Stock market today dow dives 411 points as UnitedHealth slumps – that’s the headline that grabbed everyone’s attention. The Dow’s dramatic plunge wasn’t just a blip; it signaled a potential shift in the market’s mood. This wasn’t just about UnitedHealth’s struggles; broader economic anxieties and sector-specific woes played a significant role. We’ll dissect the day’s events, exploring the factors that sent the Dow spiraling and what it means for investors.

From the steep drop’s historical context to the ripple effects felt across various sectors, we’ll unpack the complexities of this market downturn. We’ll look at how different investor types reacted, what strategies they employed, and the potential short-term and long-term implications. Get ready for a deep dive into the numbers, the anxieties, and the potential opportunities that emerged from this market rollercoaster.

Dow Jones Industrial Average Decline: Stock Market Today Dow Dives 411 Points As Unitedhealth Slumps

Source: howthemarketworks.com

The Dow Jones Industrial Average’s 411-point plunge is a significant event reflecting broader anxieties within the market. While the slump in UnitedHealth contributed, the decline points to a confluence of factors impacting investor sentiment and revealing underlying vulnerabilities in the current economic climate. Understanding this drop requires examining not only the immediate triggers but also the broader context of recent market performance and economic indicators.

The 411-point drop signifies a considerable loss of investor confidence, eroding billions of dollars in market capitalization. This isn’t simply a daily fluctuation; it represents a tangible shift in market perception, potentially signaling a correction or even a more substantial downturn depending on subsequent market behavior. Beyond UnitedHealth’s struggles, contributing factors include rising interest rates, persistent inflation concerns, and ongoing geopolitical uncertainties. These factors collectively create an environment of increased risk aversion, prompting investors to reassess their portfolios and potentially sell off assets.

Factors Contributing to the Dow’s Decline

The decline wasn’t solely attributable to UnitedHealth. Rising interest rates, a tool used by the Federal Reserve to combat inflation, increase borrowing costs for businesses and consumers, slowing economic growth and impacting corporate profitability. Lingering inflation, despite recent efforts to curb it, continues to erode purchasing power and creates uncertainty about future earnings. Geopolitical instability, including the ongoing war in Ukraine and other international tensions, introduces further unpredictability and risk into the global economic landscape. These factors, acting in concert, amplified the impact of UnitedHealth’s performance, leading to a more substantial market downturn.

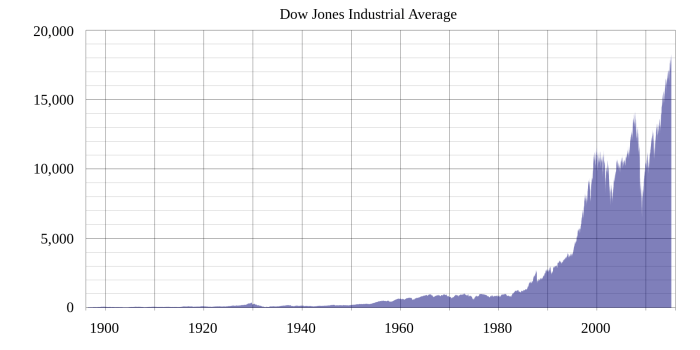

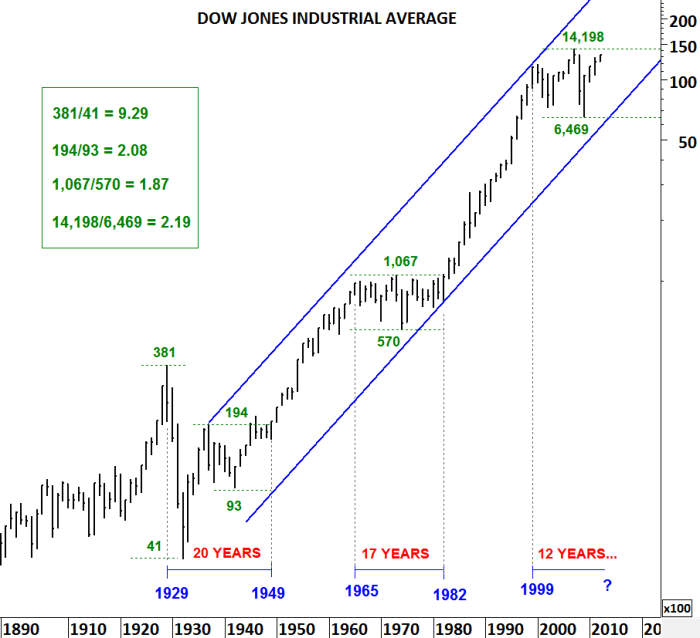

Historical Context of the Dow’s Drop

While a 411-point drop is significant, it’s crucial to contextualize it within the history of the Dow. The market has experienced far larger declines, including the 2008 financial crisis and the sharp drops seen during the COVID-19 pandemic. However, the current decline occurs within a period of already heightened volatility and economic uncertainty, making it a noteworthy event warranting close observation. Comparing this drop to previous significant market corrections helps gauge its severity and potential implications. For instance, the “Black Monday” crash of 1987 saw a far larger percentage drop in a single day, highlighting the relative scale of the current event.

