Georgia property tax on the ballot this year means big changes are brewing for homeowners and businesses alike. This isn’t just another election; it’s a direct referendum on how Georgia funds its vital services, from schools to infrastructure. We’re breaking down the complex details of the proposed changes, the arguments for and against, and what it all means for your wallet – and your community.

This year’s ballot initiatives propose significant alterations to the existing property tax system, impacting everything from assessment methods to the allocation of funds. Understanding these changes is crucial, as they will directly influence your property taxes and the future of Georgia’s public services. We’ll delve into the specifics of each measure, exploring the potential benefits and drawbacks for different groups of property owners.

Overview of Georgia Property Tax Systems

Georgia’s property tax system, while seemingly straightforward, involves a complex interplay of assessment, valuation, and revenue allocation across its diverse counties. Understanding this system is crucial for homeowners and businesses alike, as property taxes represent a significant portion of local government funding. This overview breaks down the key components to help you navigate this important aspect of Georgia’s financial landscape.

Types of Property Taxes in Georgia

Georgia levies property taxes on various types of property, including residential real estate, commercial properties, and agricultural land. The tax rate and assessment methods vary depending on the property’s classification and location. For instance, agricultural land may receive special tax considerations to encourage farming. Similarly, certain historical properties might qualify for exemptions or reduced rates. The specific details are determined at the county level, leading to variations across the state.

Property Tax Assessment in Georgia

The process of property tax assessment in Georgia begins with the county tax assessor’s office evaluating each property’s fair market value. This valuation is based on various factors, including property size, location, condition, and recent sales of comparable properties in the area. Property owners have the right to appeal the assessed value if they believe it’s inaccurate or unfairly high. This appeal process typically involves presenting evidence to support the owner’s claim, such as recent appraisals or comparable sales data. The county board of equalization reviews these appeals and makes a final determination.

Allocation and Use of Property Tax Revenue

Property tax revenue collected in Georgia is primarily used to fund local government services. This includes essential services like public education, public safety (police and fire departments), infrastructure maintenance (roads, bridges, and other public works), and other vital community programs. The specific allocation of funds varies among counties, reflecting their unique needs and priorities. For example, a county with a large school district might allocate a larger portion of its property tax revenue to education, while a county with significant infrastructure needs might prioritize road maintenance and repairs.

Comparison of Property Tax Rates Across Georgia Counties

Property tax rates differ significantly across Georgia’s 159 counties, reflecting variations in local government budgets and assessed property values. The following table provides a simplified comparison, highlighting the range of tax rates. Note that these are examples and may not reflect the most current rates. It’s crucial to consult your county’s tax assessor’s office for the most up-to-date information.

| County | Tax Rate (per $100 of assessed value) | Average Assessed Value | Approximate Annual Tax (based on average value) |

|---|---|---|---|

| Fulton | $1.80 | $300,000 | $5400 |

| Gwinnett | $1.50 | $250,000 | $3750 |

| Cobb | $1.75 | $280,000 | $4900 |

| Chatham | $1.20 | $200,000 | $2400 |

Specific Ballot Measures Regarding Property Taxes

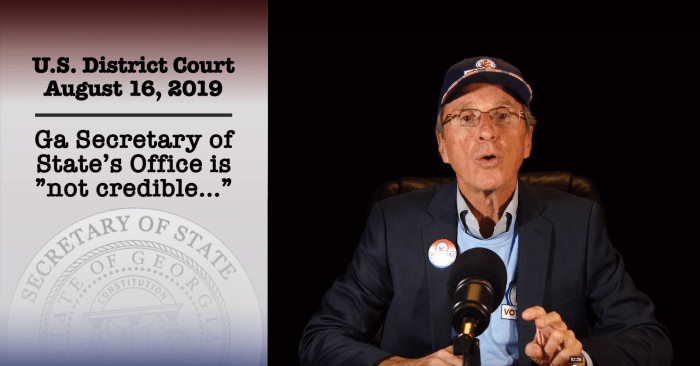

Source: voterga.org

Georgia’s property tax system is a complex beast, and understanding the nuances of proposed ballot measures is crucial for every homeowner. These measures can significantly impact your property taxes, potentially leading to substantial increases or decreases depending on their passage. Let’s break down the key ballot initiatives directly affecting Georgia property taxes.

