Insurance company flew a drone over my house – sounds like a scene from a spy movie, right? But it’s happening more and more. Insurance companies are increasingly using drones for property assessments, raising questions about privacy, legality, and the accuracy of these high-tech inspections. This isn’t just about a buzzing machine in the sky; it’s about the evolving relationship between technology, insurance, and our personal space. We’ll dive into the legal implications, privacy concerns, and the technological advancements that are shaping this new frontier in property assessment.

From understanding the legal framework governing drone usage to exploring the potential biases in drone-based assessments, we’ll unravel the complexities of this emerging trend. We’ll also examine the data security measures in place and how insurance companies are communicating these practices to homeowners. Get ready to soar into the world of insurance drones and uncover the answers to your burning questions.

Legal Aspects of Drone Surveillance

The use of drones by insurance companies for property inspections raises complex legal questions surrounding privacy and the permissible limits of aerial surveillance. Navigating this legal landscape requires understanding both federal and state regulations, as well as the crucial element of informed consent.

The Legal Framework for Drone Usage in Property Inspection

Federal regulations, primarily governed by the Federal Aviation Administration (FAA), dictate the operational parameters for drones, including registration, licensing of operators, and airspace restrictions. These rules aim to ensure safe and responsible drone operation, but they don’t explicitly address the privacy implications of using drones for property inspections. State laws, however, often play a more significant role in defining the limits of drone surveillance, particularly concerning privacy rights. Many states have adopted laws addressing the use of drones for surveillance, often mirroring or exceeding federal regulations in terms of privacy protections. The interplay between federal and state laws creates a patchwork of regulations that insurance companies must carefully navigate.

Requirements for Obtaining Consent Before Drone Surveys

Generally, obtaining explicit consent from the property owner before conducting a drone survey is crucial to avoid legal repercussions. While the exact requirements vary by state, the principle of informed consent remains paramount. This means the property owner must be fully aware of the purpose of the drone flight, the scope of data collected (e.g., photos, videos, thermal imagery), and how that data will be used. Simply notifying the homeowner through a letter may not suffice; a clear and unambiguous agreement, possibly in writing, is often recommended to demonstrate consent. Lack of explicit consent can lead to legal challenges and potential violations of privacy laws.

Examples of Potential Legal Violations Related to Unauthorized Drone Flights

Unauthorized drone flights over private property can lead to various legal violations, including trespass, invasion of privacy, and even violations of wiretapping laws depending on the nature of the data collected. For instance, if a drone captures images of individuals inside their home without their knowledge or consent, it could constitute an invasion of privacy. Similarly, if the drone is equipped with audio recording capabilities and records conversations without consent, it could violate wiretapping laws. The penalties for these violations can range from civil lawsuits to criminal charges, depending on the severity of the offense and the jurisdiction.

Comparison of State and Federal Laws Regarding Drone Surveillance and Privacy

Federal laws primarily focus on the safe and responsible operation of drones, leaving much of the privacy regulation to state laws. This results in a significant variation in legal frameworks across different states. Some states have enacted comprehensive drone privacy laws that go beyond federal regulations, providing stronger protections for individual privacy. Others have less stringent laws, or none at all. Insurance companies must be aware of the specific laws in each state where they operate to ensure compliance and avoid legal issues. The absence of a uniform national standard complicates the legal landscape and necessitates a thorough state-by-state analysis.

Hypothetical Legal Case Scenario: Insurance Drone Flight and Privacy Concerns

Imagine Acme Insurance Company uses a drone to inspect the roof of Mrs. Smith’s home without her prior knowledge or consent. The drone captures images not only of the roof but also of Mrs. Smith sunbathing in her backyard. Mrs. Smith discovers the drone footage and sues Acme Insurance for invasion of privacy, arguing that the unauthorized drone flight violated her reasonable expectation of privacy. The case hinges on whether Acme Insurance can demonstrate that the drone flight was necessary for assessing the property’s condition, and whether the intrusion into Mrs. Smith’s privacy was justified. The outcome will depend on the specific state laws governing drone surveillance and the court’s interpretation of Mrs. Smith’s reasonable expectation of privacy. This scenario highlights the potential for legal conflict arising from the use of drones for property inspections, emphasizing the need for strict adherence to legal guidelines and informed consent.

