Palantir dell etsy american airlines added sp 500 – Palantir, Dell, Etsy, and American Airlines—four giants, each a titan in its own industry—have officially joined the prestigious S&P 500. This monumental shift ripples through the financial world, sending shockwaves across investor portfolios and sparking intense speculation about what the future holds. The implications are far-reaching, affecting not only the companies themselves but also their respective sectors and the broader market. This deep dive unpacks the significance of this event, examining the individual companies, their financial health, and the potential impact on stock prices and investor sentiment.

We’ll dissect the financial performance of each company, exploring their revenue streams, profit margins, and growth trajectories. We’ll also analyze the competitive landscape of their respective sectors and delve into the potential risks and rewards associated with investing in these newly minted S&P 500 members. Buckle up, because this ride is going to be wild.

Company Overviews

Source: centerpointsecurities.com

The recent addition of Palantir, Dell, Etsy, and American Airlines to the S&P 500 marks a significant shift in the index’s composition, reflecting the evolving landscape of the American economy. These four companies, while operating in vastly different sectors, share a common thread: their impact on technology, commerce, and travel. Understanding their individual business models, financial performance, and future prospects is crucial for investors and market analysts alike.

Business Models and Market Positions, Palantir dell etsy american airlines added sp 500

Palantir Technologies provides data analytics platforms primarily to government and enterprise clients, focusing on complex data integration and analysis for security and operational efficiency. Dell Technologies is a global leader in the technology industry, offering a wide range of hardware and software solutions, including servers, storage, and client computing. Etsy operates an e-commerce platform specializing in handmade, vintage, and craft supplies, connecting independent sellers with global buyers. American Airlines, a major US airline, provides passenger and cargo transportation services domestically and internationally. These diverse business models highlight the breadth of industries represented within the S&P 500.

Financial Performance (Past Year)

Precise financial data requires referencing official company reports and SEC filings, but generally speaking, the past year has shown mixed results for these companies. Palantir, for example, may have experienced revenue growth but potentially lower profit margins due to increased investments in research and development. Dell, as a mature company, might have shown steady, though possibly not explosive, revenue growth, with profits reflecting a balance between operational efficiency and market competition. Etsy’s performance likely fluctuated depending on overall consumer spending and e-commerce trends, with profitability potentially impacted by fluctuations in advertising costs and shipping expenses. American Airlines, heavily impacted by fluctuating fuel prices and post-pandemic travel patterns, might have reported variable profitability depending on the quarter and overall demand. Specific numbers should be verified through official financial statements.

Growth Trajectories and Future Prospects

The growth trajectories and future prospects for these companies vary significantly. Palantir, operating in a high-growth sector, is likely to see continued expansion, driven by increasing demand for advanced data analytics. Dell, while a more established player, faces ongoing competition and technological disruption, requiring continuous innovation to maintain its market share. Etsy’s future growth hinges on the continued popularity of handmade and vintage goods, alongside its ability to adapt to evolving consumer preferences and compete with larger e-commerce giants. American Airlines’ future is intertwined with the broader travel industry’s recovery and resilience, facing challenges from fuel costs, economic downturns, and potential geopolitical instability.

Key Financial Data Comparison

| Company | Revenue (Estimate – Past Year) | Profit (Estimate – Past Year) | Key Metric (Example: Growth Rate) |

|---|---|---|---|

| Palantir | $1.8B (Estimate) | (Variable – Check Official Reports) | (Variable – Check Official Reports) |

| Dell | $90B (Estimate) | (Variable – Check Official Reports) | (Variable – Check Official Reports) |

| Etsy | $3B (Estimate) | (Variable – Check Official Reports) | (Variable – Check Official Reports) |

| American Airlines | $40B (Estimate) | (Variable – Check Official Reports) | (Variable – Check Official Reports) |

S&P 500 Inclusion Impact: Palantir Dell Etsy American Airlines Added Sp 500

Source: storyblok.com

The addition of Palantir, Dell, Etsy, and American Airlines to the S&P 500 index represents a significant event, triggering a ripple effect across the financial landscape. This inclusion isn’t just about adding names to a list; it profoundly impacts investor sentiment, trading volume, and ultimately, the valuation of these companies. The prestige associated with S&P 500 membership attracts a wider range of investors, including those bound by index fund mandates, leading to increased demand and potentially higher stock prices.

