Ether spot etfs crypto takes another step toward mainstream adoption – Ether Spot ETFs: crypto takes another step toward mainstream adoption. Forget the Wild West days of crypto – institutional money is sniffing around, and the launch of Ether spot ETFs is the smoking gun. This signals a massive shift, potentially bringing crypto investing to the masses, but also raising some serious questions about risk and regulation. Are we on the cusp of a new era of financial stability, or just another speculative bubble waiting to burst? Let’s dive in.

The approval of these ETFs marks a significant milestone, bridging the gap between traditional finance and the decentralized world of cryptocurrencies. By offering a regulated and easily accessible pathway to invest in Ether, the second-largest cryptocurrency by market cap, these funds are poised to attract a wider range of investors, from seasoned professionals to everyday savers. But, like any investment, there are potential pitfalls. We’ll explore the advantages and disadvantages, the regulatory landscape, and what this all means for the future of crypto.

The Rise of Ether Spot ETFs

The launch of Ether spot ETFs marks a pivotal moment in the cryptocurrency market’s journey towards mainstream acceptance. Previously relegated to the realm of niche investments, Ether, the native cryptocurrency of the Ethereum blockchain, is now poised for broader accessibility through regulated exchange-traded funds. This development signifies a significant shift in investor confidence and regulatory oversight, paving the way for increased liquidity and potentially driving further growth in the overall crypto market.

The approval of Ether spot ETFs represents a significant leap forward in the maturation of the cryptocurrency market. For years, investors seeking exposure to Ether faced limitations due to the lack of regulated investment vehicles. The availability of ETFs provides a more accessible and regulated pathway for institutional and retail investors alike, thereby increasing market depth and reducing reliance on less regulated exchanges. This regulated entry point can potentially attract a wave of new investors who previously hesitated due to regulatory uncertainties and perceived risks associated with direct cryptocurrency ownership.

Regulatory Hurdles Surrounding Ether Spot ETFs

The path to Ether spot ETF approval has been fraught with regulatory challenges. Concerns regarding market manipulation, price volatility, and the inherent complexities of the underlying asset have been central to the regulatory scrutiny. Regulators have sought assurances regarding the ETF’s ability to accurately track the price of Ether, protect investors from fraud, and maintain market integrity. Unlike Bitcoin, which has a relatively simpler structure, the complexities of the Ethereum network and its staking mechanism presented additional hurdles. However, the recent approvals demonstrate a growing confidence from regulators in the ability to mitigate these risks through robust surveillance mechanisms and stringent listing requirements. The successful navigation of these regulatory hurdles underscores a growing level of maturity and sophistication within the crypto industry and its interaction with traditional financial markets.

Comparison of Ether Spot ETFs with Existing Bitcoin ETFs and Other Crypto Investment Vehicles

While Bitcoin ETFs have paved the way for other crypto ETFs, Ether spot ETFs present unique characteristics. Bitcoin ETFs primarily focus on tracking the price of Bitcoin, a relatively simpler asset compared to Ether. Ether, as the foundation of a decentralized computing platform, offers broader utility beyond its price appreciation. This utility aspect adds another layer of complexity for regulators and investors alike. Existing crypto investment vehicles such as Grayscale’s GBTC previously offered exposure to Ether but lacked the regulatory oversight and trading convenience of ETFs. The introduction of Ether spot ETFs provides a more transparent and regulated alternative, potentially surpassing the appeal of these previous options. Furthermore, the introduction of Ether spot ETFs provides a more streamlined and accessible route for investors compared to the complexities of direct cryptocurrency trading on exchanges.