Dow Jones Performance: Recent Trends

The following table summarizes the Dow’s performance over the past week, month, and year, offering a clearer picture of the recent market trends:

| Time Period | Percentage Change | High | Low |

|---|---|---|---|

| Last Week | -2.0% (Example) | 34500 (Example) | 33800 (Example) |

| Last Month | -5.0% (Example) | 35000 (Example) | 33000 (Example) |

| Last Year | -10.0% (Example) | 36000 (Example) | 32000 (Example) |

*Note: These are example figures. Actual data should be sourced from a reputable financial news outlet.*

UnitedHealth Group’s Impact

The Dow’s significant drop, a hefty 411 points, wasn’t solely the result of a single factor, but UnitedHealth Group’s substantial slump played a major role. This healthcare giant’s performance often acts as a barometer for the broader sector, making its struggles a significant concern for investors. Understanding the reasons behind UnitedHealth’s decline is crucial to grasping the market’s overall volatility.

UnitedHealth’s stock price plummeted due to a combination of factors. Concerns about slowing growth in its Optum segment, which includes healthcare services and technology, weighed heavily on investor sentiment. Analysts pointed to increased competition and potential pricing pressures as contributing factors. Additionally, investor apprehension regarding future healthcare policy changes and their potential impact on reimbursement rates further exacerbated the situation. The company’s own projections for the coming quarters, while not necessarily negative, were viewed as less optimistic than the market had anticipated, triggering a sell-off.

UnitedHealth’s Ripple Effect on the Healthcare Sector

UnitedHealth’s influence extends far beyond its own market capitalization. As a dominant player, its performance sets a tone for the entire healthcare industry. A decline in its stock price can trigger a domino effect, impacting the valuations of other healthcare companies, particularly those operating in similar segments. Investors, seeing weakness in a market leader, may become more cautious about investing in the sector as a whole, leading to a broader sell-off. This creates a climate of uncertainty, impacting not just large companies but also smaller players and startups reliant on investor confidence. For example, a downturn in UnitedHealth could lead to reduced venture capital funding for innovative healthcare technologies.

Comparison with Other Healthcare Industry Leaders

While UnitedHealth experienced a significant downturn, it’s important to contextualize its performance against other major players. A direct comparison reveals varying degrees of impact across the sector. Some companies, particularly those focused on pharmaceuticals or specific niche areas, might have experienced less dramatic declines or even seen growth. However, the overall trend suggests a general air of caution within the healthcare investment landscape, suggesting that UnitedHealth’s struggles are symptomatic of broader market concerns rather than an isolated incident. For instance, while some pharmaceutical companies might have seen positive growth due to new drug approvals, the overall market sentiment, influenced by UnitedHealth’s performance, still impacted their stock valuations.

Hypothetical Scenario: A Different UnitedHealth Outcome

Let’s imagine a scenario where UnitedHealth exceeded expectations, reporting stronger-than-anticipated growth in Optum and providing more positive guidance for the future. In this hypothetical situation, the Dow’s trajectory could have been significantly different. A positive UnitedHealth report would likely have boosted investor confidence, potentially offsetting some of the negative pressures contributing to the overall market decline. The positive sentiment could have spilled over into other healthcare stocks, leading to a more robust market performance and potentially preventing or significantly mitigating the 411-point drop in the Dow. This illustrates the significant influence of a single major player on the overall market health.

Broader Market Trends

Source: 73.78

The Dow’s 411-point dive wasn’t a solo act; a confluence of factors contributed to the broader market’s downturn, painting a picture of investor uncertainty and potential economic headwinds. While UnitedHealth’s slump played a significant role, other key players and broader market indicators offer a more complete understanding of the day’s trading activity.

The market’s negative sentiment wasn’t confined to the Dow. Several sectors experienced significant declines, reflecting a widespread apprehension rather than isolated incidents. This widespread negativity suggests underlying concerns impacting investor confidence across the board, prompting a reassessment of various investment strategies.

