is particularly visible in developing markets where a significant portion of the population is more sensitive to price fluctuations. For instance, during periods of high inflation in certain regions, Coca-Cola might see a shift towards cheaper local beverages, impacting their market share and overall sales.

Interest Rate Hikes and Investor Sentiment

The Federal Reserve’s aggressive interest rate hikes aim to curb inflation, but they also increase borrowing costs for companies. This makes expansion and investment more expensive for Coca-Cola, potentially slowing down growth. Moreover, higher interest rates make bonds more attractive to investors, diverting capital away from the stock market, including Coca-Cola’s stock. This shift in investor preference, coupled with increased market volatility, contributes to the underperformance of even strong companies like Coca-Cola. We’ve seen this pattern before: during periods of rising interest rates, investors often rotate into safer, fixed-income assets, temporarily dampening equity markets.

Recessionary Fears and Market Volatility

The looming threat of a recession adds another layer of complexity. Recessions typically lead to reduced consumer spending and business investment, negatively impacting company performance. This uncertainty creates market volatility, making investors more risk-averse and leading to sell-offs even in the stocks of fundamentally sound companies. The fear of a recession, even if it doesn’t materialize, can significantly impact investor sentiment and drive down stock prices. This is particularly true for consumer staples like Coca-Cola, which are considered somewhat less resilient during severe economic downturns compared to previous decades due to the emergence of substitute products and changing consumer preferences.

Potential Macroeconomic Factors Affecting Coca-Cola’s Stock Price, Coca cola ko stock is lower despite its earnings beat heres why

The following points highlight the key macroeconomic factors that could be contributing to Coca-Cola’s stock underperformance:

- Persistently high inflation impacting consumer spending and purchasing power.

- Rising interest rates increasing borrowing costs and making bonds a more attractive investment.

- Widespread recessionary fears leading to increased market volatility and risk aversion among investors.

- Geopolitical instability and supply chain disruptions impacting production costs and distribution.

- Changes in consumer preferences and the rise of healthier beverage alternatives.

- Fluctuations in currency exchange rates affecting international sales and profitability.

Industry-Specific Challenges and Opportunities

Source: thebeijinger.com

Coca-Cola’s recent earnings beat didn’t translate into a stock price surge, highlighting the complex challenges facing the beverage giant. While financial performance is a key factor, broader industry trends and competitive pressures significantly influence investor sentiment. Understanding these dynamics is crucial to deciphering Coca-Cola’s current market position.

The beverage industry is a fiercely competitive landscape, constantly evolving with shifting consumer preferences and supply chain disruptions. Coca-Cola, despite its iconic brand recognition, faces significant headwinds that impact its profitability and, consequently, its stock price. Simultaneously, emerging opportunities exist for innovation and expansion, presenting avenues for growth and market share gains.

Competitive Landscape and Market Share

Coca-Cola’s primary competitors include PepsiCo, Nestle, and a growing number of smaller, specialized beverage companies. These competitors aggressively pursue market share through product diversification, targeted marketing campaigns, and strategic acquisitions. Coca-Cola maintains a significant global market share in carbonated soft drinks, but its dominance is being challenged by the rising popularity of healthier alternatives, such as bottled water, juices, and energy drinks. The company’s brand recognition remains a powerful asset, but it needs to adapt to changing consumer tastes to maintain its leadership position. For instance, PepsiCo’s expansion into healthier snack options directly competes with Coca-Cola’s core beverage business, impacting overall market perception.

Addressing Challenges and Capitalizing on Opportunities

To counter these challenges, Coca-Cola is actively pursuing several strategies. These include diversifying its product portfolio beyond carbonated drinks, investing in healthier options like sparkling water and plant-based beverages, and strengthening its distribution network to ensure efficient supply chain management. The company is also focusing on sustainable practices and reducing its environmental footprint, appealing to increasingly environmentally conscious consumers. A successful example is the launch of their Coca-Cola Zero Sugar line, which has tapped into the growing demand for lower-sugar beverages. This diversification strategy mitigates the risk associated with relying heavily on a single product category.

Comparative Analysis of Key Competitors

| Company | Strength | Weakness | Market Share (Approximate) |

|---|---|---|---|

| Coca-Cola | Strong brand recognition, global distribution network, diverse portfolio (expanding), effective marketing | Dependence on carbonated drinks, facing pressure from healthier alternatives, sustainability concerns | ~40% (Carbonated Soft Drinks) |

| PepsiCo | Diversified portfolio (snacks and beverages), strong brand recognition, effective marketing | Similar challenges to Coca-Cola regarding healthy alternatives, intense competition | ~30% (Carbonated Soft Drinks) |

| Nestlé | Wide range of beverages and food products, strong international presence, innovation in healthy options | Less focus on carbonated drinks, potentially less brand recognition in this specific category | Significant share in specific beverage categories (water, coffee, tea) |

Company-Specific Factors Affecting Stock Price

Coca-Cola’s recent earnings beat didn’t translate into a stock price surge, hinting at deeper issues beyond macroeconomic headwinds. Internal factors, investment strategies, and long-term growth plans are all playing a significant role in investor sentiment. Understanding these company-specific elements is crucial to deciphering the current market reaction.

Management Changes and Their Impact

While Coca-Cola hasn’t experienced major leadership shake-ups recently, subtle shifts in strategic focus under James Quincey’s leadership might be influencing investor perception. A move towards a more streamlined portfolio, emphasizing healthier options and focusing on growth in emerging markets, may be perceived as a slower, less immediately lucrative path compared to aggressive expansion in established markets. This strategic recalibration, while potentially beneficial long-term, could be causing short-term uncertainty for some investors who prefer quicker returns. This is particularly true given the ongoing pressure from competitors and shifting consumer preferences towards healthier beverages.