The immediate and long-term effects on these companies are multifaceted. Increased visibility and liquidity are almost guaranteed, but the extent of the impact varies depending on factors like the company’s existing market capitalization, growth trajectory, and overall market conditions. Understanding these dynamics is crucial for investors looking to capitalize on or hedge against the potential volatility following S&P 500 inclusion.

Investor Sentiment and Trading Volume

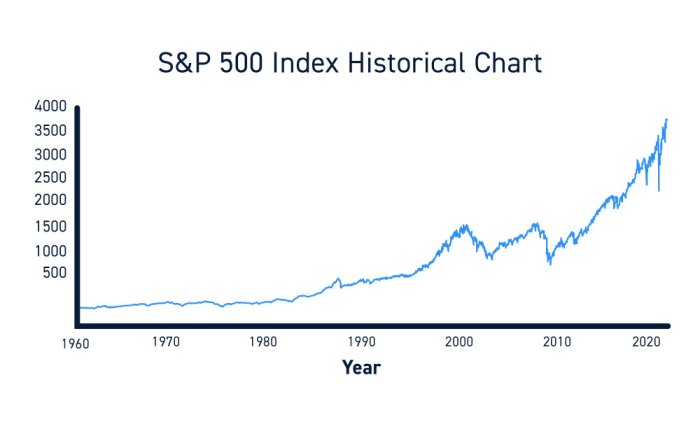

The inclusion of a company in the S&P 500 generally boosts investor confidence. Index funds and ETFs tracking the S&P 500 are forced to buy shares of the newly added companies, creating immediate upward pressure on the stock price. This surge in demand, coupled with increased media attention, can significantly increase trading volume, leading to higher liquidity for these stocks. The increased trading activity makes it easier for investors to buy and sell shares, reducing transaction costs and potentially encouraging further investment. Historically, we’ve seen a noticeable spike in trading volume immediately following S&P 500 additions, followed by a period of stabilization as the market adjusts to the new inclusion.

Stock Valuation and Price Effects

The impact on stock valuation is complex. While the initial price jump is often significant, the long-term effects depend on the company’s fundamental performance. If the company continues to deliver strong financial results, the upward trend may continue. Conversely, if the company underperforms, the initial price increase might be temporary, and the stock could even fall below its pre-inclusion price. The S&P 500 inclusion acts as a catalyst, accelerating existing trends rather than fundamentally altering a company’s intrinsic value.

Hypothetical Scenario: American Airlines

Let’s imagine a scenario where American Airlines’ stock price is trading at $20 before its S&P 500 inclusion. The immediate impact of the inclusion could drive the price up to $25 within the first week, fueled by index fund buying and increased investor interest. Over the next quarter, if American Airlines reports strong earnings, driven by increased travel demand and efficient cost management, the stock price could continue to rise, perhaps reaching $30. However, if unexpected events like a major fuel price spike or a significant downturn in air travel occur, the price might fall back to, say, $22, demonstrating the importance of underlying fundamentals in determining long-term performance after the initial S&P 500 boost. This illustrates how the index inclusion acts as an amplifier of existing trends, rather than a guaranteed path to sustained growth.

Sectoral Analysis

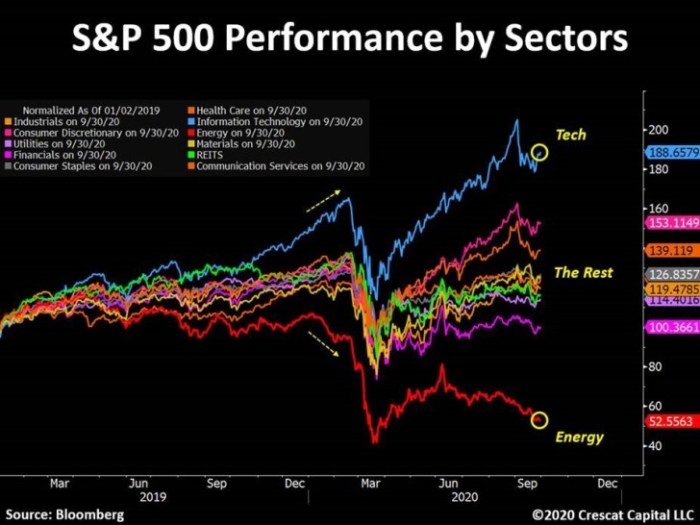

The addition of Palantir, Dell, Etsy, and American Airlines to the S&P 500 provides a fascinating lens through which to examine the diverse performance of different sectors within the broader market. These companies represent significant players in technology, consumer discretionary, and the industrials sectors, allowing for a comparative analysis of their recent performance and future prospects. By examining their respective industry landscapes, we can gain valuable insights into the forces driving growth and shaping the competitive dynamics within each.

