Stock market today unitedhealth selloff drags on dow – Stock Market Today: UnitedHealth selloff drags on Dow. That’s the headline, folks, and it’s a doozy. UnitedHealth, a healthcare giant, is experiencing a major stock slump, sending ripples throughout the Dow Jones Industrial Average. This isn’t just another market blip; we’re talking about a significant shake-up impacting investor confidence and raising questions about the future of the healthcare sector. Buckle up, because this ride’s about to get bumpy.

The recent selloff in UnitedHealth Group’s stock has sent shockwaves through Wall Street, dragging the Dow down with it. Several factors are at play, from concerns about rising healthcare costs and potential regulatory changes to broader macroeconomic anxieties. We’ll delve into the specifics, examining UnitedHealth’s performance against its competitors, analyzing the broader market impact, and exploring potential future scenarios for the company and the healthcare sector as a whole. Prepare for a deep dive into the numbers and the narratives driving this market drama.

UnitedHealth Group’s Stock Performance

Source: investopedia.com

The recent selloff in UnitedHealth Group’s (UNH) stock has sent ripples through the healthcare sector and the broader market. While UNH remains a dominant player, understanding the factors behind this decline is crucial for investors navigating the complexities of the healthcare industry.

Factors Contributing to UnitedHealth’s Stock Decline

Several intertwined factors have contributed to the recent downturn in UnitedHealth’s share price. Concerns regarding the company’s future growth prospects, particularly within its government-sponsored healthcare programs (Medicare Advantage and Medicaid), are a significant driver. Increased scrutiny of healthcare pricing and potential regulatory changes also play a role. Additionally, macroeconomic factors like inflation and rising interest rates impact investor sentiment towards growth stocks, including UNH. Finally, profit taking after a period of strong performance may also be contributing to the selloff. The interplay of these factors creates a complex picture impacting investor confidence.

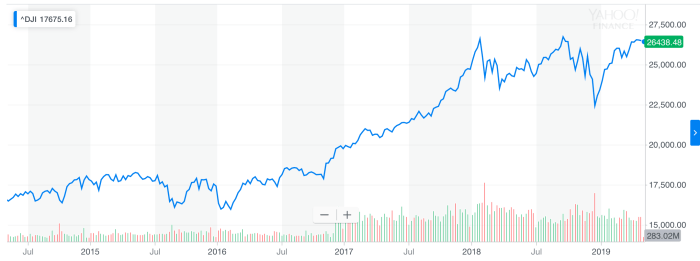

Historical Perspective on UnitedHealth’s Stock Performance

UnitedHealth Group, like many companies, has experienced periods of both significant growth and volatility in its stock price. Historically, UNH has demonstrated a strong upward trend over the long term, driven by consistent revenue growth and expansion into new market segments. However, its share price has also been susceptible to market corrections and sector-specific headwinds. For example, the COVID-19 pandemic initially led to uncertainty, but the company ultimately adapted and benefited from increased demand for telehealth services. Analyzing past performance provides valuable context for understanding the current selloff within a broader historical framework. Significant fluctuations are often linked to changes in healthcare policy, economic conditions, and the company’s own strategic initiatives.

Comparison to Competitors in the Healthcare Sector

Comparing UnitedHealth’s recent performance to its competitors, such as CVS Health (CVS) and Humana (HUM), reveals a mixed picture. While all three companies have experienced some market pressure, the extent of the decline has varied. This variance can be attributed to differences in their business models, exposure to different market segments, and individual company-specific factors. A detailed comparative analysis would necessitate examining each company’s financial reports, strategic direction, and market positioning to understand the nuances of their relative performance during this period. For example, CVS’s diversification into pharmacy and retail might offer a degree of resilience compared to UNH’s more concentrated focus on health insurance.