Proposed Amendment to the Homestead Exemption

This amendment proposes to increase the homestead exemption for seniors and disabled individuals. Currently, the homestead exemption offers a reduction in the assessed value of a primary residence. This proposed amendment aims to raise the exemption amount, offering greater tax relief to eligible homeowners. The potential impact on property owners would be a reduction in their annual property tax bill, although the exact amount would vary based on the individual’s assessed property value and the specific increase in the exemption. For example, if the exemption increased by $50,000 and a homeowner’s assessed value was $200,000, their taxable value would drop to $150,000, resulting in a lower tax bill. This measure contrasts with other potential measures that might focus on overall tax rate reductions, instead targeting specific demographics for relief.

Proposed Changes to the Property Tax Assessment Process

Several ballot measures may focus on modifying the methods used to assess property values. These changes could include adjustments to appraisal frequency, the use of different valuation models, or stricter guidelines for assessors. The impact on property owners would depend on the specifics of the proposed changes. For instance, if the assessment process shifts to a more frequent appraisal schedule, some homeowners might see their tax bills increase if property values have risen. Conversely, if the new models result in lower assessed values, it could lead to lower property tax bills. Comparing this to the homestead exemption amendment, this measure impacts all property owners, not just a specific demographic. The key difference lies in its broad application versus the targeted relief of the homestead exemption.

Proposed Property Tax Rate Adjustments

Ballot measures might also directly address the property tax rate itself. This could involve a proposed increase or decrease in the millage rate (the amount of tax levied per $1,000 of assessed value). A reduction in the millage rate would lower property taxes for all homeowners, while an increase would raise them. The impact is straightforward: a lower millage rate directly translates to lower tax bills, and vice versa. This contrasts with the homestead exemption, which provides targeted relief, and the assessment process changes, which indirectly affect taxes based on the resulting valuations. A millage rate decrease of, say, 2 mills on a property assessed at $250,000 would result in a $500 annual tax reduction ($250,000 / 1000 * 2 mills).

Arguments For and Against Proposed Changes

Georgia’s property tax system is a complex beast, and proposed changes often spark heated debate. Understanding the arguments for and against these changes is crucial for informed participation in the democratic process. This section will dissect the pros and cons of specific ballot measures, exploring their potential economic impacts on both individuals and the state.

Arguments For and Against Ballot Measure A: Increased Homestead Exemption

Before diving into the specifics, it’s important to remember that Ballot Measure A aims to increase the homestead exemption, reducing the assessed value of a primary residence used for taxation purposes.

Arguments in favor of Ballot Measure A often center on providing relief to homeowners, particularly those on fixed incomes or struggling financially. These arguments highlight the measure’s potential to:

- Reduce property tax burdens for homeowners, freeing up money for other essential expenses.

- Stimulate the local economy by increasing disposable income for homeowners.

- Provide a safety net for vulnerable homeowners facing financial hardship.

- Improve the quality of life for residents by lessening the financial strain of property taxes.

Conversely, arguments against Ballot Measure A raise concerns about its potential negative consequences. Critics argue that increasing the homestead exemption could:

- Reduce local government revenue, potentially leading to cuts in essential services like schools and public safety.

- Disproportionately benefit wealthier homeowners, who own more valuable properties and thus receive a larger tax break.

- Shift the tax burden onto other property owners, such as renters and businesses.

- Create an unsustainable long-term financial strain on local governments.

Arguments For and Against Ballot Measure B: Reassessment Frequency Changes

Ballot Measure B proposes altering the frequency of property reassessments. This change has significant implications for both homeowners and local governments.

Arguments supporting Ballot Measure B often focus on:

- Increased predictability for homeowners regarding their property taxes.

- Reduced administrative costs associated with frequent reassessments for local governments.

- Potentially stabilizing property tax revenue for local governments, making budgeting more reliable.

However, opponents of Ballot Measure B argue that the proposed changes could:

- Lead to outdated property valuations, potentially resulting in unfair tax burdens for some homeowners.

- Hinder the ability of local governments to accurately assess property values and adjust tax rates accordingly.

- Create inequities in property tax assessments, benefiting some homeowners while burdening others.