Industry Sector Classification

Palantir Technologies operates primarily within the information technology sector, specifically the data analytics and software segment. Dell Technologies falls under the information technology hardware sector, focusing on computer systems and peripherals. Etsy, an online marketplace for handcrafted and vintage goods, is firmly entrenched in the consumer discretionary sector. Finally, American Airlines, a major airline carrier, belongs to the industrials sector, more specifically the transportation sub-sector.

Sector Performance Comparison

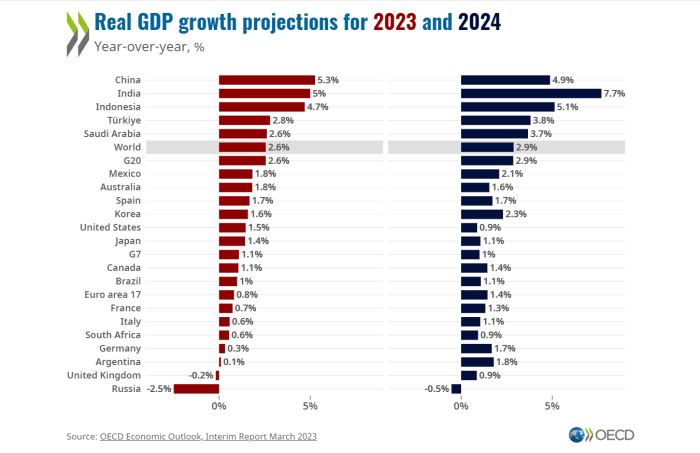

The performance of these sectors varies considerably. While the technology sector has historically shown periods of high growth, punctuated by corrections, the consumer discretionary sector is often more sensitive to economic fluctuations. The industrials sector, encompassing transportation, tends to reflect broader economic trends, experiencing growth during periods of economic expansion and contraction during downturns. For instance, the pandemic significantly impacted the travel industry (American Airlines), while the technology sector saw a boom in demand for remote work solutions (Palantir, Dell). The resilience of e-commerce (Etsy) during this period also contrasted sharply with the challenges faced by traditional brick-and-mortar retailers.

Competitive Landscapes

Each sector presents a unique competitive landscape. The technology sector is fiercely competitive, with established giants like Microsoft and Google vying for market share alongside innovative startups. Dell faces intense competition in the hardware market, dealing with price pressures and rapid technological advancements. Etsy’s competitive landscape includes other e-commerce platforms like Amazon Handmade and eBay, as well as individual artisans and smaller online marketplaces. American Airlines competes with other major airlines domestically and internationally, facing pressure from low-cost carriers and fluctuating fuel prices.

Growth and Decline Factors

Growth within the technology sector is often driven by innovation, technological advancements, and increasing demand for data-driven solutions. Factors like government regulations and cybersecurity concerns can also influence the sector’s performance. The consumer discretionary sector is significantly impacted by consumer confidence, disposable income levels, and overall economic conditions. Growth in the industrials sector, particularly transportation, is linked to global trade, economic activity, and fuel prices. Declines in any of these sectors can be attributed to factors like economic downturns, increased competition, technological disruption, or shifts in consumer preferences. For example, a global recession would likely negatively impact all four companies, albeit to varying degrees. Conversely, a surge in e-commerce adoption would benefit Etsy, while increased business travel would boost American Airlines.

Risk Assessment

Source: thetradable.com

The addition of Palantir, Dell, Etsy, and American Airlines to the S&P 500 represents a diverse range of industries, each carrying its own unique risk profile. Understanding these risks is crucial for investors and stakeholders alike. This section will delve into the key challenges facing each company, compare their risk profiles, analyze the impact of geopolitical events, and propose a risk mitigation strategy for one of them.