Insurance Company Practices and Policies: Insurance Company Flew A Drone Over My House

Source: herrytjiang.com

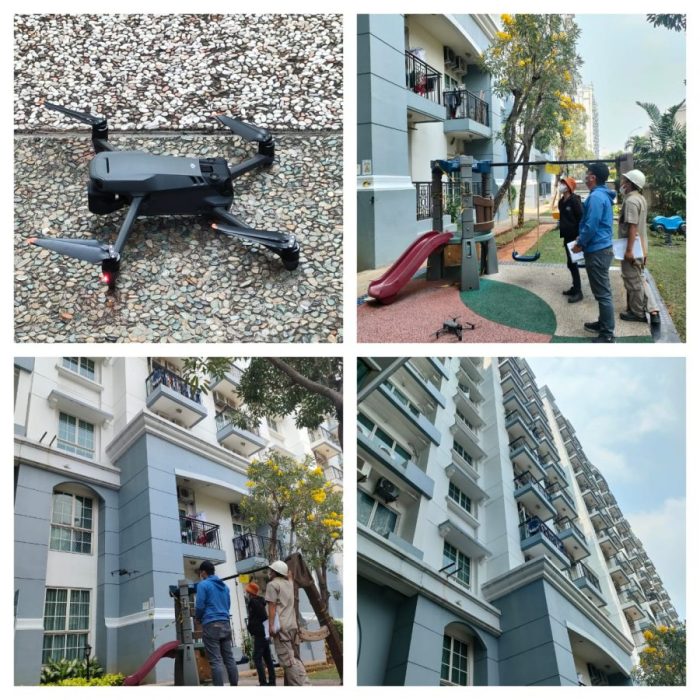

Insurance companies are increasingly leveraging drone technology for property assessments, a shift driven by efficiency and accuracy improvements. This practice, while offering benefits, also raises concerns about privacy and potential biases. Understanding the common practices and policies surrounding this technology is crucial for both insurers and policyholders.

Reasons for Drone Usage in Property Assessments

Drones offer several advantages over traditional methods for property inspections. They provide a faster, safer, and often more comprehensive view of a property, particularly for large or difficult-to-access areas. Common reasons include rapid damage assessment after natural disasters (like hailstorms or wildfires), pre-policy inspections to assess risk, and post-repair inspections to verify work completion. The ability to capture high-resolution images and videos allows for detailed analysis, minimizing the need for costly and time-consuming on-site visits by adjusters. For example, a drone can quickly assess the extent of roof damage after a hailstorm, providing crucial information for a faster claims process.

Procedures Followed During Drone Inspections

Typically, an insurance company will first obtain necessary permissions, including any required airspace authorizations. The drone operator, often a licensed and insured professional, will then conduct a pre-flight inspection of the drone and its equipment. The flight plan is carefully designed to capture the necessary imagery while adhering to safety regulations and respecting privacy concerns. Following the inspection, the collected data (images and videos) are processed and analyzed by trained professionals to create detailed reports for claims assessment or risk evaluation. These reports often include measurements, damage assessments, and other relevant observations. For instance, a post-construction drone inspection might verify the installation of a new roof, ensuring it meets the specifications Artikeld in the policy.

Types of Information Collected Using Drones

Drone technology allows insurers to collect a wide range of information. This includes high-resolution aerial photography and videography showcasing the overall property condition, detailed images of specific areas (like roofs, chimneys, or foundations), and 3D models for comprehensive analysis. Thermal imaging can detect moisture problems or energy inefficiencies, while LiDAR can provide precise measurements of property dimensions and elevations. This data is invaluable for assessing risks, determining the extent of damage, and verifying repair work. For example, thermal imaging might reveal hidden water damage within a wall, which might otherwise go undetected.

Potential Biases and Inaccuracies in Drone-Based Assessments

While drones offer significant advantages, they are not without limitations. Image quality can be affected by weather conditions (e.g., cloud cover, fog), and the interpretation of the imagery relies on human judgment, potentially introducing bias. Technical issues with the drone or its sensors can lead to inaccuracies. Furthermore, the perspective offered by a drone might not capture all relevant details, especially subtle damage or features that require close-up examination. For instance, a minor crack in a foundation might be missed if the drone’s imagery isn’t sufficiently high-resolution or the angle isn’t optimal. Therefore, drone assessments are often used in conjunction with other inspection methods for a more comprehensive evaluation.