Summary of Pros and Cons

| Ballot Measure | Pros | Cons | Potential Economic Consequences |

|---|---|---|---|

| A: Increased Homestead Exemption | Reduced tax burden for homeowners, increased disposable income, potential economic stimulus. | Reduced local government revenue, potential cuts in services, disproportionate benefit to wealthier homeowners. | Potential slowdown in local government spending, possible increase in consumer spending, potential shift in tax burden. Similar to the effect seen in other states which have implemented similar exemptions, we might see a short-term economic boost followed by a need for local governments to adjust spending or find new revenue streams. For example, the implementation of a similar measure in [State X] resulted in a [Percentage]% decrease in local government revenue within [Timeframe]. |

| B: Reassessment Frequency Changes | Increased predictability for homeowners, reduced administrative costs for local governments, potentially more stable tax revenue. | Outdated property valuations, potential inequities in tax burdens, hindered ability of local governments to accurately assess property values. | Potential for uneven tax burdens across different property owners, potentially impacting real estate markets. A less frequent reassessment could lead to a lag in reflecting market value changes, potentially causing under- or over-taxation depending on market fluctuations. This could be similar to the experience of [City Y] where infrequent reassessments led to [Specific outcome, e.g., a significant drop in property tax revenue during a housing boom]. |

Impact on Different Property Owner Groups

Source: scotusblog.com

Georgia’s proposed property tax changes will differentially affect various property owner groups. Understanding these impacts is crucial for informed voting. The measures under consideration may offer tax relief to some while potentially increasing burdens on others, depending on property type, value, and location. This analysis examines the potential consequences for key property owner groups.

Impact on Homeowners

The proposed changes could significantly alter the property tax burden for homeowners. For example, a measure aimed at lowering the millage rate would directly reduce property taxes for all homeowners, regardless of property value. However, other measures, such as those focused on reassessment methodologies, could disproportionately impact homeowners in rapidly appreciating neighborhoods. Those in areas with slower growth might see a smaller tax increase or even a decrease, while those in rapidly appreciating areas could experience a substantial increase, even with a lowered millage rate. A hypothetical example: A homeowner in a rapidly growing suburb might see their assessed value double, offsetting any millage rate reduction and leading to a higher overall tax bill. Conversely, a homeowner in a rural area with stagnant property values might experience a net decrease in their property tax.

Impact on Businesses

Businesses, particularly those owning commercial real estate, are another group significantly affected by property tax changes. Increased property values often translate to higher tax bills, impacting profitability and potentially leading to higher prices for consumers. Conversely, tax breaks or reductions specifically targeted at businesses could stimulate economic growth and job creation. For instance, a tax abatement program for small businesses could incentivize investment and expansion, benefiting the local economy. However, large corporations with extensive commercial holdings might see only a minimal impact relative to their overall financial strength, compared to the impact on smaller businesses.

Impact on Agricultural Landowners

Agricultural landowners often benefit from special tax assessments or exemptions designed to protect farmland from development and support agricultural operations. Proposed changes could either maintain or alter these existing protections. For example, a change to the assessment methodology could inadvertently increase the tax burden on agricultural land, making it less economically viable to continue farming. Conversely, an increase in agricultural tax exemptions could provide much-needed relief to struggling farmers. Consider a scenario where a new assessment system fails to account for the unique challenges of farming, resulting in significantly higher taxes for agricultural land compared to similarly valued residential or commercial properties. This could force some farmers out of business.

Visual Representation of Varied Impact

Imagine a bar graph. The horizontal axis represents different property owner groups: homeowners, businesses, and agricultural landowners. The vertical axis represents the percentage change in property tax burden after the proposed changes are implemented. The bars would show varying heights for each group, illustrating the differential impact. For instance, the bar for homeowners might show a slight decrease, the bar for businesses a moderate increase, and the bar for agricultural landowners a significant increase or decrease, depending on the specific measures adopted. This visualization would clearly demonstrate the uneven distribution of the impact across different property owner groups, highlighting the need for careful consideration of the potential consequences before implementing any changes.

Potential Long-Term Effects of Ballot Outcomes: Georgia Property Tax On The Ballot

The Georgia property tax ballot measures carry significant weight, shaping the state’s fiscal landscape and impacting residents for years to come. Understanding the potential long-term effects, both positive and negative, is crucial for informed voting. These effects ripple through local government services, the real estate market, and the overall economic health of communities across the state.