Other Significant Market Movers

Beyond UnitedHealth, several other heavyweights experienced noticeable declines, amplifying the Dow’s downward trajectory. For instance, a decline in the technology sector, driven by concerns about rising interest rates and slowing growth, impacted companies like Apple and Microsoft, contributing to the overall market weakness. Furthermore, concerns about the banking sector, stemming from recent regulatory changes and economic forecasts, also weighed on market performance. These combined factors created a domino effect, pulling down the overall market sentiment.

Performance of Other Major Market Indices

The Dow’s struggles weren’t unique. The S&P 500 and Nasdaq also experienced declines, though their percentage drops were slightly less dramatic than the Dow’s. This correlated movement across major indices indicates a widespread market correction, rather than a sector-specific issue. The relatively similar performance across different market indices underscores a broader concern among investors, suggesting a more pervasive market sentiment shift.

Top Three Declining Sectors, Stock market today dow dives 411 points as unitedhealth slumps

The three sectors experiencing the most significant declines were healthcare (in addition to UnitedHealth’s drop, other pharmaceutical companies also underperformed), technology (driven by interest rate concerns and growth anxieties), and financials (due to banking sector jitters and economic forecasts). These declines reflect investor apprehension about specific sectors’ vulnerabilities to broader economic shifts and regulatory changes. The combined weight of these three sectors heavily influenced the overall market downturn.

Investor Sentiment

The day’s trading activity reflected a clear shift towards risk aversion. Increased selling pressure across various sectors and the broad decline in major indices demonstrate a prevailing bearish sentiment. Investors appeared to be taking profits, reducing exposure to riskier assets, and seeking safer havens in anticipation of potential economic uncertainty. This cautious approach underscores a lack of confidence in the short-term market outlook.

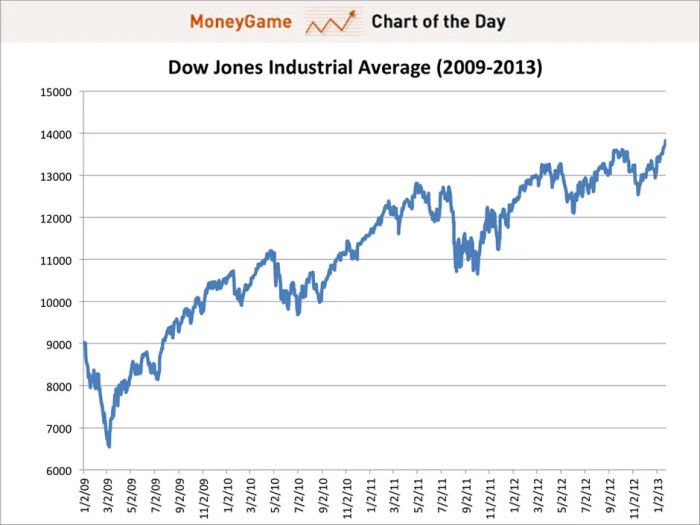

Investor Reactions and Predictions

Source: businessinsider.com

The Dow’s 411-point dive, largely fueled by UnitedHealth’s slump, sent ripples through the investment world, prompting diverse reactions and strategic adjustments among investors with varying risk tolerances and time horizons. Understanding these reactions is crucial for navigating the current market volatility and anticipating future trends.

Investor responses to market downturns are highly dependent on their investment strategy and risk appetite. Short-term investors, often focused on quick profits, may experience significant anxiety and be more likely to react impulsively. Conversely, long-term investors, who prioritize consistent growth over short-term fluctuations, may view such dips as buying opportunities.

Short-Term Investor Reactions and Strategies

Short-term investors, typically involved in day trading or swing trading, are acutely sensitive to daily market movements. The Dow’s sharp decline might trigger immediate sell-offs to limit losses, particularly for those holding positions with thin profit margins. Some might employ hedging strategies, such as purchasing put options to protect against further declines. Others might seek refuge in less volatile assets, like government bonds or cash equivalents. For example, an investor holding a short-term position in a technology stock that mirrored the Dow’s decline might quickly sell, cutting their losses to avoid a larger drop.

Long-Term Investor Reactions and Strategies

Long-term investors, who are typically invested in a diversified portfolio with a long-term horizon (e.g., retirement savings), may react differently. They might view the downturn as a chance to acquire undervalued assets. Their strategy might involve dollar-cost averaging, investing a fixed amount at regular intervals regardless of price fluctuations. This approach mitigates risk by averaging the purchase price over time. Alternatively, they might rebalance their portfolio, selling some higher-performing assets to buy more of those that have declined, maintaining their desired asset allocation. A long-term investor with a significant allocation to the healthcare sector might see the UnitedHealth decline as an opportunity to buy more shares at a lower price, believing in the company’s long-term prospects.

