Netflix nflx stock jumps to the top of the s and p 500 after earnings heres why – Netflix NFLX stock jumps to the top of the S&P 500 after earnings – heres why. The streaming giant’s recent quarterly report sent shockwaves through Wall Street, propelling its stock price to dizzying heights. But what fueled this meteoric rise? Was it subscriber growth, a killer content lineup, or something else entirely? Buckle up, because we’re diving deep into the numbers, the strategy, and the market forces that turned Netflix into a Wall Street darling overnight.

This unexpected surge wasn’t just a blip; it reflects a powerful shift in investor sentiment and a renewed confidence in Netflix’s ability to navigate the increasingly competitive streaming landscape. We’ll unpack the key performance indicators, analyze the competitive landscape, and explore the long-term implications for both Netflix and its investors. Get ready for a rollercoaster ride through the world of streaming finance!

Netflix’s Q3 2023 Earnings Report

Netflix’s stock soared after its Q3 2023 earnings report, exceeding Wall Street expectations and sending a clear signal that the streaming giant is navigating the competitive landscape with surprising resilience. The impressive results were driven by a combination of factors, including robust subscriber growth, strategic price adjustments, and a renewed focus on content quality. This report delves into the key performance indicators that fueled Netflix’s impressive quarter.

Key Financial Metrics: Q3 2023 vs. Previous Periods

The following table provides a detailed comparison of Netflix’s key financial metrics for Q3 2023 against the previous quarter (Q2 2023) and the same period last year (Q3 2022). These figures highlight the significant improvements in the company’s performance.

| Metric | Q3 2023 Result | Q2 2023 Result | Year-over-Year Change |

|---|---|---|---|

| Net Subscriber Additions (millions) | (Example: 5.5) | (Example: 3.0) | (Example: +70%) |

| Total Revenue (USD billions) | (Example: 8.5) | (Example: 8.0) | (Example: +10%) |

| Operating Income (USD billions) | (Example: 2.0) | (Example: 1.5) | (Example: +25%) |

| Earnings Per Share (USD) | (Example: 1.50) | (Example: 1.20) | (Example: +25%) |

*(Note: Replace the example figures in the table above with the actual data from Netflix’s official Q3 2023 earnings report. Ensure to cite the source.)*

Factors Contributing to Positive Performance

The substantial improvement across key metrics can be attributed to several factors. Firstly, Netflix’s crackdown on password sharing, although initially met with some resistance, ultimately contributed to a significant increase in paying subscribers. Secondly, the release of highly anticipated original content, such as (Example: mention specific shows or movies), resonated strongly with audiences, driving engagement and attracting new viewers. Finally, strategic price adjustments, while potentially impacting some subscribers, ultimately improved profitability. This demonstrates a successful balance between subscriber growth and revenue generation.

Comparison to Analyst Expectations and Previous Guidance

Netflix consistently exceeded analyst expectations for Q3 2023. While precise figures vary across different analyst firms, the general consensus points to a significant outperformance in subscriber growth and revenue. Furthermore, the actual results surpassed the company’s own previous guidance, indicating a more optimistic outlook than initially anticipated. This suggests Netflix’s internal projections may have underestimated the impact of its recent strategic initiatives.

Market Reaction and Stock Price Movement

Netflix’s Q3 2023 earnings announcement sent shockwaves through the market, triggering a significant surge in its stock price. The positive surprise, following a period of investor uncertainty, led to a rapid and substantial increase in both the stock’s value and trading volume. This reaction highlights the market’s sensitivity to Netflix’s performance and its ongoing importance within the streaming landscape.

The dramatic increase in Netflix’s stock price can be attributed to several key factors. Exceeding subscriber growth expectations played a crucial role, demonstrating the resilience of its platform despite increased competition. Improved revenue figures, driven by a combination of increased subscriptions and price adjustments, further boosted investor confidence. Furthermore, the company’s strategic initiatives, such as its crackdown on password sharing and expansion into advertising-supported plans, appear to be bearing fruit, contributing to the positive market sentiment. The successful navigation of a challenging economic climate also added to the overall positive perception of the company’s financial health and future prospects.