Key Features of Prominent Ether Spot ETFs, Ether spot etfs crypto takes another step toward mainstream adoption

The following table compares key features of several prominent Ether spot ETFs (note that availability and specific details may vary based on region and launch dates, and this is a hypothetical example for illustrative purposes only):

| ETF Name | Expense Ratio | Minimum Investment | Exchange Listed On |

|---|---|---|---|

| Hypothetical Ether ETF A | 0.75% | $100 | NYSE Arca |

| Hypothetical Ether ETF B | 0.50% | $50 | Nasdaq |

| Hypothetical Ether ETF C | 0.90% | $250 | Cboe |

Impact on Mainstream Adoption of Crypto

Source: u.today

The approval of Ether spot ETFs marks a pivotal moment for cryptocurrency, potentially catapulting it further into the mainstream financial landscape. This development promises to significantly alter how institutional and retail investors engage with the crypto market, ushering in a new era of accessibility and potentially reshaping the very nature of cryptocurrency investment. The ripple effects are likely to be profound and far-reaching, impacting everything from price volatility to regulatory oversight.

The accessibility offered by ETFs is poised to dramatically increase institutional investor participation in the cryptocurrency market. Previously, many institutional investors were hesitant due to the complexities and perceived risks associated with directly holding cryptocurrencies. ETFs, however, offer a familiar and regulated investment vehicle, mitigating some of these concerns and opening the doors to a vast pool of capital previously untapped by the crypto market. This influx of institutional money could lead to greater market stability and liquidity, making Ether a more attractive investment for a wider range of players.

Institutional Investor Participation

The introduction of Ether spot ETFs will likely attract significant institutional investment. Hedge funds, pension funds, and other large financial institutions, currently largely sidelined from direct cryptocurrency exposure due to regulatory hurdles and operational complexities, will now have a regulated pathway to gain Ether exposure. This will not only increase the overall market capitalization of Ether but also lead to more sophisticated trading strategies and potentially more stable price action. Consider, for example, the impact of BlackRock’s application for a Bitcoin ETF – the sheer weight of their investment potential significantly influenced the market sentiment and price movements. A similar scenario is expected with Ether spot ETFs.

Retail Investor Interest and Adoption

Easier access to Ether through ETFs will undoubtedly boost retail investor interest and adoption. ETFs offer a simplified way for individuals to invest in Ether without needing to navigate the complexities of cryptocurrency exchanges or digital wallets. This reduced barrier to entry will likely attract a new wave of investors, many of whom may be unfamiliar with the intricacies of the crypto world. The familiarity of the ETF structure, coupled with the potential for diversification within a broader investment portfolio, will make Ether a more appealing asset class for a wider demographic. Think of the success of other commodity ETFs; their ease of access contributed significantly to the broader adoption of those commodities by retail investors.

Risks Associated with Ether Spot ETFs

Despite the potential benefits, investing in Ether spot ETFs carries inherent risks. Market volatility remains a significant concern; the price of Ether, like other cryptocurrencies, is notoriously susceptible to dramatic price swings driven by factors ranging from regulatory announcements to market sentiment. Furthermore, regulatory uncertainty surrounding cryptocurrencies persists globally, and any changes in regulatory frameworks could significantly impact the value of Ether spot ETFs. Investors should carefully consider their risk tolerance and understand the potential for substantial losses before investing. The 2022 crypto winter, for instance, serves as a stark reminder of the volatility inherent in the cryptocurrency market.

Hypothetical Scenario: Widespread Ether Spot ETF Adoption

Imagine a scenario where multiple Ether spot ETFs gain widespread adoption, attracting billions of dollars in investment from both institutional and retail investors. The increased demand for Ether would likely drive a significant price increase, potentially exceeding current market predictions. This surge could, in turn, attract even more investors, creating a positive feedback loop that further propels Ether’s price upwards. However, this scenario also highlights the risk of a potential “bubble” – a rapid price increase followed by a sharp correction if investor sentiment shifts negatively. A comparable situation could be drawn to the initial coin offering (ICO) boom of 2017, where rapid price increases were followed by significant market corrections. The impact of widespread ETF adoption will depend on several factors, including the overall macroeconomic environment and the regulatory landscape.