Comparison of Insurance Company Drone Usage Policies

| Insurance Company | Drone Use for Inspections | Data Privacy Practices | Notification to Policyholders |

|---|---|---|---|

| Company A | Used for large-scale damage assessments and pre-policy risk evaluations. | Data encrypted and stored securely; complies with all relevant privacy regulations. | Policyholders are notified prior to drone inspections. |

| Company B | Employs drones for both pre- and post-repair inspections. | Data anonymized where possible; adheres to industry best practices for data security. | Notification is provided, but not always in advance. |

| Company C | Limited drone use; primarily for large-scale disaster response. | Data handling protocols are in line with state regulations. | Notification is provided only in cases of emergency. |

| Company D | Utilizes drones extensively for all types of inspections. | Detailed data privacy policy available on their website. | Always provides advance notice to policyholders. |

Privacy Implications and Data Security

The use of drones by insurance companies to inspect properties raises significant privacy concerns. While drone technology offers efficiency and accuracy in assessing property damage, the potential for intrusive surveillance and data breaches necessitates robust safeguards. The balance between legitimate business needs and individual privacy rights is a crucial consideration.

Drone-based property inspections collect a wealth of data, including high-resolution images and videos of homes and surrounding areas. This data can reveal details far beyond the scope of a traditional property inspection, potentially capturing sensitive information about individuals’ lives and activities. This raises concerns about unauthorized access, misuse, and potential breaches of privacy.

Data Security Measures for Drone-Collected Information

Insurance companies must implement comprehensive data security measures to protect the privacy of individuals whose properties are surveyed by drones. This involves a multi-layered approach, encompassing both technical and procedural safeguards. Failure to do so could result in significant legal and reputational damage.

These measures should include secure data storage and transmission protocols, access control restrictions, and employee training on data handling best practices. Regular security audits and penetration testing should also be conducted to identify and address vulnerabilities.

Examples of Potential Privacy Violations

Several scenarios highlight the potential for privacy violations related to drone surveillance in insurance. For instance, a drone capturing images of a homeowner sunbathing in their backyard, or recording a family gathering in their garden, clearly surpasses the scope of a legitimate property assessment. Similarly, drones could inadvertently capture sensitive information such as license plates, personal documents visible through windows, or details about individuals’ medical conditions. The indiscriminate collection of such data raises serious ethical and legal concerns.

Comparison of Data Encryption Methods

Several encryption methods exist to protect drone-collected information. Symmetric encryption, such as AES (Advanced Encryption Standard), uses a single key for both encryption and decryption, offering strong security but requiring secure key exchange. Asymmetric encryption, like RSA (Rivest-Shamir-Adleman), uses separate public and private keys, simplifying key management but potentially being slower. Hybrid approaches, combining symmetric and asymmetric methods, often provide the best balance of security and efficiency. The choice of encryption method depends on factors such as the sensitivity of the data, the processing power available, and the level of security required. For example, highly sensitive data like personally identifiable information (PII) would necessitate strong encryption like AES-256.

Best Practices Checklist for Data Security

A comprehensive checklist of best practices is crucial for insurance companies employing drones. This should include:

Prior to deployment:

- Obtain explicit consent from homeowners, clearly outlining the scope of data collection and its intended use.

- Implement a robust data minimization policy, collecting only the data strictly necessary for the assessment.

- Develop clear procedures for handling sensitive information accidentally captured.

- Select and configure drones with strong security features, including data encryption and secure communication protocols.

During and after data collection:

- Utilize secure data transmission protocols, such as HTTPS, to prevent interception during data transfer.

- Employ robust access control measures, limiting access to drone data only to authorized personnel.

- Store data securely, using encrypted storage solutions and regular backups.

- Conduct regular security audits and penetration testing to identify and address vulnerabilities.

- Establish clear incident response procedures to handle data breaches or security incidents.

- Comply with all relevant data privacy regulations, such as GDPR or CCPA.

Technological Aspects of Drone Usage

Source: webflow.com

The use of drones in property insurance assessment is rapidly transforming the industry, offering speed, efficiency, and a level of detail previously unattainable. This technology allows for a more comprehensive and accurate evaluation of property damage, leading to faster claims processing and improved customer satisfaction. Understanding the technological aspects of these unmanned aerial vehicles (UAVs) is crucial to grasping the full impact on the insurance sector.