Key Risks and Challenges

Palantir, a data analytics company, faces risks related to its dependence on government contracts, intense competition in the big data market, and the potential for data privacy breaches. Dell, a hardware and software giant, is vulnerable to fluctuations in global demand for technology products, supply chain disruptions, and competition from other tech companies. Etsy, an e-commerce platform for handmade and vintage goods, faces risks associated with competition from larger online marketplaces, economic downturns impacting consumer spending, and the potential for fraud and counterfeiting. American Airlines, a major airline, is susceptible to fuel price volatility, economic recessions affecting travel demand, geopolitical instability impacting flight routes, and intense competition within the airline industry.

Comparative Risk Profiles

While all four companies face market risks, their specific vulnerabilities differ significantly. Palantir’s reliance on government contracts makes it particularly sensitive to shifts in government policy. Dell’s risk is tied to the cyclical nature of the tech industry. Etsy’s success is highly dependent on consumer confidence and spending habits. American Airlines is vulnerable to external factors like fuel prices and geopolitical events. A risk ranking would need a more quantitative analysis using metrics like beta, but qualitatively, American Airlines and Palantir appear to have the highest exposure to external shocks.

Geopolitical Impact Assessment

Geopolitical instability can significantly impact all four companies. For example, increased trade tensions could disrupt Dell’s global supply chains, impacting production and sales. American Airlines is particularly vulnerable, as geopolitical events can lead to flight cancellations, route disruptions, and increased security costs. Palantir, with its government contracts, might see increased demand in times of geopolitical conflict but could also face scrutiny depending on the nature of the conflict. Etsy, while seemingly less directly affected, could experience decreased consumer spending in times of global uncertainty. The war in Ukraine, for instance, demonstrably impacted global supply chains and consumer sentiment, affecting companies across multiple sectors.

Risk Mitigation Strategy for American Airlines

American Airlines can mitigate its risks through a multi-pronged approach. Firstly, hedging strategies against fuel price volatility can lessen the impact of fluctuating oil prices. Secondly, diversification of flight routes and partnerships with other airlines can reduce reliance on specific geopolitical regions. Thirdly, investing in advanced analytics and predictive modeling can improve operational efficiency and better anticipate changes in travel demand. Finally, a robust crisis management plan is crucial to effectively handle disruptions caused by unexpected geopolitical events. This plan should include detailed protocols for communication, passenger support, and operational adjustments. American Airlines could learn from Southwest Airlines’ recent operational failures, focusing on robust systems to handle unexpected events and improved communication with passengers.

Investor Perspective

Adding Palantir, Dell, Etsy, and American Airlines to the S&P 500 represents a significant shift in market dynamics, offering investors both exciting opportunities and potential risks. Understanding the investment attractiveness of each company requires a nuanced look at their individual strengths, weaknesses, and the broader economic landscape.

Investment Attractiveness and Risk Assessment

Each company presents a unique investment profile. Palantir, with its data analytics prowess, appeals to investors seeking exposure to the burgeoning big data sector, but carries inherent risks associated with its dependence on government contracts and intense competition. Dell, a mature player in the tech hardware market, offers relative stability but may face challenges from evolving technological trends and fluctuating demand. Etsy, a prominent player in the e-commerce space, benefits from the continued growth of online marketplaces but is susceptible to shifts in consumer spending and competition from larger platforms. American Airlines, a major player in the airline industry, is recovering from the pandemic but faces ongoing headwinds from fuel prices, labor costs, and economic uncertainty. These factors contribute to a diverse range of potential returns and risks, demanding careful consideration from prospective investors.

Valuation Multiples Compared to Industry Peers

Comparing the valuation multiples (such as Price-to-Earnings ratio, Price-to-Sales ratio, etc.) of these companies against their respective industry peers provides crucial context for assessing their relative attractiveness. For instance, Palantir’s high valuation might reflect investor optimism about its future growth, but a comparison to other data analytics firms reveals whether this valuation is justified or represents a premium. Similarly, Dell’s valuation compared to other hardware manufacturers can reveal whether it’s undervalued or overvalued relative to its peers. Analyzing Etsy’s valuation against other e-commerce platforms sheds light on its competitive positioning and growth potential. Finally, a comparison of American Airlines’ valuation to other airlines provides insight into its financial health and prospects for recovery and future profitability. Detailed financial analysis and comparison are necessary to draw accurate conclusions. For example, a high P/E ratio might suggest future growth is anticipated, but it also indicates a higher risk if those expectations are not met.