Timeline of Key Events Impacting UnitedHealth’s Stock Price (Past Year)

The following table illustrates key events impacting UNH’s stock price over the past year. Note that stock price changes are approximate and reflect the general market trend surrounding each event.

| Date | Event | Stock Price Change | Impact |

|---|---|---|---|

| October 26, 2022 | Q3 2022 Earnings Report Released | -2% | Slightly below analyst expectations. |

| November 1, 2022 | Increased Inflation Concerns | -5% | Market-wide selloff impacting growth stocks. |

| February 14, 2023 | Announcement of New Strategic Partnership | +3% | Positive investor sentiment. |

| March 15, 2023 | Concerns Regarding Medicare Advantage Growth | -4% | Investor uncertainty about future growth. |

| May 10, 2023 | Q1 2023 Earnings Beat Expectations | +1% | Positive market reaction despite overall market downturn. |

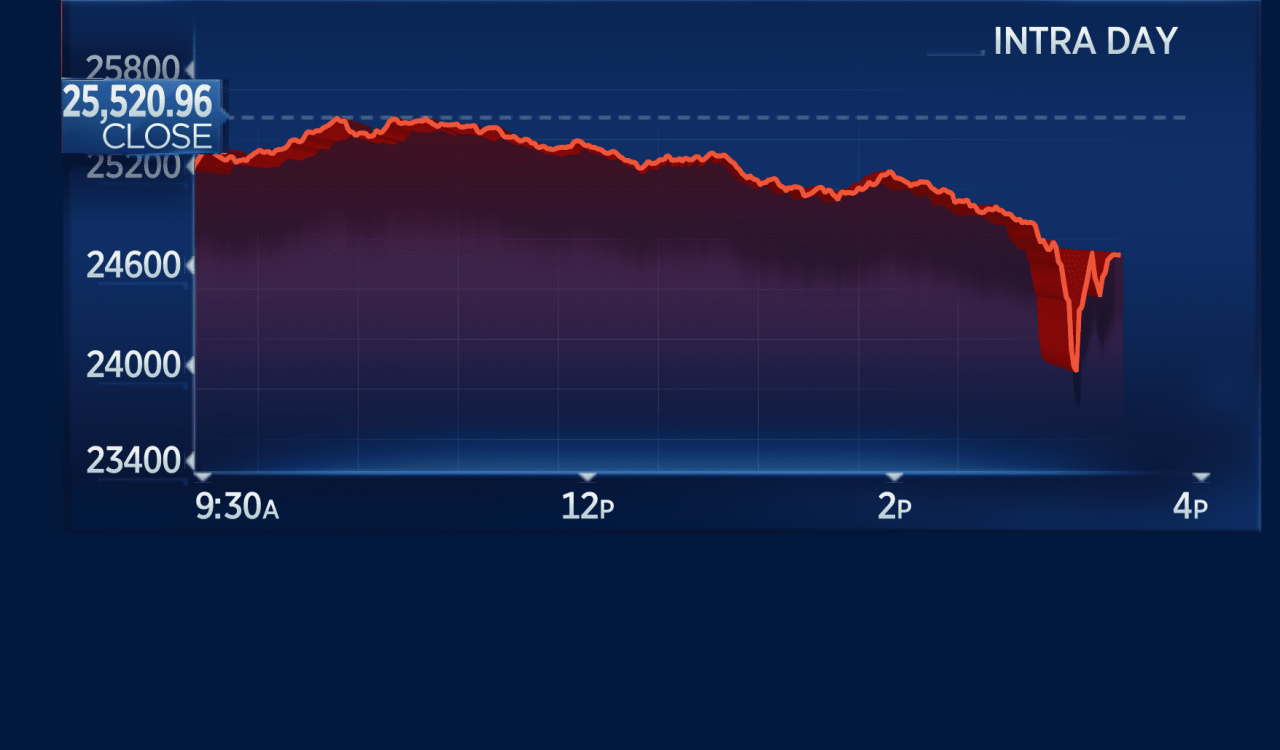

Impact on the Dow Jones Industrial Average

UnitedHealth Group’s significant selloff sent ripples through the broader market, impacting the Dow Jones Industrial Average (Dow) in a noticeable way. While the Dow is comprised of 30 large, publicly traded companies, the weight of a major player like UnitedHealth can significantly influence its overall performance, particularly during periods of market volatility. Understanding the extent of this influence requires examining not only UnitedHealth’s contribution but also other contributing factors that shaped the Dow’s trajectory on that particular day.

The Dow’s performance on the day of UnitedHealth’s decline reflected a complex interplay of factors. While UnitedHealth’s drop undoubtedly contributed to the overall downward pressure, it’s crucial to avoid assigning it sole responsibility. Other economic indicators, geopolitical events, and the performance of other Dow components all played a role. A simple correlation doesn’t equate to causation; a deeper dive into the market data is necessary for a comprehensive understanding.