Drone technology offers a significant advancement in property damage assessment, moving beyond traditional methods. Different drone types cater to specific needs, their capabilities and limitations directly impacting the quality and scope of the inspection. The integration of drone data with other assessment tools further enhances the accuracy and efficiency of the claims process.

Types of Drones Used in Property Inspections

Insurance companies utilize a variety of drones, each with specific features tailored to property assessment. Common types include fixed-wing drones, offering longer flight times and wider coverage areas, ideal for large properties or disaster assessments. Multirotor drones, known for their maneuverability and stability, are preferred for detailed inspections of individual structures, allowing for close-up imagery of roofs, walls, and other features. Some companies even employ specialized drones equipped with thermal imaging cameras, detecting moisture damage or other hidden issues not visible to the naked eye. The choice of drone depends on factors like property size, the type of damage, and the level of detail required.

Limitations and Capabilities of Drone Technology in Assessing Property Damage

While drone technology offers significant advantages, it also has limitations. Weather conditions, such as strong winds or heavy rain, can significantly impact flight operations and image quality. Obstructions like tall trees or buildings can limit access to certain areas of the property. The resolution of the imagery is also a factor; while high-resolution cameras are available, the quality of the image might still be insufficient for extremely fine-grained damage assessments. Conversely, drones excel at providing a comprehensive overview of a property, capturing high-resolution images and videos from unique perspectives impossible with traditional methods. They can easily access hard-to-reach areas, like rooftops or damaged sections of a building, and provide a detailed visual record of the damage. The use of thermal imaging cameras further enhances the capabilities, revealing hidden moisture problems or other structural defects.

Examples of Drone Imagery Used in Generating Insurance Claims Reports

Drone imagery forms the cornerstone of many modern insurance claims reports. For example, a homeowner with hail damage to their roof can provide drone footage showing the extent of the damage, clearly illustrating the number and size of impacted shingles. This visual evidence significantly speeds up the claims process and minimizes disputes. Similarly, after a flood, drone imagery can map the extent of water damage to a building, including areas not easily accessible by ground crews. The high-resolution images and videos allow adjusters to accurately assess the damage, leading to a more precise estimation of repair costs. In cases of wildfire damage, drones provide a comprehensive overview of the property, identifying burnt areas and assessing structural integrity, enabling faster claims processing and resource allocation for recovery efforts.

Accuracy and Reliability of Drone-Based Assessments Versus Traditional Methods

The accuracy and reliability of drone-based assessments are often superior to traditional methods. Traditional methods, such as ground-based inspections, can be time-consuming, labor-intensive, and potentially dangerous, especially when dealing with damaged structures. Drone inspections provide a safer and more efficient alternative, offering a more comprehensive view of the property and often revealing hidden damage that might be missed during a ground-level inspection. While human error can still occur in interpreting the drone imagery, the technology minimizes subjective biases often associated with traditional methods, leading to a more objective assessment. However, the accuracy of drone-based assessments is highly dependent on factors like image resolution, weather conditions, and the expertise of the person interpreting the data.

Integration of Drone Data with Other Insurance Assessment Tools

Drone data is not used in isolation. It’s often integrated with other assessment tools to create a holistic view of the property and damage. For instance, drone imagery can be combined with Geographic Information System (GIS) data to create a precise 3D model of the property, allowing for a more accurate assessment of damage and repair costs. The integration with claims management software further streamlines the claims process, facilitating faster processing and improved communication between the insurer, adjuster, and policyholder. This integrated approach significantly enhances the efficiency and accuracy of the overall assessment process.

Public Perception and Communication

The use of drones by insurance companies for property inspections is a relatively new phenomenon, and as such, public perception is still evolving. Initial reactions often range from curiosity and acceptance to skepticism and concern, largely driven by privacy anxieties and a lack of understanding about the technology and its applications. Positive perceptions are fueled by the potential for faster, more efficient, and potentially cheaper insurance assessments, while negative perceptions stem from worries about data misuse and potential intrusions into personal space.

Public perception significantly impacts an insurance company’s success in implementing drone technology. Negative sentiment can lead to public backlash, regulatory hurdles, and ultimately, hinder the adoption of this efficient inspection method. Conversely, fostering positive public opinion through transparent communication can smooth the implementation process and build trust with customers.