Impact on Local Government Services and Budgets

Passage or failure of these measures will directly influence the funding available for essential local services. Approved tax increases could bolster budgets, allowing for improved infrastructure (roads, schools, public safety), enhanced public services (libraries, parks, community centers), and potentially increased salaries for public employees. Conversely, rejected measures might necessitate service cuts, delayed maintenance projects, or increased reliance on other funding sources, potentially leading to higher fees or reduced service quality. For instance, if a measure to increase school funding fails, school districts might face larger class sizes, reduced extracurricular activities, or deferred building maintenance. Conversely, successful tax increases in a county could lead to the construction of a new community center or the expansion of the local library system.

Examples from Other States and Localities

Several states have seen significant shifts in local government services following property tax referendums. In California, for example, Proposition 13, which limited property tax increases, led to significant underfunding of public schools and other essential services in many areas. This resulted in increased reliance on state funding, which often came with its own set of complexities and limitations. Conversely, some states that have successfully implemented property tax increases targeted towards education have seen improved educational outcomes and increased property values in affected areas. These contrasting examples highlight the profound and lasting effects of property tax decisions on local communities.

Potential Impact on Property Values and the Real Estate Market

Changes in property taxes can significantly impact property values and the real estate market. Increased property taxes could potentially depress property values, making homes less attractive to buyers. This is because higher taxes increase the overall cost of homeownership, potentially slowing down the market. Conversely, if tax increases are accompanied by substantial improvements in local services (better schools, safer neighborhoods), property values could rise due to increased demand. This is especially true in areas with robust school systems, which are a major driver of property values. The interplay between property taxes, local services, and property values is complex and context-dependent, but the relationship is undeniably strong. For example, a community investing in new parks and improved infrastructure through increased property taxes might see a boost in property values, offsetting the initial increase in tax burden.

Voter Information and Resources

Navigating the complexities of Georgia’s property tax system and understanding the implications of ballot measures can feel overwhelming. However, numerous resources are available to help voters make informed decisions. This section provides a guide to accessing crucial information and participating effectively in the election.

Understanding the proposed changes to Georgia’s property tax system requires accessing reliable information from official sources. This ensures you’re basing your vote on accurate data and not misinformation. The following resources will help you navigate this process.

Relevant Government Websites and Organizations

Accessing official information is key to informed voting. The Georgia Secretary of State’s website provides details on election dates, registration deadlines, and polling locations. The Georgia Department of Revenue offers in-depth explanations of the current property tax system and any proposed changes. County tax assessor websites provide specific information relevant to your local area, including property tax rates and assessment details. Finally, legislative websites provide access to the full text of proposed ballot measures and any related committee reports or discussions. These resources provide a comprehensive overview, allowing voters to form their own informed opinions.

A Brief Guide to Understanding and Participating in the Election, Georgia property tax on the ballot

To participate effectively, first register to vote well in advance of the election deadline. Verify your registration status online. Then, carefully review the ballot measures, utilizing the resources mentioned above. Attend candidate forums or town halls to hear their positions directly. Finally, cast your vote on election day or during the early voting period.

Finding Information on the Impact of Ballot Measures on Individual Property Tax Bills

Determining the specific impact of a ballot measure on your individual property tax bill requires careful investigation. Start by accessing your current property tax assessment from your county tax assessor’s website. Then, examine the proposed changes Artikeld in the ballot measure. Many measures will include estimates of their potential impact on different property types or tax brackets. Look for detailed analyses provided by government agencies or independent organizations. Remember that the impact will vary depending on your property’s assessed value, location, and the specific details of the ballot measure. For example, a measure reducing the millage rate will likely result in a lower tax bill, while one increasing exemptions might benefit some homeowners more than others. If you’re still unsure, contacting your county tax assessor’s office directly can provide personalized guidance.

Wrap-Up

Source: boltdns.net

Ultimately, the Georgia property tax proposals on the ballot represent a critical juncture for the state’s financial future. Understanding the nuances of these measures – the potential impact on your taxes, the arguments surrounding them, and the long-term consequences – is vital for informed voting. Take the time to research, engage, and make your voice heard; your participation shapes the future of your community and Georgia’s fiscal landscape.