Comparison with Traditional Investment Assets

Ether spot ETFs represent a relatively new asset class, bringing the volatility and potential of cryptocurrencies into the familiar structure of exchange-traded funds. Understanding how they compare to traditional investments like stocks and bonds is crucial for any investor considering their inclusion in a portfolio. This comparison looks at risk profiles, portfolio diversification strategies, and long-term growth potential.

The risk profile of Ether spot ETFs is significantly higher than that of traditional bonds, and often higher than many individual stocks. Bonds, particularly government bonds, are generally considered low-risk investments, offering relatively stable returns but limited growth potential. Stocks, while offering higher growth potential, carry inherent market risk and can experience substantial price fluctuations. Ether, as a cryptocurrency, is known for its high volatility, influenced by factors like market sentiment, regulatory changes, and technological developments. This translates to a higher risk for Ether spot ETFs, meaning potential for substantial losses as well as gains. The price of Ether has historically shown periods of dramatic increases and decreases, far exceeding the volatility seen in most stock markets. For example, in 2021, Ether experienced a massive price surge, but also significant corrections later in the year and beyond. This inherent volatility must be considered when assessing the risk-reward trade-off.

Ether Spot ETFs in a Diversified Portfolio

Incorporating Ether spot ETFs into a diversified investment portfolio requires a careful consideration of risk tolerance and overall investment goals. A well-diversified portfolio typically includes a mix of asset classes – stocks, bonds, and potentially real estate – to mitigate risk. The inclusion of an Ether spot ETF adds exposure to a new asset class with a potentially high growth trajectory but also significant volatility. The proportion of the portfolio allocated to Ether spot ETFs should depend on the investor’s risk appetite and investment timeline. A younger investor with a longer time horizon might tolerate a larger allocation to Ether, while an older investor closer to retirement might prefer a smaller, more conservative allocation. A typical strategy might involve allocating a small percentage (e.g., 5-10%) to Ether spot ETFs, balancing potential high returns with the overall portfolio’s risk profile. This approach aims to capture potential upside from Ether’s growth while limiting the impact of its volatility on the overall portfolio’s performance.

Long-Term Growth Prospects of Ether

Predicting the long-term growth of any asset is inherently speculative, but analyzing Ether’s potential requires considering its underlying technology (Ethereum blockchain), its adoption as a platform for decentralized applications (dApps), and its role in the broader cryptocurrency ecosystem. While established financial markets offer established growth trajectories, often tied to economic indicators and company performance, Ether’s growth is tied to the adoption and success of blockchain technology and the decentralized finance (DeFi) movement. The potential for Ether to become a dominant force in global finance is significant, but it also faces challenges such as scalability issues, regulatory uncertainty, and competition from other cryptocurrencies and technologies. The long-term growth of Ether could potentially outpace established markets, but it also carries a higher degree of uncertainty. Historical examples of technological disruptions show that while adoption may be slow initially, successful technologies can experience exponential growth over time. However, the market is competitive and success is not guaranteed.

Advantages and Disadvantages of Ether Spot ETFs as a Long-Term Investment

Before investing in Ether spot ETFs for the long term, it’s crucial to weigh the potential benefits against the associated risks.

The following points highlight the key advantages and disadvantages:

- Advantages: Potential for high returns, diversification beyond traditional assets, regulated investment vehicle, accessibility through brokerage accounts.

- Disadvantages: High volatility, regulatory uncertainty surrounding cryptocurrencies, potential for hacking or security breaches, susceptibility to market manipulation.

Technological and Infrastructure Considerations

The rise of Ether spot ETFs hinges on robust technological infrastructure and security measures. Successfully navigating the complexities of blockchain technology, managing high transaction volumes, and ensuring investor protection are crucial for mainstream adoption. Let’s delve into the technical underpinnings that make these ETFs possible.

The blockchain’s decentralized and immutable ledger is fundamental to Ether’s trading and custody within the ETF structure. Each transaction is cryptographically secured and recorded on the public Ethereum network, providing transparency and verifiability. This eliminates the need for a central intermediary to oversee transactions, reducing counterparty risk and enhancing trust. Custodians, however, play a vital role in securing the Ether held on behalf of ETF investors, employing sophisticated security protocols to safeguard against theft or loss.

