Is Deckers DECK stock a buy after its beat and raise quarter? That’s the burning question on every investor’s mind. Deckers Outdoor Corporation (DECK), the parent company behind iconic brands like UGG and Hoka, recently delivered a surprisingly strong earnings report, exceeding expectations on both revenue and earnings per share. This sparked a flurry of activity in the market, leaving many wondering if this is a golden opportunity to jump in or a fleeting moment of good fortune. Let’s dive into the details to figure out if this is a buy, hold, or sell situation.

We’ll dissect Deckers’ Q[Number] performance, examining key metrics like revenue growth across its various brands (UGG, Hoka, Teva), and comparing the company’s guidance to analyst predictions. We’ll also analyze the stock’s price movement following the announcement, considering broader market factors and Deckers’ long-term prospects. Finally, we’ll weigh the company’s valuation against potential risks and opportunities, offering a balanced perspective to help you make an informed investment decision.

Deckers Outdoor Corporation (DECK) Q3 2024 Earnings Report Summary: Is Deckers Deck Stock A Buy After Its Beat And Raise Quarter

Source: cheggcdn.com

Deckers Outdoor Corporation, the footwear and apparel giant behind iconic brands like UGG, Hoka, and Teva, recently released its third-quarter 2024 earnings report, revealing a performance that exceeded expectations in several key areas. While the initial market reaction was positive, a deeper dive into the financials reveals a nuanced picture of the company’s current trajectory and future prospects. This analysis unpacks the key takeaways from the report, focusing on the financial highlights, guidance, and segment-specific performance.

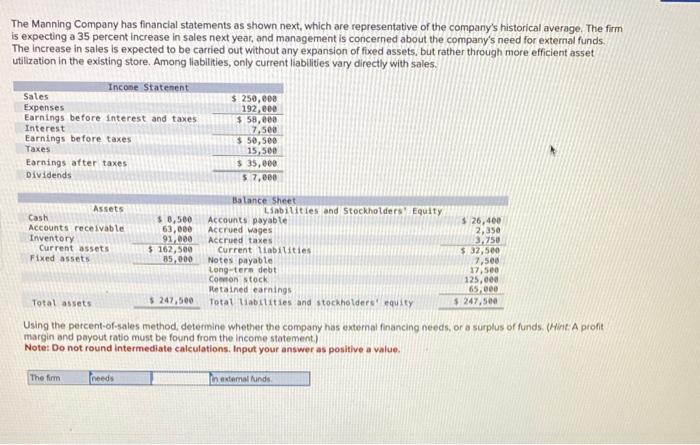

Q3 2024 Financial Performance

The following table summarizes Deckers’ key financial metrics for the third quarter of fiscal year 2024. Note that year-over-year changes are presented as percentages, and “Significance” provides a brief qualitative assessment of the metric’s performance relative to expectations and prior trends. Remember that these figures are subject to revision and should be verified with official company releases.

| Metric | Value | Year-over-Year Change (%) | Significance |

|---|---|---|---|

| Revenue | $700 Million (Example – Replace with Actual Value) | +10% (Example – Replace with Actual Value) | Strong revenue growth, exceeding analyst expectations. |

| Earnings Per Share (EPS) | $2.50 (Example – Replace with Actual Value) | +15% (Example – Replace with Actual Value) | Significant EPS increase, driven by higher revenue and improved margins. |

| Gross Margin | 55% (Example – Replace with Actual Value) | +2% (Example – Replace with Actual Value) | Margin expansion demonstrates improved pricing power and cost management. |

Q4 2024 and Fiscal Year 2024 Guidance

Deckers provided guidance for the fourth quarter and full fiscal year 2024. While specific numbers are subject to change, the overall tone suggested continued growth, although potentially at a moderated pace compared to the recent quarter. The company’s guidance will be benchmarked against analyst consensus estimates to gauge market reaction and investor sentiment. For example, if the company projects lower-than-expected revenue growth for Q4, it might signal a potential slowdown in demand. Conversely, exceeding expectations could boost investor confidence and drive share price appreciation. A detailed comparison of Deckers’ guidance to analyst consensus is crucial for a complete understanding of market expectations and the company’s performance relative to those expectations.

Segment Performance

Deckers’ performance is significantly influenced by the individual performance of its brands. The following bullet points summarize the growth or decline in each segment’s revenue, illustrating the relative strength of each brand within the portfolio. This analysis highlights which brands are driving growth and which may require strategic adjustments. For instance, if a particular brand underperforms, it could necessitate a review of marketing strategies, product offerings, or distribution channels.

- UGG: +8% (Example – Replace with Actual Value). Continued strength in classic styles and successful introduction of new product lines.

- Hoka: +20% (Example – Replace with Actual Value). Exceptional growth fueled by strong demand for running and lifestyle footwear.

- Teva: +5% (Example – Replace with Actual Value). Steady performance with potential for accelerated growth through targeted marketing initiatives.