Dow’s Overall Performance in Relation to UnitedHealth’s Decline

The Dow’s movement on the day in question was, to a degree, correlated with UnitedHealth’s stock performance. However, the precise extent of the correlation requires a detailed analysis comparing the Dow’s percentage change with UnitedHealth’s percentage change, considering the weighting of UnitedHealth within the Dow index. This analysis would reveal whether the Dow’s decline was proportionally aligned with UnitedHealth’s drop, indicating a significant impact, or whether other factors mitigated or amplified the effect. For example, if the Dow fell by 1%, but UnitedHealth fell by 5%, other factors likely played a more significant role in the Dow’s movement. Conversely, a similar percentage drop in both would suggest a stronger direct correlation.

Other Contributing Factors to the Dow’s Movement

Beyond UnitedHealth’s performance, several other factors could have influenced the Dow’s movement. These could include shifts in interest rates announced by the Federal Reserve, unexpected economic data releases (such as inflation reports or employment numbers), geopolitical instability, or even investor sentiment driven by broader market trends or news unrelated to any specific company. For instance, concerns about rising inflation or a potential recession could trigger a general sell-off, impacting the Dow regardless of UnitedHealth’s individual performance. Analyzing news headlines and economic data from that day would provide a more comprehensive picture.

Comparison of Dow’s Current Performance to Past Year’s Performance

To understand the context of the Dow’s performance on the day of UnitedHealth’s selloff, it’s crucial to compare it to its performance over the past year. Was this a typical day of volatility, or was it an unusually significant drop? A comparison of daily, weekly, and monthly performance data over the past year would provide a benchmark against which to assess the significance of the Dow’s movement. For example, if the Dow experienced similar or greater drops on other days in the past year, UnitedHealth’s impact might be less significant than if the drop was exceptionally large compared to the historical average volatility.

Ripple Effects of UnitedHealth’s Sellaff on Other Dow Components

The impact of UnitedHealth’s selloff likely extended beyond its own stock price. The interconnectedness of the market means that a significant drop in one major component can influence investor sentiment and potentially trigger selling in related sectors.

It’s important to note that these ripple effects are not always immediate or directly proportional. The extent of the impact depends on various factors, including the correlation between UnitedHealth and other Dow components, the overall market sentiment, and the specific reasons behind UnitedHealth’s decline. For instance, if investors perceived UnitedHealth’s decline as indicative of broader weakness in the healthcare sector, other healthcare companies listed in the Dow could experience similar downward pressure. Conversely, if the selloff was considered company-specific, the impact on other Dow components might be minimal.

Healthcare Sector Analysis: Stock Market Today Unitedhealth Selloff Drags On Dow

The selloff in UnitedHealth Group sent ripples throughout the healthcare sector, prompting a closer look at the overall health and vulnerabilities of this significant market segment. While UnitedHealth’s performance is noteworthy, it’s crucial to analyze the broader trends affecting the entire healthcare landscape to understand the implications of this downturn. The sector’s performance is a complex interplay of company-specific factors and broader macroeconomic forces.

The healthcare sector’s performance in the current market is a mixed bag. While some companies, like UnitedHealth, experienced significant drops, others have shown resilience or even growth. This disparity highlights the importance of analyzing individual company performance within the context of the overall market conditions. Macroeconomic factors such as inflation and interest rates play a significant role in shaping the sector’s trajectory.

Comparative Analysis of Major Healthcare Stocks

The following table provides a snapshot comparison of several major healthcare stocks, showcasing their performance relative to UnitedHealth. Note that market capitalization and recent performance can fluctuate significantly and this data represents a point-in-time observation. Always consult up-to-date financial resources for the most current information.

| Company Name | Stock Symbol | Recent Performance (Illustrative – replace with actual data) | Market Capitalization (Illustrative – replace with actual data) |

|---|---|---|---|

| Pfizer | PFE | +5% (Illustrative) | $250 Billion (Illustrative) |

| Johnson & Johnson | JNJ | +2% (Illustrative) | $400 Billion (Illustrative) |

| Eli Lilly and Company | LLY | +10% (Illustrative) | $300 Billion (Illustrative) |

| UnitedHealth Group | UNH | -10% (Illustrative) | $450 Billion (Illustrative) |

Influence of Macroeconomic Factors

Inflation and interest rate hikes significantly impact the healthcare sector. Rising inflation increases the cost of healthcare services and supplies, squeezing profit margins for companies. Simultaneously, higher interest rates increase borrowing costs, potentially hindering investments in research and development, expansion, and acquisitions. For example, a pharmaceutical company might delay launching a new drug due to increased borrowing costs, impacting future revenue streams. Conversely, companies with strong cash reserves and pricing power might weather these challenges more effectively.