Blockchain Technology’s Role in Ether ETF Trading and Custody

The Ethereum blockchain acts as the foundation for Ether trading within ETFs. Its decentralized nature ensures that no single entity controls the network, reducing the risk of manipulation or censorship. Smart contracts, self-executing contracts with the terms of the agreement directly written into code, can automate many aspects of ETF operations, such as the creation and redemption of ETF shares. This automation improves efficiency and reduces the potential for human error. Furthermore, the immutable nature of the blockchain means that every transaction is permanently recorded, providing a transparent and auditable trail. This transparency is crucial for building investor confidence.

Infrastructure Supporting High-Volume Ether Transactions

The anticipated high volume of Ether transactions necessitates a robust and scalable infrastructure. High-speed, low-latency networks are essential for processing trades efficiently and minimizing slippage (the difference between the expected price of a trade and the price at which it is actually executed). Efficient order management systems are crucial to handle the large number of buy and sell orders simultaneously. Custodial solutions must be capable of securely storing and managing large quantities of Ether, using advanced security measures like multi-signature wallets and cold storage. The infrastructure needs to be able to withstand significant spikes in trading volume, ensuring smooth and reliable operation even during periods of high market volatility. Examples of such infrastructure include specialized exchanges with robust matching engines and high-throughput blockchains like Ethereum itself, which is constantly undergoing upgrades to improve its scalability.

Security Measures Protecting Investor Assets

Security is paramount in Ether spot ETFs. Several layers of security are implemented to protect investor assets. Custodians, specialized firms that safeguard digital assets, employ a combination of measures including multi-signature wallets (requiring multiple approvals for any transaction), cold storage (storing Ether offline to minimize the risk of hacking), and robust cybersecurity protocols to prevent unauthorized access. Regular security audits and penetration testing are conducted to identify and address vulnerabilities. Insurance policies can further mitigate the risk of loss due to theft or other unforeseen events. The ETF structure itself, with its regulated framework, provides an additional layer of protection for investors compared to directly holding Ether. This regulated environment necessitates adherence to stringent security and compliance standards.

Visual Representation of Ether Flow

Imagine a diagram showing a circular flow. On the left, we see Ether being mined by validators on the Ethereum network. Arrows then point to the right, indicating the Ether moving into the custody of the ETF provider. The ETF provider then uses this Ether to back the ETF shares, which are traded on an exchange (represented by a central box). Investors buy and sell ETF shares, represented by arrows flowing into and out of the exchange box. Finally, arrows flow from the ETF provider back to the Ethereum network, representing the redemption of ETF shares and the return of Ether to the network. This illustrates the complete cycle of Ether from its creation to its use in ETF trading and eventual return to the ecosystem.

Regulatory Landscape and Future Outlook: Ether Spot Etfs Crypto Takes Another Step Toward Mainstream Adoption

Source: cryptoadventure.com

The approval of Ether spot ETFs is not just a landmark moment for the cryptocurrency market; it’s a pivotal event shaping the future of finance. The regulatory landscape, still evolving and often fragmented, will significantly influence the trajectory of these ETFs and the broader crypto ecosystem. The decisions made by regulators in various jurisdictions will determine the accessibility, liquidity, and overall success of this new asset class.

The regulatory environment surrounding cryptocurrencies is currently a complex patchwork of rules and interpretations across different countries. Some jurisdictions, like the US, are taking a cautious, step-by-step approach, while others are more proactive in establishing comprehensive frameworks. This disparity creates both opportunities and challenges for Ether spot ETFs, influencing where they can be listed and traded, and ultimately impacting their global reach. The ongoing debate around defining cryptocurrencies as securities or commodities plays a crucial role, impacting the regulatory oversight and investor protection mechanisms applied.