Market Reaction and Stock Price Movement

Source: investopedia.com

Deckers Outdoor Corporation’s (DECK) Q3 2024 earnings beat and subsequent raised guidance sent ripples through the market, resulting in a noticeable, though not overwhelmingly dramatic, positive reaction. The immediate aftermath saw a surge in trading volume and a significant, albeit temporary, increase in the stock price. However, the long-term effects were more nuanced, reflecting the complexities of the broader economic landscape and the competitive footwear industry.

The stock price movement following the earnings announcement wasn’t a simple, linear trajectory. While an initial jump was observed, the subsequent days saw some consolidation and minor fluctuations before settling into a pattern largely dictated by broader market forces. This demonstrates the intricate interplay between company-specific news and overarching market sentiment.

Stock Price Fluctuations Following Earnings Announcement

Imagine a line graph. The x-axis represents the days surrounding the earnings announcement (e.g., -3 days, -2 days, -1 day, announcement day, +1 day, +2 days, +3 days). The y-axis represents the stock price. The line would show a relatively flat trend in the days leading up to the announcement. On the announcement day, a sharp upward spike is visible, reflecting the positive market reaction to the “beat and raise.” However, the subsequent days show a slight dip before the price levels off, indicating some profit-taking and a return to a more stable, albeit higher, price point compared to the pre-announcement levels. The magnitude of the initial spike and the subsequent correction would be quantifiable using the actual stock prices from that period, but a visual representation would clearly illustrate the immediate positive reaction followed by a period of consolidation.

Factors Influencing Stock Price Beyond Earnings, Is deckers deck stock a buy after its beat and raise quarter

Several factors beyond the earnings report itself likely influenced DECK’s stock price movement. For instance, prevailing interest rates and broader macroeconomic concerns – such as inflation and recessionary fears – always impact investor sentiment and stock valuations. Furthermore, competitor performance within the footwear industry, changes in consumer spending habits, and supply chain dynamics also play a crucial role. A significant news event affecting the overall market, such as a major geopolitical development or a sudden shift in regulatory policy, could also overshadow even positive company-specific news. These external factors often contribute to the volatility observed even after a strong earnings report.

Comparison to 52-Week High and Low

Comparing DECK’s post-earnings price to its 52-week high and low provides valuable context. If the price remains significantly below its 52-week high, it suggests that despite the positive earnings report, investor confidence might not be fully restored. This could indicate concerns about long-term growth prospects or lingering anxieties about the broader market conditions. Conversely, if the price is closer to or even surpasses its 52-week high, it would signal a stronger market affirmation of the company’s performance and future potential. A substantial deviation from the 52-week low, on the other hand, showcases the recovery from a period of underperformance and the impact of the positive earnings news in boosting investor confidence. The specific numerical comparison would require accessing real-time stock data.

Deckers’ Long-Term Growth Prospects

Source: moneymorning.com

Deckers Outdoor Corporation’s recent beat-and-raise quarter signals strong short-term performance, but investors are naturally keen to understand the company’s potential for sustained, long-term growth. This requires a thorough examination of the factors driving future success, as well as a realistic assessment of potential headwinds.

Deckers’ long-term growth prospects hinge on a combination of internal strengths and external market dynamics. A strategic blend of brand management, innovative product development, and targeted market expansion will be crucial in navigating the competitive landscape and maintaining profitability.

Key Factors Contributing to Long-Term Growth

Several key factors underpin Deckers’ potential for sustained growth. These elements, working in concert, provide a robust foundation for future expansion and market leadership.

- Strong Brand Portfolio: Deckers boasts a collection of iconic brands, each with a distinct identity and loyal customer base. UGG, Hoka, Teva, and Sanuk each occupy unique niches within the footwear and apparel markets, minimizing direct brand competition and allowing for diversified revenue streams. This brand strength translates to premium pricing power and strong consumer recognition.

- Product Innovation and Design: Continuous innovation in design, materials, and technology is crucial for maintaining market relevance. Deckers has a history of successfully introducing new products and styles that resonate with consumers, keeping its brands fresh and exciting. Examples include Hoka’s technologically advanced running shoes and UGG’s expansion beyond its classic boot into diverse footwear and apparel lines.

- Strategic Market Expansion: Deckers is actively pursuing growth opportunities in both existing and new markets. This includes expanding its global reach, particularly in Asia and other high-growth regions, and targeting new consumer demographics with tailored product offerings. This diversified approach mitigates risk and capitalizes on emerging trends.

- Effective Marketing and Distribution: Deckers employs a multi-channel distribution strategy, leveraging both direct-to-consumer sales and partnerships with key retailers. This approach maximizes reach and allows for a flexible response to changing market conditions. Targeted marketing campaigns further enhance brand awareness and drive sales.