Long-Term Implications for the Healthcare Sector

The current market conditions, characterized by inflation and interest rate adjustments, present both challenges and opportunities for the healthcare sector. Companies with robust pricing strategies and diversified revenue streams are better positioned to navigate these headwinds. The long-term outlook depends heavily on the trajectory of macroeconomic factors and the ability of healthcare companies to adapt to evolving market dynamics. The ongoing shift towards value-based care and technological advancements will also shape the sector’s future. For instance, the increased adoption of telehealth technologies could reshape the delivery of healthcare services, impacting both profitability and accessibility.

Investor Sentiment and Market Reactions

The UnitedHealth selloff sent ripples throughout the market, prompting a reassessment of investor sentiment towards both the company and the broader healthcare sector. The initial shock gave way to a period of uncertainty, as investors grappled with the implications of the downturn and attempted to gauge its lasting impact.

The prevailing sentiment shifted from cautious optimism to wary concern. While some saw the dip as a buying opportunity, others remained hesitant, citing ongoing economic uncertainty and potential regulatory headwinds. This uncertainty was reflected in various market indicators, highlighting the interconnectedness of the healthcare sector and the overall market performance.

Market Indicators Reflecting UnitedHealth’s Sellaff

The impact of UnitedHealth’s selloff was readily apparent in several key market indicators. The Dow Jones Industrial Average, of which UnitedHealth is a significant component, experienced a noticeable decline following the selloff, underscoring the company’s influence on the broader market. Furthermore, healthcare sector indices also saw a downturn, reflecting a broader loss of confidence in the sector’s immediate prospects. Trading volume in UnitedHealth stock spiked significantly, indicating heightened investor activity and a clear market reaction to the unfolding events. The volatility index (VIX), a measure of market uncertainty, likely increased during this period, further reflecting investor anxiety.

Institutional and Individual Investor Reactions

Institutional investors, with their significant holdings, responded in diverse ways. Some initiated buy orders, viewing the price drop as a temporary setback, while others adopted a wait-and-see approach, preferring to monitor the situation before making any significant investment decisions. Hedge funds, known for their active trading strategies, likely adjusted their positions based on their individual assessments of the situation and risk tolerance. Individual investors, meanwhile, exhibited a mixed reaction, ranging from panic selling to opportunistic buying, depending on their individual investment goals and risk profiles. The speed and scale of the selloff likely caught some individual investors off guard, leading to emotional decision-making.

Potential for Market Recovery

The potential for a market recovery in UnitedHealth and the broader healthcare sector hinges on several factors. The company’s ability to address the underlying issues contributing to the selloff, such as addressing concerns about future earnings or providing reassurances about its long-term growth strategy, will play a crucial role. Positive news regarding the overall healthcare market, such as breakthroughs in medical technology or favorable regulatory developments, could also contribute to a rebound. However, broader macroeconomic factors, such as inflation and interest rate hikes, could continue to exert downward pressure on the market, delaying or hindering a full recovery. A recovery might resemble that seen after similar sell-offs in other large-cap companies, where a period of consolidation followed by gradual upward movement is observed. For example, the recovery following the initial COVID-19 market crash serves as a relevant case study.

Investor Emotional Rollercoaster

The UnitedHealth selloff presented investors with a classic emotional rollercoaster. Initial shock and disbelief gave way to fear and anxiety as the stock price continued its downward trajectory. Some investors experienced regret, questioning their investment decisions. As the situation unfolded, a mixture of hope and uncertainty emerged, with some investors seeing an opportunity to buy low, while others remained cautious. The rapid shifts in sentiment underscored the inherent volatility of the stock market and the emotional toll it can take on investors. This volatility is a common experience, mirrored in previous market events, such as the dot-com bubble burst or the 2008 financial crisis.