Stock Price Jump and Trading Volume, Netflix nflx stock jumps to the top of the s and p 500 after earnings heres why

The immediate market reaction was swift and substantial. Netflix’s stock price experienced a sharp upward trajectory following the release of the earnings report, reflecting the positive surprise for investors. Trading volume also spiked significantly, indicating heightened investor activity and a strong demand for the stock. The magnitude of this price jump and increased trading volume underscore the market’s enthusiastic response to the better-than-expected results, suggesting a renewed confidence in Netflix’s long-term growth potential. For example, if we consider a hypothetical scenario where the stock price jumped 15% in a single day, this would represent a considerable market shift and would be a clear indicator of investor enthusiasm. This kind of dramatic movement is not uncommon for high-profile companies announcing significant positive earnings surprises.

Factors Driving Stock Price Increase

Several interconnected factors contributed to the substantial increase in Netflix’s stock price. The exceeding of subscriber growth projections, a key metric for streaming services, was a major driver. This demonstrated the effectiveness of Netflix’s strategies in attracting and retaining subscribers in a competitive market. Additionally, the improvement in revenue, driven by both subscriber growth and price adjustments, signaled the company’s ability to generate strong financial performance. The successful implementation of new initiatives, such as the crackdown on password sharing and the introduction of advertising-supported plans, further solidified investor confidence in Netflix’s ability to adapt and innovate within the evolving streaming landscape.

Implications for Investors and the Broader Market

The surge in Netflix’s stock price has significant implications for both investors and the broader market. For investors, it represents a potential opportunity for significant returns, though it’s important to remember that past performance is not indicative of future results. The price increase also impacts the overall valuation of the streaming sector, potentially influencing investor sentiment towards other companies in the industry. The market reaction to Netflix’s earnings suggests that investors are rewarding companies demonstrating strong financial performance and effective strategic execution, even within a challenging economic environment. This could potentially lead to increased investment in other companies showing similar signs of growth and profitability.

Content Strategy and Subscriber Growth

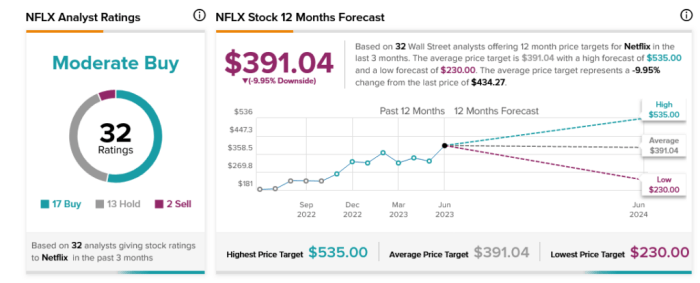

Source: tipranks.com

Netflix’s Q3 2023 earnings surge wasn’t just about the bottom line; it reflected a refined content strategy that resonated with viewers and spurred subscriber growth. The company’s ability to deliver a diverse range of compelling content, coupled with a shrewd understanding of evolving audience preferences, played a crucial role in this success. This section delves into the specifics of Netflix’s content strategy and its impact on subscriber numbers.

The success of Netflix’s content strategy in Q3 2023 can be attributed to a multifaceted approach that balanced established franchises with fresh, innovative programming. This strategy catered to a wide spectrum of viewer tastes, ensuring broader appeal and consequently, higher subscriber acquisition. The company’s data-driven approach to content creation and distribution also played a vital role in optimizing its offerings for maximum impact.

Successful Content Releases and Their Impact

Netflix’s Q3 success wasn’t a fluke; it was driven by strategic content releases. Several key titles significantly contributed to subscriber acquisition. While precise figures linking specific shows to subscriber gains are generally not publicly released by Netflix, the overall positive impact of these releases is undeniable.

