Whats happening with taxes on overtime pay – What’s happening with taxes on overtime pay? It’s a question many grapple with, especially when that extra paycheck rolls in. Understanding the tax implications of overtime isn’t just about crunching numbers; it’s about making sure you keep more of your hard-earned cash. From federal rates to state-specific quirks, and the unique challenges faced by the self-employed, navigating the world of overtime taxes can feel like a maze. But fear not, we’re here to unravel the complexities and illuminate the path to a clearer understanding.

This guide breaks down everything you need to know, from how overtime pay is calculated for federal taxes and the variations across different states, to the specific tax implications for self-employed individuals and the impact of different payment structures. We’ll provide clear examples, helpful tables, and even address some common FAQs to ensure you’re fully equipped to handle your overtime tax situation with confidence.

Federal Overtime Tax Implications

Overtime pay, that sweet reward for extra hours toiled, isn’t entirely yours to keep. Uncle Sam wants his cut, and understanding how federal taxes impact your overtime earnings is crucial for managing your finances. This section breaks down the federal tax implications of overtime pay, providing clarity on how it’s calculated and taxed.

Federal Tax Rates on Overtime Pay

The federal income tax rates applied to overtime pay are the same as those applied to your regular pay. This means your overtime earnings are taxed according to your overall income bracket for the tax year. There’s no special, lower tax rate for overtime. The more you earn, both regularly and through overtime, the higher your overall tax bracket, and consequently, the higher your effective tax rate.

Overtime Pay Calculation for Federal Tax Purposes

For federal tax purposes, overtime pay is simply added to your regular earnings to determine your total taxable income. The calculation is straightforward: your regular pay plus your overtime pay equals your gross income. From this gross income, deductions (like pre-tax contributions to retirement plans or health savings accounts) are subtracted to arrive at your taxable income. This taxable income is then used to calculate your federal income tax liability. The tax liability is determined by using the appropriate tax brackets for your filing status (single, married filing jointly, etc.) and income level.

Examples of Overtime Tax Calculation

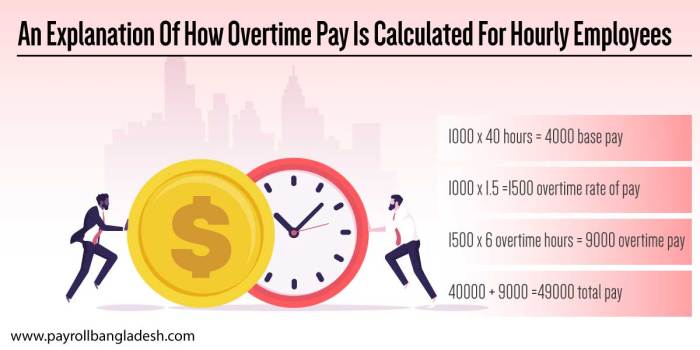

Let’s illustrate with some examples. Assume a standard 40-hour work week and a regular hourly rate of $25. Overtime is typically paid at 1.5 times the regular rate (time and a half).

Example 1: You work 50 hours in a week. Your regular pay is $1000 (40 hours x $25/hour). Your overtime pay is $375 (10 hours x $25/hour x 1.5). Your gross income is $1375. The tax owed on this income will depend on your specific tax bracket and deductions.

Example 2: You work 60 hours in a week. Your regular pay is $1000. Your overtime pay is $750 (20 hours x $25/hour x 1.5). Your gross income is $1750. Again, the tax will be calculated based on your tax bracket and deductions, resulting in a higher tax liability than Example 1.

Comparing Tax Burden on Overtime vs. Regular Pay

While the tax *rate* is the same, the *burden* can feel different. Because overtime pay is taxed at your marginal tax rate (the rate applied to the highest dollar of income), a significant amount of overtime pay might push you into a higher tax bracket, resulting in a larger percentage of your overtime earnings going to taxes compared to your regular pay. This is simply due to the progressive nature of the US federal income tax system.

Federal Income Tax Brackets and Overtime Tax Rates (2023 – Single Filers)

| Taxable Income | Tax Rate |

|---|---|

| $0 to $11,000 | 10% |

| $11,001 to $44,725 | 12% |

| $44,726 to $95,375 | 22% |

| $95,376 to $182,100 | 24% |

State-Level Overtime Tax Variations

Navigating the world of overtime pay can feel like traversing a minefield, especially when you consider the variations between federal and state tax laws. While the federal government sets a baseline, individual states often introduce their own nuances, creating a complex patchwork of regulations. Understanding these differences is crucial for both employers and employees to ensure accurate tax withholding and compliance.