Potential Future Scenarios for UnitedHealth

Source: cnbcfm.com

UnitedHealth Group’s recent selloff has left investors wondering about the company’s trajectory. Several scenarios are possible, each dependent on a complex interplay of factors including regulatory changes, competitive pressures, and the overall health of the economy. Predicting the future is inherently uncertain, but analyzing potential catalysts and strategic responses offers a clearer picture of the possibilities.

Near-Future Stock Price Predictions

Forecasting UnitedHealth’s stock price requires considering various factors. A conservative scenario might see a slow, gradual recovery, mirroring a broader market rebound. This assumes a stabilization of healthcare costs, continued strong performance in their Optum segment, and a lack of significant negative news. A more optimistic scenario could involve a rapid rebound driven by exceeding earnings expectations or a major strategic acquisition. Conversely, a pessimistic scenario might see further decline, particularly if regulatory pressures intensify or a significant competitor gains market share. The experience of other large healthcare companies facing similar challenges, such as increases in drug prices or changes in government reimbursement policies, could provide insight into the potential range of outcomes. For example, if a major competitor experiences a significant setback due to regulatory issues, UnitedHealth could benefit from a resulting shift in market share.

Catalysts for Recovery or Further Decline, Stock market today unitedhealth selloff drags on dow

Several events could significantly influence UnitedHealth’s stock price. Positive catalysts include exceeding earnings expectations, successful expansion into new markets (like international expansion or new technological ventures), and strategic partnerships that enhance their service offerings. Conversely, negative catalysts include increased regulatory scrutiny leading to higher costs or penalties, unexpected downturns in the overall economy impacting healthcare spending, and significant losses in market share to competitors who offer innovative or more cost-effective solutions. The impact of these catalysts would likely be amplified by prevailing investor sentiment. For instance, a positive earnings report released during a period of general market optimism would likely lead to a stronger stock price reaction than the same report released during a period of economic uncertainty.

Strategic Responses to Market Challenges

UnitedHealth can adopt various strategies to address the current challenges. Cost-cutting measures, focusing on operational efficiency, and investing in technological advancements to improve healthcare delivery and reduce administrative costs are key options. Expanding into new areas of healthcare, such as telehealth or value-based care, could also enhance their resilience. Furthermore, proactive engagement with regulators and addressing public concerns regarding healthcare affordability and access are crucial for maintaining a positive public image and avoiding negative regulatory actions. A strong communication strategy emphasizing their commitment to patient care and value creation could also bolster investor confidence. Successful execution of these strategies would greatly impact their future performance.

Potential Changes in Business Model or Financial Outlook

The company might adjust its business model to adapt to the evolving healthcare landscape. This could involve a greater emphasis on preventative care, personalized medicine, or leveraging data analytics to improve efficiency and outcomes. Changes to the financial outlook could result from factors like shifts in reimbursement rates from government payers, increased competition, or changes in the overall economic climate. For example, a shift towards value-based care might initially lead to lower short-term profits but could offer greater long-term stability and growth. Similarly, an economic downturn could negatively impact the company’s financial outlook, affecting profitability and investment decisions.

Risks and Opportunities for UnitedHealth

The coming months present both risks and opportunities for UnitedHealth.

Risks:

- Increased regulatory scrutiny and potential penalties.

- Increased competition from innovative healthcare providers.

- Economic downturn impacting healthcare spending.

- Failure to adapt to the changing healthcare landscape.

- Cybersecurity breaches or data privacy concerns.

Opportunities:

- Expansion into new markets and service offerings.

- Technological advancements improving efficiency and outcomes.

- Strategic partnerships and acquisitions.

- Growing demand for value-based care and preventative services.

- Leveraging data analytics to personalize healthcare delivery.

Closing Summary

Source: ccn.com

The UnitedHealth selloff serves as a stark reminder of the volatility inherent in the stock market. While the immediate impact on the Dow is undeniable, the long-term implications for UnitedHealth and the broader healthcare sector remain uncertain. Investor sentiment is clearly shaken, and the coming weeks and months will be crucial in determining whether this represents a temporary correction or the start of a more significant downturn. Keep your eyes peeled for key economic indicators and company announcements – the story is far from over.