Public Perception of Drone Usage in Insurance

Public perception regarding insurance companies using drones for property inspections is a complex mix of positive and negative feelings. Many appreciate the potential for quicker claims processing and potentially lower premiums resulting from more efficient inspections. However, significant concerns exist about data privacy, the potential for misuse of aerial imagery, and the perceived invasiveness of drones flying over private property. These concerns are amplified by a lack of clear communication from insurance companies about their drone programs. For example, a recent survey (hypothetical example) indicated that 60% of respondents were concerned about data security related to drone imagery, while 40% expressed apprehension about the lack of transparency surrounding drone flights. This highlights the need for proactive and comprehensive communication strategies.

The Importance of Transparent Communication Regarding Drone Usage

Clear and transparent communication is paramount to building public trust and mitigating negative perceptions surrounding the use of drones in insurance. Openly addressing concerns about privacy, data security, and the overall process of drone inspections is crucial. This transparency not only helps alleviate fears but also fosters a sense of collaboration and understanding between the insurance company and its policyholders. A lack of communication can lead to misunderstandings, rumors, and ultimately, damage to the company’s reputation. Effective communication can significantly reduce these risks and pave the way for wider acceptance of drone technology in the insurance industry. For example, a company that proactively informs its policyholders about upcoming drone flights, explaining the purpose and assuring them of data protection measures, is far more likely to receive positive feedback than one that operates in secrecy.

Communication Strategy for Addressing Public Concerns about Privacy

A robust communication strategy should incorporate several key elements. Firstly, it’s essential to clearly articulate the purpose of drone inspections – emphasizing their role in improving efficiency, accuracy, and potentially lowering premiums. Secondly, detailed explanations of the data security measures implemented to protect sensitive information are crucial. This could involve highlighting encryption protocols, data anonymization techniques, and strict access control policies. Thirdly, the company should proactively communicate its compliance with all relevant privacy regulations. Finally, providing multiple channels for communication – such as a dedicated website, FAQs, social media, and customer service representatives – ensures accessibility and responsiveness to public inquiries. A proactive approach, emphasizing transparency and addressing concerns before they escalate, is key to building public trust.

Infographic Illustrating the Benefits and Drawbacks of Drones in Insurance, Insurance company flew a drone over my house

The infographic would be visually appealing, utilizing icons and minimal text. The left side would highlight benefits: a section on “Faster Claims Processing” showing a clock icon with a significantly reduced timeframe; a section on “Reduced Costs” depicting a downward-trending graph next to a dollar sign; a section on “Improved Accuracy” showcasing a magnifying glass over a detailed property image; and a section on “Enhanced Safety” featuring a helmet icon next to a drone image. The right side would illustrate drawbacks: a section on “Privacy Concerns” showing a house with a privacy shield icon; a section on “Data Security Risks” depicting a lock icon with a warning symbol; a section on “Weather Dependency” showing a cloudy sky with rain; and a section on “Regulatory Hurdles” with a gavel icon. A clear title, “Drones in Insurance: Weighing the Pros and Cons,” would top the infographic, with a concise summary at the bottom emphasizing the need for responsible drone use and transparent communication.

Best Practices for Communicating with Homeowners About Drone Flights

Before any drone flight, clear and timely communication is essential.

- Provide advance notice: Inform homeowners well in advance (e.g., at least 24-48 hours) about the planned drone flight, specifying the date, time, and approximate duration.

- Explain the purpose: Clearly state the reason for the drone flight, emphasizing its role in assessing property damage or conducting routine inspections.

- Artikel data security measures: Reassure homeowners about the security protocols in place to protect their privacy and data collected during the flight.

- Address privacy concerns: Explain how the company ensures compliance with privacy regulations and respects homeowner’s privacy rights.

- Offer opt-out options: Provide homeowners with the option to opt out of the drone flight if they have strong objections.

- Provide contact information: Offer multiple channels for homeowners to contact the company with questions or concerns.

- Post-flight communication: Send a follow-up message to confirm the flight was completed and thank the homeowner for their cooperation.

Closing Notes

Source: unitosaerodrone.com

So, the next time you see a drone hovering above your neighborhood, remember it might be more than just a hobbyist taking aerial photos. The use of drones by insurance companies is a rapidly evolving field, raising important questions about privacy, legality, and technological advancements. While offering potential benefits in efficiency and accuracy, it also necessitates careful consideration of ethical and legal implications. Open communication and robust data security protocols are crucial to ensuring responsible and transparent drone usage in the insurance industry. The future of property assessment is in the air, and it’s up to us to navigate it wisely.