The impact of state-level overtime tax regulations can significantly affect your take-home pay. Unlike the federal system which generally applies a consistent tax rate to all income, including overtime, many states have unique rules concerning how overtime earnings are taxed. This can include different tax brackets, specific deductions, or even the application of different tax rates to overtime compared to regular wages. This complexity underscores the need for careful consideration of both federal and state tax implications when calculating overtime compensation.

State-Specific Overtime Tax Regulations

Several states employ distinct methods for taxing overtime pay. For example, some states may use a progressive tax system where higher overtime earnings fall into higher tax brackets, leading to a greater tax burden. Others might apply a flat tax rate to all income, regardless of whether it’s regular pay or overtime. California, for instance, follows a progressive tax system, meaning the higher your overtime earnings, the higher the marginal tax rate. Conversely, a state with a flat tax rate would tax overtime at the same rate as regular wages. This variation means that an employee in California earning significant overtime might face a higher effective tax rate on their overtime compared to an employee in a flat-tax state earning the same amount of overtime. Understanding the specific tax brackets and rates in your state is critical for accurate tax planning.

Interaction of State and Federal Overtime Taxes

State and federal taxes on overtime interact in a straightforward, additive manner. The federal government taxes your total income, including overtime, according to its own tax brackets. Then, your state taxes your total income, including overtime, separately according to its own tax brackets and regulations. This means you essentially pay taxes twice on your overtime earnings—once at the federal level and once at the state level. The overall tax burden is the sum of these two separate tax calculations. For example, if your federal tax on overtime is $500 and your state tax on the same overtime is $100, your total tax liability for that overtime is $600.

State-Level Tax Credits or Deductions for Overtime Pay

While not universally common, some states may offer specific tax credits or deductions related to overtime pay, particularly for certain professions or industries. These credits or deductions can help reduce the overall tax burden on overtime earnings. However, the availability and specifics of such benefits vary significantly from state to state, and eligibility often depends on factors like occupation, income level, and filing status. It’s crucial to consult your state’s tax regulations or a tax professional to determine if you qualify for any relevant tax credits or deductions related to your overtime income.

Key Differences in State Overtime Tax Treatments, Whats happening with taxes on overtime pay

It’s essential to remember that state tax laws are constantly evolving. Always consult official state resources for the most up-to-date information.

- Tax Rate Structure: States may utilize progressive, flat, or other unique tax rate systems for overtime pay.

- Tax Brackets: The specific tax brackets used to determine the tax rate on overtime can differ significantly.

- Tax Credits/Deductions: Some states may offer specific tax credits or deductions for overtime income, while others do not.

- Withholding Requirements: Employers’ obligations regarding withholding state taxes on overtime may vary by state.

- Definition of Overtime: The legal definition of what constitutes overtime (e.g., hours worked, eligible employees) might differ slightly between states.

Self-Employment and Overtime Taxes: Whats Happening With Taxes On Overtime Pay

Source: payrollbangladesh.com

Freelancing, consulting, or running your own business offers flexibility, but it also means navigating the complexities of self-employment taxes, especially when it comes to overtime. Unlike employees who have their taxes automatically deducted, self-employed individuals are responsible for paying both the employer and employee portions of Social Security and Medicare taxes. This means a higher tax burden overall, and overtime income adds another layer to this already intricate process. Understanding how overtime impacts your self-employment tax is crucial for accurate financial planning.

Self-employment taxes on overtime income are calculated differently than for employees. The key difference lies in the fact that self-employed individuals are responsible for paying both the employer and employee portions of Social Security and Medicare taxes. This contrasts with employees, where the employer covers half of these taxes.

Calculating Self-Employment Taxes on Overtime Income

The calculation of self-employment taxes on overtime income involves several steps. First, you need to determine your net earnings from self-employment, including your regular income and overtime pay. Next, you’ll multiply this figure by 0.9235 (this accounts for a deduction allowed for self-employed individuals). This adjusted amount is then subject to the Social Security and Medicare tax rates. The Social Security tax rate is currently 12.4% (6.2% for the employer and 6.2% for the employee), but only applies to earnings up to a certain annual limit (this limit changes annually). Medicare tax is a flat 2.9%. Therefore, your total self-employment tax is calculated as: (Net earnings from self-employment * 0.9235) * (Social Security tax rate + Medicare tax rate).