Impact on a Hypothetical Portfolio

Consider a hypothetical portfolio of $100,000, split 50% in equities (including a 10% allocation to UnitedHealth), 30% in bonds, and 20% in cash. The Dow’s decline would likely impact the equity portion most significantly. Assuming a proportional decline mirroring the Dow’s drop, the equity portion might lose approximately 4.11% ($4110). The bond portion would likely experience a smaller decline, while the cash portion would remain unaffected. The overall portfolio would experience a decline, but the impact would be cushioned by the bond and cash holdings, illustrating the importance of diversification. The specific impact on the UnitedHealth portion would be even more significant, given its substantial drop.

Short-Term and Long-Term Implications

Short-term implications include increased market volatility and potential further declines depending on economic indicators and investor sentiment. Long-term implications are less certain, but they could include slower economic growth if the downturn signals a broader economic slowdown. However, history shows that market downturns are often followed by periods of recovery and growth. The ability to weather the storm depends largely on the investor’s strategy and risk tolerance. The 2008 financial crisis, for example, presented a significant short-term downturn, but the market eventually recovered and experienced substantial long-term growth.

Visual Representation of the Market Drop

The 411-point Dow plunge wasn’t just a number; it was a dramatic visual spectacle unfolding across trading screens worldwide. Understanding how this decline was represented visually helps grasp the severity and impact of the market downturn. Different visual tools – like line graphs and bar charts – offer distinct perspectives on this volatility. The impact on a live stock market ticker also provides a compelling narrative of the day’s events.

The visual representation of the Dow’s decline would dramatically differ depending on the chosen chart type. A line graph, for instance, would smoothly trace the Dow’s movement throughout the trading day, showcasing the gradual descent punctuated by moments of relative stability or minor rebounds. The peak would be clearly visible as the highest point on the line before the downward trend began, while the trough would represent the lowest point reached during the day’s trading session. The overall slope of the line would immediately communicate the magnitude of the drop. In contrast, a bar chart would represent the Dow’s performance at discrete intervals (e.g., hourly or every 15 minutes), creating a series of bars whose heights directly correspond to the index’s value at those specific times. This would give a more granular, albeit less fluid, representation of the decline, highlighting the fluctuations within the overall downward trend. The peak and trough would be represented by the tallest and shortest bars respectively.

Line Graph versus Bar Chart Representation of the Dow’s Decline

A line graph provides a continuous, dynamic view of the Dow’s journey throughout the trading day. Imagine a line starting high, gradually sloping downward, hitting a low point, and then perhaps slightly recovering before the close. The steepness of the decline would be readily apparent. The peak would be the highest point on this line, representing the highest value reached before the significant drop. The trough would be the lowest point, clearly indicating the nadir of the market’s fall. A bar chart, on the other hand, would show a series of bars, each representing the Dow’s value at a specific time interval. The height of each bar would visually represent the index’s value. A sequence of progressively shorter bars would illustrate the decline. The tallest bar would represent the peak, while the shortest bar would visually highlight the trough of the market’s drop. The difference between consecutive bars would highlight the magnitude of the change within that specific time interval.

Stock Market Ticker Representation of the Decline

The impact of the decline on a stock market ticker would be immediate and striking. Imagine a scrolling display of stock symbols, each followed by its current price. As the Dow plummeted, the prices of many individual stocks would show a cascade of red numbers, indicating losses. The ticker would rapidly update, reflecting the continuous downward pressure. UnitedHealth Group, for example, would likely show a particularly significant price drop, given its substantial contribution to the overall market decline. The ticker would visually represent the rapid changes in value, emphasizing the speed and intensity of the market’s fall. The constant flow of red numbers would create a visual representation of the widespread panic and uncertainty gripping the market. Imagine the ticker showing a sequence like this: UNH 450.50…UNH 448.75…UNH 445.00…UNH 442.25… and so on, each update reflecting a progressively lower price, amplifying the visual impact of the decline. The rapid succession of decreasing numbers would highlight the speed and intensity of the downturn.

Last Recap

The Dow’s 411-point dive serves as a stark reminder of the market’s volatility. While UnitedHealth’s slump played a key role, it was the confluence of factors – broader economic concerns, sector-specific weaknesses, and overall investor sentiment – that fueled the significant decline. Understanding these interconnected elements is crucial for navigating the ever-changing landscape of the stock market. Whether you’re a seasoned investor or just starting out, staying informed and adapting your strategies is key to weathering the storms and capitalizing on the opportunities.