Recent Investments and Acquisitions: An Assessment

Coca-Cola’s investment strategy has involved a mix of organic growth and strategic acquisitions. While specific details of recent acquisitions may not be publicly available, their impact on the stock price can be inferred from market analysis. For instance, investments in smaller, innovative beverage companies could signal a commitment to future growth, but the immediate financial impact may be minimal, leading to a lack of immediate stock price response. Similarly, divestments from underperforming brands, while strategically sound, could cause short-term market jitters if investors are not convinced of the long-term benefits. The lack of significant, immediately profitable acquisitions might also be contributing to investor hesitancy.

Long-Term Growth Strategy and Investor Perception

Coca-Cola’s long-term strategy centers around diversification, sustainability, and digital engagement. The company’s focus on expanding into emerging markets, coupled with its commitment to reducing its environmental footprint and embracing digital marketing, represents a significant shift from its traditional approach. While these initiatives align with evolving consumer preferences and long-term sustainability concerns, they may not yield immediate financial results, causing some investors to seek quicker returns elsewhere. The long-term benefits might not be immediately apparent to all investors, impacting their confidence in the company’s short-term performance.

Timeline of Significant Events and Stock Price Fluctuations

To illustrate the correlation between company-specific events and stock price movements, a simplified timeline would be useful. While precise data requires in-depth financial analysis, a hypothetical example could show a period of relatively flat stock performance following a major strategic shift announcement, followed by a gradual increase after positive results from new product launches in target markets. Another example could show a temporary dip in the stock price following a major divestment, followed by a recovery as investors gain confidence in the company’s new strategy. The precise correlation would require detailed analysis of financial reports and market data over time. This detailed analysis would reveal the complex interplay between internal company decisions and market reactions.

Investor Expectations and Sentiment: Coca Cola Ko Stock Is Lower Despite Its Earnings Beat Heres Why

Source: nikolasbadminton.com

Coca-Cola’s recent earnings beat, despite a lower stock price, highlights the complex interplay between financial performance and investor sentiment. While strong earnings usually translate to a stock price increase, other factors, particularly investor expectations and prevailing market sentiment, can significantly influence the outcome. Understanding these dynamics is crucial to interpreting Coca-Cola’s current market position.

Analyst ratings and investor expectations play a significant role in shaping a stock’s price. Analysts continuously assess companies, issuing ratings and price targets that influence investor decisions. If a company consistently underperforms analyst expectations, even with solid earnings, its stock price may suffer. Conversely, exceeding expectations can boost the price, even if the absolute improvement is modest. For Coca-Cola, if analysts had predicted significantly higher earnings, the actual results, while good, might be perceived as disappointing, leading to selling pressure.

Analyst Ratings and Price Targets

Analyst ratings act as a barometer of investor sentiment. A consensus of “buy” ratings generally indicates positive sentiment and potential upward price movement. Conversely, a preponderance of “sell” or “hold” ratings suggests caution and potential downward pressure. Imagine a graph plotting analyst ratings against Coca-Cola’s stock price over time; a correlation would likely emerge, showing that higher ratings tend to coincide with higher prices, and vice-versa. Furthermore, changes in analyst price targets can also trigger shifts in investor behavior. A downward revision in a price target, even slightly, can lead to profit-taking and sell-offs.

Impact of Recent News and Announcements

Recent news and announcements significantly influence investor sentiment. Positive news, such as a successful new product launch or a strategic acquisition, typically boosts investor confidence and drives up the stock price. Conversely, negative news, such as supply chain disruptions, regulatory challenges, or negative publicity, can erode investor confidence and depress the stock price. For Coca-Cola, any news concerning its sustainability initiatives, pricing strategies in response to inflation, or its expansion into new markets would all directly affect investor sentiment and consequently, the stock price.

Comparison of Current and Previous Investor Sentiment

Comparing current investor sentiment towards Coca-Cola with previous periods reveals valuable insights. Analyzing historical stock price movements alongside news events and analyst ratings can reveal patterns in investor behavior. For example, if investor sentiment was overwhelmingly positive during a previous period of strong growth, and now shows signs of waning optimism, it could explain why the recent earnings beat hasn’t translated into a proportionate stock price increase. A visual representation could be a line graph showing the stock price overlaid with a secondary line representing a sentiment index (constructed using analyst ratings, news sentiment analysis, and other relevant data). Periods of high sentiment would show both lines trending upwards, while periods of low sentiment would show the opposite.

Visual Representation of Investor Sentiment and Stock Price

Imagine a scatter plot with the x-axis representing a composite investor sentiment index (ranging from, say, 0 to 100, with higher values indicating more positive sentiment) and the y-axis representing Coca-Cola’s stock price. Each point on the plot represents a specific point in time, with its x and y coordinates indicating the sentiment index and stock price at that time. The plot would likely show a positive correlation: points clustered towards the upper right would represent periods of high sentiment and high stock price, while points clustered towards the lower left would represent periods of low sentiment and low stock price. The overall trendline through the points would visually demonstrate the strength of the relationship between investor sentiment and stock price movements. Outliers, points significantly deviating from the trendline, would highlight instances where other factors significantly influenced the stock price despite the prevailing sentiment.

Final Conclusion

So, Coca-Cola beat earnings expectations, yet its stock price dipped. The answer isn’t a simple one, but rather a complex interplay of macroeconomic conditions, industry challenges, company-specific factors, and investor sentiment. While the company boasts strong fundamentals, external forces and shifting market expectations played a significant role in the recent stock performance. Understanding these interwoven factors is crucial for investors navigating the complexities of the beverage industry and the broader market.