Examples of Self-Employment Tax vs. Employee Tax on Overtime

Let’s consider two scenarios: Sarah, an employee, and Mark, a self-employed individual, both earning $50,000 annually, with $10,000 in overtime pay. Assuming Sarah’s employer pays half of the Social Security and Medicare taxes, her tax burden on the overtime pay will be lower than Mark’s. Mark, on the other hand, must pay both the employer and employee portions, significantly increasing his tax liability on the overtime income. The precise difference depends on the current tax rates and the annual Social Security earnings limit. It’s crucial to note that this is a simplified example and actual tax liability may vary based on deductions and other tax-related factors.

Comparison of Overall Tax Burden

Generally, the overall tax burden for self-employed individuals earning overtime is higher than for employees earning the same amount. This is primarily due to the responsibility of paying both the employer and employee portions of Social Security and Medicare taxes. The additional self-employment tax significantly reduces the net income compared to an employee’s net income after similar deductions. While deductions and credits may mitigate this difference to some degree, the self-employed individual will generally face a higher overall tax burden.

Comparison of Tax Forms and Filing Procedures

Employees typically have their taxes withheld from their paychecks. Overtime pay is also subject to these withholdings. Their annual tax return, Form 1040, summarizes the income and tax withheld throughout the year. Self-employed individuals, however, are responsible for paying estimated taxes quarterly through IRS Form 1040-ES. They also file Schedule C (Profit or Loss from Business) with their Form 1040 to report self-employment income, including overtime earnings. Schedule SE (Self-Employment Tax) is then used to calculate and report self-employment taxes. This process requires more proactive tax planning and record-keeping compared to the employee’s more passive system.

Impact of Overtime Pay on Tax Withholding

Source: ebralavi.com

Overtime pay, while a welcome boost to your income, significantly impacts the amount of taxes withheld from your paycheck. Understanding how this works is crucial for both employees and employers to avoid unexpected tax burdens or penalties come tax season. This section details how overtime affects withholding, providing practical examples and guidance.

Overtime pay is generally taxed at the same rate as regular pay, but the increased income pushes you into a higher tax bracket for that pay period. This means a larger portion of your overtime earnings will be withheld for federal and state income taxes, as well as Social Security and Medicare taxes. The method of withholding, however, can vary depending on how your employer handles payroll.

Methods for Adjusting Withholding for Fluctuating Overtime Income

Many employers use a system that anticipates average weekly earnings. This method estimates your income based on a projection that includes expected overtime. However, if overtime fluctuates significantly, this method might lead to either under-withholding (resulting in a larger tax bill at the end of the year) or over-withholding (resulting in a larger refund). Some employers allow employees to submit a revised W-4 form to reflect anticipated overtime, allowing for more accurate withholding. Others may use more sophisticated payroll software that automatically adjusts withholding based on actual overtime hours worked.

Examples of Overtime’s Impact on Annual Tax Liability

Let’s consider two scenarios. Scenario A: An employee earns $50,000 annually with no overtime. Scenario B: The same employee earns $50,000 in regular pay, but also earns $10,000 in overtime. While the total income in Scenario B is $60,000, the tax liability will be significantly higher than a simple proportional increase due to the progressive nature of the tax system. The higher income bracket for the overtime pay pushes a larger percentage into taxes. For example, the additional $10,000 might result in an additional tax liability exceeding $2,000, depending on the applicable tax rates and deductions. This difference is crucial to understand when planning for annual tax obligations.

Calculating the Impact of Overtime on Annual Tax Returns

Calculating the precise impact requires understanding your individual tax bracket and applicable deductions. Tax software or a tax professional can help accurately determine your liability. However, a simplified estimation can be done by comparing the tax liability calculated for your regular income versus your total income (including overtime) using relevant tax brackets and deduction information. Remember, this is an estimate; the actual tax liability might vary based on other factors.

A Step-by-Step Guide for Employers on Correctly Withholding Taxes from Overtime Pay

- Determine the employee’s regular pay rate and overtime rate. This is crucial for accurately calculating gross pay.

- Calculate the gross pay including overtime. Ensure compliance with federal and state overtime laws regarding pay rate and eligibility.