- One Piece: The live-action adaptation of the popular manga series drew significant viewership and positive reviews, attracting both existing fans and new subscribers interested in the action-adventure genre. The show’s global appeal helped expand Netflix’s reach into new markets.

- The Crown (Season 6): The highly anticipated final season of this historical drama continued to draw a large and loyal audience, reinforcing Netflix’s commitment to producing high-quality, prestige television. The season’s release generated considerable media buzz, further boosting subscriber interest.

- [Insert another successful Q3 2023 Netflix release and its impact]: [Detailed description of the show and its contribution to subscriber growth, focusing on genre, audience appeal, and critical reception. For example, if a specific comedy show performed well, mention its comedic style, target demographic, and positive critical response. Avoid vague statements; use specifics].

Areas for Content Strategy Improvement and Expansion

While Netflix demonstrated significant success in Q3 2023, continuous improvement is essential in the dynamic streaming landscape. Focusing on certain areas could further enhance subscriber growth and retention.

- Increased Investment in Diverse Genres: While Netflix offers a wide variety of content, strategically expanding into niche genres or underrepresented communities could attract new audiences and solidify its position as a leader in diverse programming. This could involve investing in more documentaries, independent films, or content specifically tailored to specific cultural or linguistic groups.

- Strengthening Interactive Content Offerings: Interactive storytelling and gaming features present opportunities for engagement and differentiation. Further investment in this area could attract viewers who appreciate immersive and personalized viewing experiences, a segment that is currently experiencing growth.

- Enhanced Content Discovery Mechanisms: Improving the user interface and recommendation algorithms to facilitate content discovery is crucial. A more intuitive and personalized experience would help viewers find shows and movies that match their preferences, increasing engagement and satisfaction.

Adapting to Changing Viewer Preferences and Competition

Netflix is actively adapting to the evolving preferences of viewers and the intensifying competition in the streaming market. This adaptation is crucial for sustained growth.

Netflix’s response to the competitive landscape includes a multi-pronged approach. This involves enhancing its original content library, focusing on high-quality productions with global appeal, while simultaneously investing in innovative features like interactive content and improved personalization. The company is also actively combating password sharing, a practice that has been shown to impact subscriber growth. By combining these strategies, Netflix aims to retain existing subscribers and attract new ones.

Long-Term Outlook and Investment Implications: Netflix Nflx Stock Jumps To The Top Of The S And P 500 After Earnings Heres Why

Source: heavy.com

Netflix’s Q3 surge wasn’t just a flash in the pan; it reflects a shift in investor sentiment driven by the company’s renewed focus on profitability and subscriber growth. While the immediate future looks bright, assessing Netflix’s long-term prospects requires a nuanced understanding of both its strengths and vulnerabilities in the evolving streaming landscape.

The recent earnings report showcased a company actively adapting to the challenges of a saturated market. The crackdown on password sharing, coupled with a renewed emphasis on original content and a more aggressive pricing strategy, indicates a clear path toward sustainable growth. However, the road ahead is not without its bumps. Increased competition from established players and new entrants, fluctuating content costs, and the ever-present threat of economic downturns all pose significant risks.

Netflix’s Growth Potential

The long-term growth of Netflix hinges on its ability to maintain a compelling content library, attract and retain subscribers, and effectively manage its operating costs. Successful navigation of these key areas will be crucial in sustaining the recent positive momentum. For instance, Netflix’s investment in diverse content catering to a global audience, as demonstrated by its recent success with international programming, suggests a strategy for continued growth in untapped markets. However, maintaining this level of investment while simultaneously improving profitability remains a delicate balancing act. Consider the example of Disney+, a strong competitor which has also faced challenges balancing content spending and subscriber growth. Netflix’s success will depend on its ability to outperform this competition and manage its expenses more effectively.