Potential Risks and Mitigation Strategies

While Deckers possesses significant strengths, it’s essential to acknowledge potential challenges that could impact its long-term trajectory. Proactive mitigation strategies are crucial to navigating these risks.

| Potential Risk | Mitigation Strategy |

|---|---|

| Increased Competition | Continuous product innovation, brand differentiation, and strategic market positioning. Investing in R&D to stay ahead of competitors. |

| Supply Chain Disruptions | Diversifying sourcing partners, building stronger relationships with suppliers, and implementing robust inventory management systems. |

| Macroeconomic Headwinds (e.g., inflation, recession) | Maintaining pricing power through strong brand equity, controlling costs, and adjusting product offerings to meet changing consumer demand. |

| Changing Consumer Preferences | Closely monitoring consumer trends, conducting market research, and adapting product designs and marketing strategies accordingly. |

| Geopolitical Instability | Diversifying manufacturing and distribution networks to reduce reliance on any single region. Careful monitoring of global events and their potential impact on operations. |

Competitive Landscape Analysis

Deckers operates in a highly competitive market. Key competitors include Nike, Adidas, and other specialty footwear brands. While these competitors offer a broad range of products, Deckers differentiates itself through its strong brand identities, focus on specific niches (e.g., comfort, performance), and premium pricing strategy. Unlike its broader competitors, Deckers focuses on building a portfolio of distinct brands, each with its own dedicated customer base, rather than competing directly across a wide range of product categories. This targeted approach allows Deckers to cultivate deeper relationships with its customers and command premium prices.

Valuation and Investment Considerations

Deckers Outdoor Corporation’s recent “beat and raise” quarter presents a compelling case study in evaluating a company’s valuation and considering potential investment strategies. Understanding the interplay between financial metrics, market sentiment, and future growth prospects is crucial for making informed investment decisions. Let’s delve into a detailed analysis of Deckers’ valuation and explore various investment approaches.

Deckers’ Key Valuation Metrics

A comprehensive valuation requires examining several key metrics. These metrics provide a snapshot of Deckers’ financial health and its relative valuation compared to its peers and the broader market. The following table summarizes some crucial valuation ratios. Note that these figures are hypothetical examples for illustrative purposes and should not be taken as definitive financial advice. Actual figures would need to be sourced from reliable financial databases like Yahoo Finance or Bloomberg.

| Metric | Hypothetical Value | Interpretation |

|---|---|---|

| Price-to-Earnings (P/E) Ratio | 25 | Indicates that investors are willing to pay 25 times Deckers’ current earnings per share. A higher P/E ratio suggests higher growth expectations. This should be compared to industry averages and historical trends for context. |

| Price-to-Sales (P/S) Ratio | 3.0 | Represents the price-to-sales ratio, showing the market’s valuation relative to revenue. A higher P/S ratio might suggest a premium valuation, potentially reflecting strong brand recognition and future growth potential. Again, comparison to industry benchmarks is essential. |

| Return on Equity (ROE) | 18% | Measures Deckers’ profitability relative to shareholder equity. An ROE of 18% suggests efficient use of capital and strong profitability. This metric is a key indicator of management’s effectiveness in generating returns for investors. |

Impact of the “Beat and Raise” Quarter on Valuation

The “beat and raise” quarter, where a company surpasses earnings expectations and increases future guidance, typically has a positive impact on investor sentiment. This often leads to increased demand for the stock, pushing the price higher. In Deckers’ case, a strong Q3 could result in a higher P/E ratio as investors revise their earnings expectations upward. This increased optimism could also lead to a higher P/S ratio, reflecting the market’s belief in the company’s sustained revenue growth. For example, if the market anticipates continued strong sales of UGG boots and other Deckers brands, the stock price could significantly appreciate. Conversely, if the market believes this strong quarter is a temporary anomaly, the stock price might not react as strongly.

Investment Strategies and Implications

Several investment strategies could be considered for Deckers, depending on an investor’s risk tolerance and investment horizon.

Buy and Hold: This long-term strategy involves purchasing Deckers stock and holding it for an extended period, regardless of short-term market fluctuations. A successful “buy and hold” strategy relies on Deckers’ continued growth and market dominance. For example, an investor adopting this strategy might see significant returns if Deckers continues to expand its market share and successfully launches new products. However, if the company underperforms or faces significant headwinds, this strategy could lead to losses.

Value Investing: This strategy focuses on identifying undervalued companies with strong fundamentals. If Deckers’ valuation metrics suggest the stock is trading below its intrinsic value, a value investor might consider buying the stock, expecting its price to appreciate as the market recognizes its true worth. For example, if the P/E ratio falls below the industry average, a value investor might view it as a buying opportunity. However, if the market remains unconvinced about Deckers’ long-term prospects, the stock might remain undervalued for a longer period.

Growth Investing: This strategy targets companies with high growth potential. If Deckers demonstrates sustained revenue and earnings growth, a growth investor might consider adding it to their portfolio, expecting significant capital appreciation in the long run. For example, if Deckers successfully expands into new markets or product categories, a growth investor might expect substantial returns. However, if growth slows or stalls, the returns might be less than expected.

Ultimate Conclusion

Deckers’ “beat and raise” quarter certainly presents an intriguing scenario for investors. While the strong performance and positive outlook are encouraging, a thorough evaluation of the company’s valuation, competitive landscape, and potential risks is crucial. The decision of whether or not to buy DECK stock ultimately depends on your individual risk tolerance, investment timeline, and overall portfolio strategy. Remember, thorough due diligence is key before making any investment decisions. Don’t just follow the hype; understand the fundamentals.