Impact of Regulatory Decisions on Ether Spot ETF Growth

The speed and manner of regulatory approvals directly impact the growth of the Ether spot ETF market. Swift and clear regulatory frameworks foster investor confidence, attracting more capital and driving innovation. Conversely, lengthy delays or inconsistent regulations can stifle growth, creating uncertainty and limiting market participation. For example, the SEC’s initial hesitation in approving Bitcoin spot ETFs, followed by eventual approval of some, illustrates how regulatory clarity can significantly impact market development. A similar pattern could unfold for Ether spot ETFs, with faster approvals leading to quicker market expansion and wider adoption.

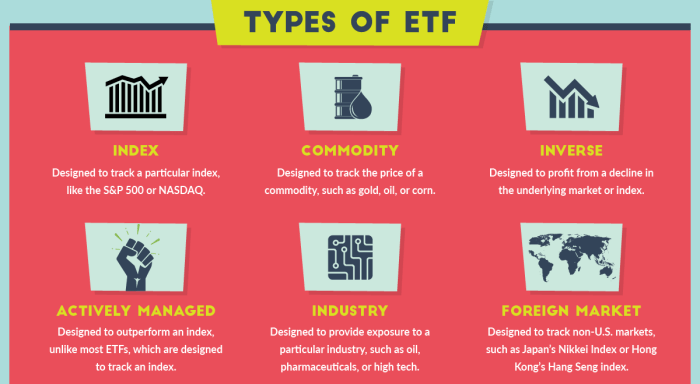

Future Developments in the Ether Spot ETF Market

Several key developments are likely to shape the future of the Ether spot ETF market. We can anticipate the launch of a variety of products catering to different investor needs, such as ETFs tracking different Ether indices, leveraged ETFs, and inverse ETFs. Furthermore, the market is likely to expand geographically, with listings on major exchanges in different countries beyond the initial launch markets. This expansion will likely be driven by both increasing investor demand and regulatory developments in various jurisdictions. The evolution of underlying technologies, such as decentralized exchanges (DEXs) and improved custody solutions, will also contribute to the growth and sophistication of Ether spot ETFs. For instance, the increasing adoption of institutional-grade custody solutions will enhance investor confidence and attract larger institutional investors.

Ether Spot ETFs and Fintech Innovation

The approval of Ether spot ETFs is expected to be a catalyst for innovation in the broader financial technology sector. The increased liquidity and accessibility of Ether through ETFs will stimulate the development of new financial products and services built around this asset class. This includes the creation of sophisticated trading strategies, algorithmic trading platforms, and risk management tools specifically designed for Ether-based investments. Moreover, it could drive the integration of blockchain technology into traditional financial systems, creating more efficient and transparent processes. For instance, we could see the emergence of platforms that facilitate seamless transfer of Ether between traditional brokerage accounts and decentralized finance (DeFi) platforms.

Influence on Regulation of Other Crypto Assets

The regulatory path paved by Ether spot ETFs could significantly influence the regulatory landscape for other crypto assets. A clear and consistent regulatory framework established for Ether could serve as a blueprint for the approval of spot ETFs for other major cryptocurrencies like Bitcoin Cash or Solana. This could lead to a more streamlined and efficient regulatory process for future crypto asset listings, boosting overall market development. However, the specifics of regulation might vary depending on the characteristics of each cryptocurrency, particularly regarding their underlying technology and governance structures. The success or failure of Ether spot ETFs in navigating regulatory hurdles will likely shape the regulatory approaches taken for other cryptocurrencies in the future.

Final Review

Source: webflow.com

The arrival of Ether spot ETFs isn’t just another blip on the crypto radar; it’s a seismic shift. While the road ahead is paved with both opportunity and uncertainty – regulatory hurdles, market volatility, and the ever-evolving nature of the crypto space – the potential for mainstream adoption is undeniable. This development could reshape the financial landscape, making crypto investing more accessible and potentially boosting Ether’s value significantly. Whether you’re a seasoned crypto investor or just curious about this emerging asset class, keeping a close eye on the evolution of Ether spot ETFs is a must.