- Determine the applicable tax rates. Consult federal and state tax tables or use payroll software to determine the appropriate tax withholdings for both regular and overtime pay.

- Calculate the total tax withholding. Apply the determined tax rates to the employee’s total gross pay, including overtime. Consider both federal and state income taxes, Social Security, and Medicare taxes.

- Deduct the withholding from the employee’s gross pay. The remaining amount is the employee’s net pay.

- Regularly review and adjust withholding methods. If employees consistently work significant overtime, consider adjusting withholding methods to minimize discrepancies between withheld taxes and actual tax liability at the end of the year. Regularly review and update payroll procedures to reflect changes in tax laws and employee income.

Tax Implications of Different Payment Structures

Overtime pay, while a welcome boost to your income, can have varying tax implications depending on how it’s paid. Understanding these differences is crucial for accurate tax planning and avoiding unpleasant surprises come tax season. This section explores the tax treatment of overtime pay received as a lump sum versus regular payments, the impact of different payment frequencies, and the tax implications of bonuses and other compensation received alongside overtime.

Overtime Pay: Lump Sum vs. Regular Payments

Receiving a lump-sum overtime payment versus regular payments significantly impacts your tax liability. A lump sum payment typically results in a higher tax burden in the payment period it’s received due to being taxed at a higher marginal tax rate. Regular payments, spread across several pay periods, generally lead to a smoother tax distribution and may result in a lower overall tax liability due to a lower marginal tax rate applied to each individual payment. This is because your total income is spread out across more tax brackets. For example, a $5,000 overtime lump sum could push you into a higher tax bracket than if that same amount was paid out in smaller increments over several weeks.

Payment Frequency and Tax Withholding

The frequency of your paychecks directly affects tax withholding. With more frequent pay periods (e.g., weekly or bi-weekly), taxes are withheld more regularly, leading to a more accurate reflection of your annual tax liability. Less frequent payments (e.g., monthly or quarterly) might result in either under-withholding (requiring a larger tax payment at the end of the year) or over-withholding (leading to a larger refund). Employers typically use tax withholding tables and/or payroll software to calculate withholding, but individual circumstances can significantly impact the accuracy of these calculations. For example, an individual with multiple sources of income might experience greater discrepancies with less frequent payment cycles.

Bonuses and Other Compensation Alongside Overtime

Bonuses, commissions, and other forms of compensation received alongside overtime pay are also subject to income tax. These additional payments increase your overall taxable income, potentially pushing you into a higher tax bracket and increasing your tax liability. The tax treatment of these additional payments depends on their nature and the specific laws governing them. For instance, some bonuses might be subject to additional taxes or withholdings depending on the terms of employment or company policies. Accurately reporting all sources of income is crucial to avoid penalties.

Examples of Tax Differences Between Payment Methods

Let’s consider two scenarios:

Scenario 1: Sarah earns $50,000 annually and receives a $5,000 overtime bonus as a lump sum. This significantly increases her taxable income for that pay period, potentially resulting in a higher marginal tax rate and increased tax liability.

Scenario 2: John earns the same annual salary as Sarah but receives the $5,000 overtime pay spread across ten bi-weekly paychecks. His tax liability is lower because the additional income is spread across multiple pay periods, reducing the impact on his marginal tax rate for each period.

Flowchart Illustrating Tax Implications Based on Different Payment Structures for Overtime Pay

[A descriptive text of a flowchart would be included here. The flowchart would visually represent the decision-making process for determining tax implications based on payment structure. It would start with a decision point: “Is overtime paid as a lump sum?” If yes, it would lead to a box indicating higher potential tax liability due to higher marginal tax rate. If no, it would lead to a decision point: “What is the payment frequency?”. This would branch into options such as weekly, bi-weekly, monthly, etc., each leading to a box describing the potential tax withholding implications for that frequency. Finally, all branches would converge to a box summarizing the potential tax consequences based on the chosen path.]

Epilogue

Source: vskills.in

So, what’s the takeaway on overtime taxes? It’s a multifaceted issue, varying significantly based on your employment status, location, and payment structure. While the federal guidelines provide a baseline, state-level regulations add layers of complexity. Understanding these nuances is crucial for accurate tax filing and maximizing your after-tax income. By carefully considering the information provided – from federal tax rates to state-specific rules and self-employment considerations – you can navigate the overtime tax landscape with greater clarity and confidence. Remember to consult a tax professional if you need personalized advice!