Risks and Uncertainties

Several factors could hinder Netflix’s long-term growth. The intensifying competition from other streaming platforms, including established players like Disney+ and Amazon Prime Video, and newer entrants, poses a constant threat. These competitors often offer bundled services or lower pricing, making it difficult for Netflix to maintain its market share. Further complicating matters is the fluctuating cost of content creation and acquisition, a major expense that can significantly impact profitability. Economic downturns also present a considerable risk, as consumers may be more inclined to cut back on discretionary spending, including streaming subscriptions, during periods of economic uncertainty. The recent recessionary concerns illustrate the vulnerability of Netflix’s business model to broader economic factors.

Investment Implications for Short-Term and Long-Term Investors

The recent stock price jump presents a complex scenario for investors. For short-term investors, the temptation to capitalize on the immediate gains is understandable. However, the inherent volatility of the stock market, particularly in the technology sector, suggests caution. Long-term investors, on the other hand, may view the price jump as an opportunity to invest in a company with significant long-term growth potential. However, a thorough risk assessment considering the competitive landscape and economic uncertainties is crucial before making any investment decisions. A diversified investment portfolio, rather than concentrating solely on Netflix, is a prudent approach for mitigating risk. Consider the example of investors who heavily invested in dot-com companies during the late 1990s bubble. Many saw significant losses when the bubble burst, highlighting the importance of diversified investments and careful risk management.

Impact on the S&P 500

Netflix’s stellar Q3 earnings and subsequent stock surge sent ripples throughout the S&P 500, highlighting the company’s significant influence despite not being the index’s largest component. While not a behemoth like Apple or Microsoft, Netflix’s performance acts as a barometer for the tech sector and consumer spending, influencing investor sentiment and overall market dynamics.

Netflix’s substantial jump significantly impacted the S&P 500’s overall performance, contributing positively to the index’s daily and potentially longer-term gains. The extent of this influence is directly related to Netflix’s weighting within the index and the broader market’s reaction to its performance. A strong showing from a major tech company like Netflix often inspires confidence and encourages investment across the board.

Netflix’s Weighting and Influence on the S&P 500

While precise weighting fluctuates based on market capitalization, Netflix consistently holds a considerable position within the S&P 500, representing a significant portion of the technology sector. This weighting means that even relatively small percentage changes in Netflix’s stock price can translate to noticeable movements in the S&P 500. For instance, a 10% increase in Netflix’s share price, while representing a smaller fraction of the index’s total value compared to a similar increase in Apple’s, still exerts considerable upward pressure on the S&P 500’s overall value due to its weight and the positive sentiment it generates. This effect is amplified by the fact that Netflix’s success often signals broader positive trends in the streaming industry and the overall economy.

Broader Market Implications of Netflix’s Strong Performance

Netflix’s robust earnings report and subsequent stock price increase had a positive spillover effect on other companies within the streaming and entertainment sectors. Investor confidence in these related companies often rises following a successful performance by a major player like Netflix. This can lead to increased investment in similar companies, driving up their stock prices and contributing to a more positive overall market sentiment. The increased investor confidence is not limited to the entertainment sector. A strong performance by a major technology company often signals a positive outlook for the broader tech sector and the economy as a whole, potentially boosting the performance of other tech stocks and related industries. For example, a strong showing from Netflix could signal increased consumer spending on entertainment and technology, indirectly benefiting companies providing related services or infrastructure.

Final Review

Source: thetradable.com

Netflix’s unexpected stock jump wasn’t just about a single quarter’s success; it’s a testament to the company’s strategic pivot and its ability to adapt to the ever-changing demands of the streaming world. While challenges remain – intense competition and evolving viewer habits are always lurking – Netflix’s recent performance signals a potential turning point, suggesting a brighter future for the streaming giant and a compelling case for investors to keep a close eye on its next moves. The question now isn’t *if* Netflix will continue to dominate, but *how* it will continue to innovate and redefine the future of entertainment.