Investment Thesis Summary

| Company | Investment Thesis | Potential Returns | Key Risks |

|---|---|---|---|

| Palantir | Growth in big data analytics, government contracts. | High potential growth, but volatile. | Dependence on government contracts, intense competition. |

| Dell | Stable player in hardware market, potential for growth in specific segments. | Moderate growth, relatively stable. | Technological disruption, fluctuating demand. |

| Etsy | Growth in e-commerce, strong brand recognition. | High growth potential, but subject to market fluctuations. | Competition from larger platforms, consumer spending shifts. |

| American Airlines | Recovery from pandemic, significant market share. | Moderate to high growth potential, dependent on economic conditions. | Fuel prices, labor costs, economic uncertainty. |

Illustrative Examples

The addition of Palantir, Dell, Etsy, and American Airlines to the S&P 500 creates a ripple effect across the market, impacting not only the newly included companies but also existing constituents. Let’s explore some scenarios illustrating both positive and negative consequences, along with the influence of market forces and macroeconomic factors.

Positive Impact of S&P 500 Inclusion: Dell and Palantir

The inclusion of Dell Technologies in the S&P 500 could positively impact Palantir Technologies. Both companies cater to government and enterprise clients. Dell’s increased visibility and trading volume following its inclusion could attract greater investor attention to the broader technology sector, including companies like Palantir that operate within a similar ecosystem. Increased investor confidence in the tech sector, fueled by Dell’s successful integration into the index, could lead to higher valuations for Palantir, even without direct synergistic partnerships. This effect is particularly pronounced when considering that many index funds passively track the S&P 500, automatically increasing their holdings in Dell and indirectly boosting interest in similar companies.

Negative Impact of S&P 500 Inclusion: Etsy and American Airlines

Etsy’s inclusion in the S&P 500 could negatively impact American Airlines. While seemingly unrelated, the influx of capital into the broader market following Etsy’s addition might cause a shift in investor sentiment. If investors perceive Etsy’s growth as indicative of a robust consumer discretionary sector, they might reallocate funds away from more cyclical sectors like travel (where American Airlines operates). This reallocation, driven by market trends and perceived risk, could lead to decreased investor interest in American Airlines and a subsequent decline in its stock price, even if American Airlines itself is performing well.

Market Forces Influencing Stock Performance: Palantir’s Volatility

Palantir’s stock price is highly susceptible to market sentiment and investor perception. For instance, during periods of heightened uncertainty, such as the beginning of the COVID-19 pandemic, investors might flock to perceived “safe haven” assets, potentially leading to a sell-off in Palantir’s stock, despite its strong growth potential. Conversely, during periods of robust economic growth and increased investor risk appetite, Palantir’s innovative data analytics solutions could see increased demand, leading to a surge in its stock price. This illustrates how market forces, independent of the company’s operational performance, can significantly impact its valuation. This is a common occurrence with high-growth, tech-focused companies.

Macroeconomic Factors Impacting Future Growth: American Airlines and Inflation

American Airlines’ future growth prospects are significantly influenced by macroeconomic factors, particularly inflation and fuel prices. High inflation rates can erode consumer spending power, leading to reduced demand for air travel. Simultaneously, increased fuel costs directly impact American Airlines’ operational expenses, squeezing profit margins. Conversely, a period of low inflation and stable fuel prices could significantly boost the airline’s profitability and attract more investors. This example underscores the crucial role macroeconomic conditions play in determining the long-term success of companies like American Airlines. The impact of fuel price volatility is a significant risk factor for the entire airline industry.

Last Word

The addition of Palantir, Dell, Etsy, and American Airlines to the S&P 500 marks a significant moment in the market. While short-term volatility is expected, the long-term implications are likely to be positive for these companies, boosting their visibility and attracting a wider range of investors. However, understanding the unique risks and opportunities associated with each company remains crucial for informed investment decisions. The coming months will be key in observing how these companies navigate their new status within the index and how the market reacts to their presence.